Net Foreign Exchange Flows Through The Nigerian Economy

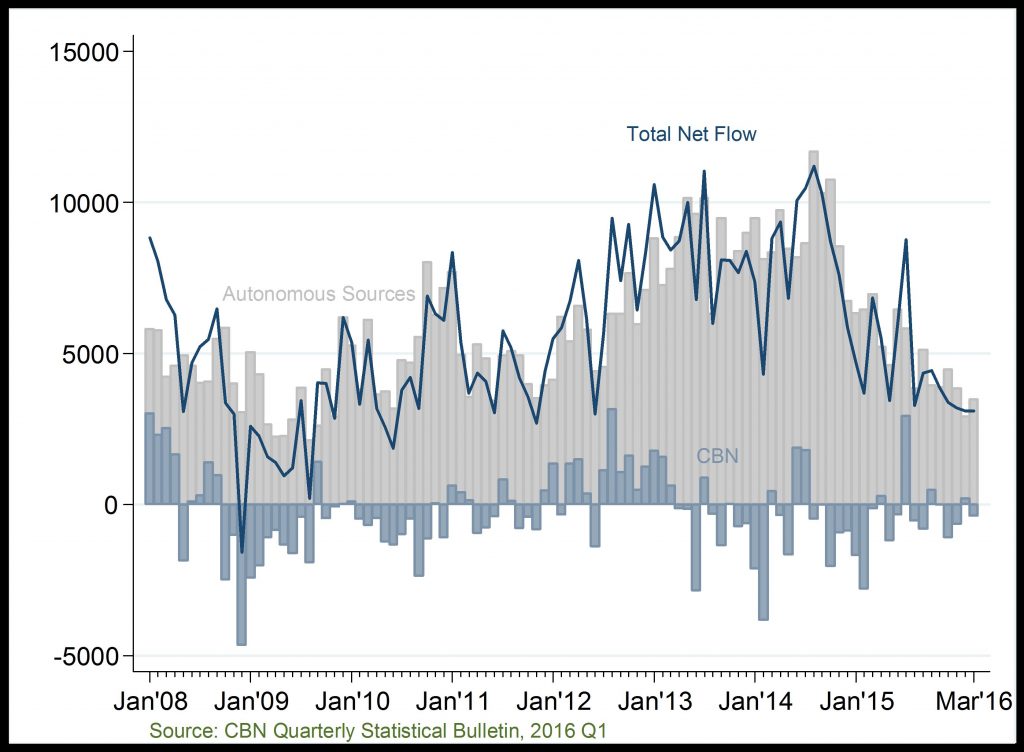

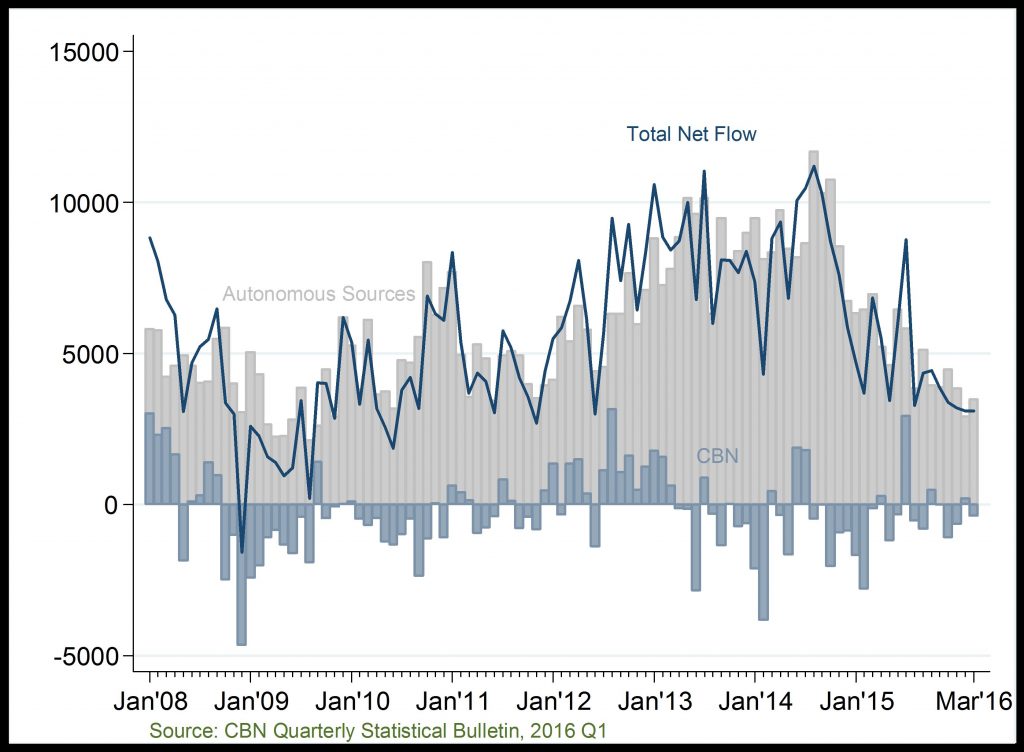

Net Foreign Exchange Flows (US$ Million)

