FDI, FPI And Other Investments 2