Declining forex flows, post-2014

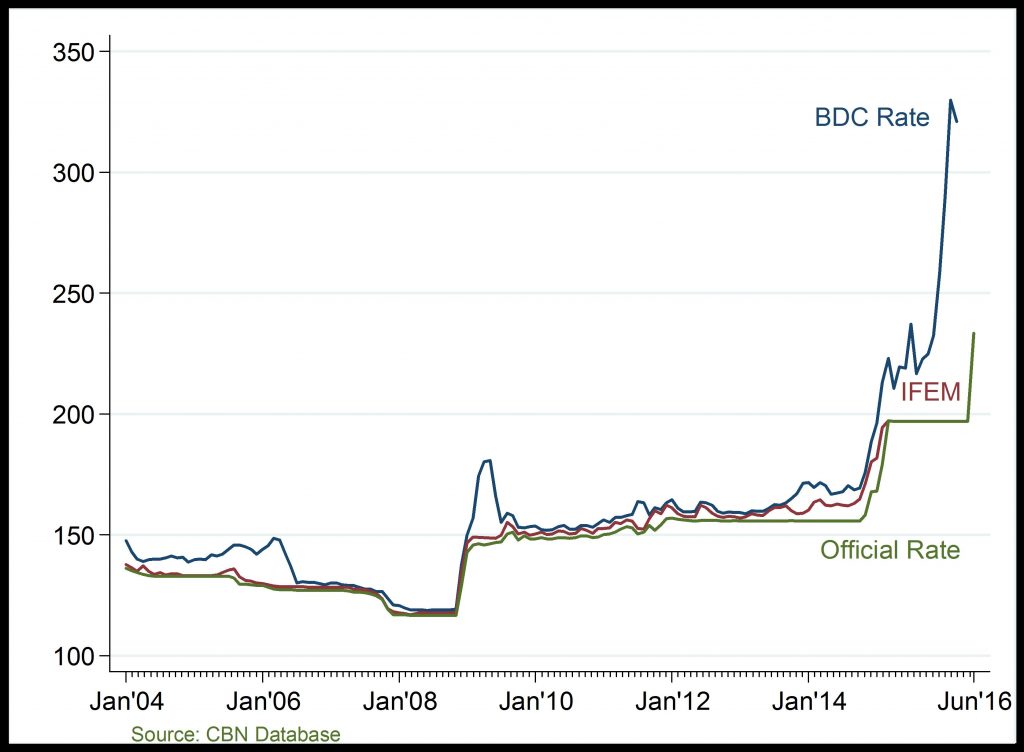

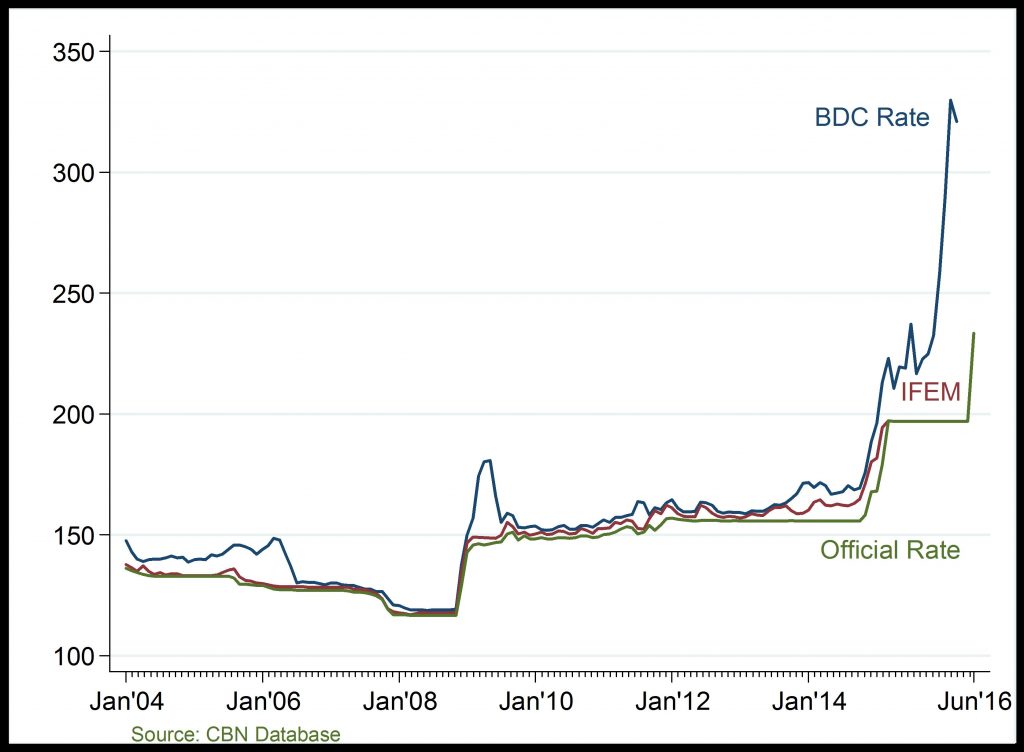

Exchange Rate (/$)

Dramatic rise in exchange rate, post-2014

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonomous sources.

Exchange Rate: The gap between official and parallel market rate (typically, BDC) widened abnormally in 2016Q1. This is attributed to the fall in oil price driving down foreign reserve. Exchange rate worsened in 2016Q2 with the introduction of flexible exchange rate policy in June.

Related

Capital Importation: Investment in the oil and gas sector has remained low since 2009. However, investments into the sector fell more deeply in 2015, on the account of persistent global and domestic c

External Reserve: External reserve picked up from its year-2000 level below $10,000 million to above $60,000 million in 2008. However, the external reserve fell deeply in 2010/11 and even further in 2

FDI, FPI and other Investments: The unusual fall in overall capital importation, especially in equity investment, in the late 2015 and early 2016 is attributable to the tougher macroeconomic and finan

Capital Importation: Capital expenditure into the construction sector remained above 10 percent since 2005 until 2015. Similar to the manufacturing sector, overall capital imported into the constructi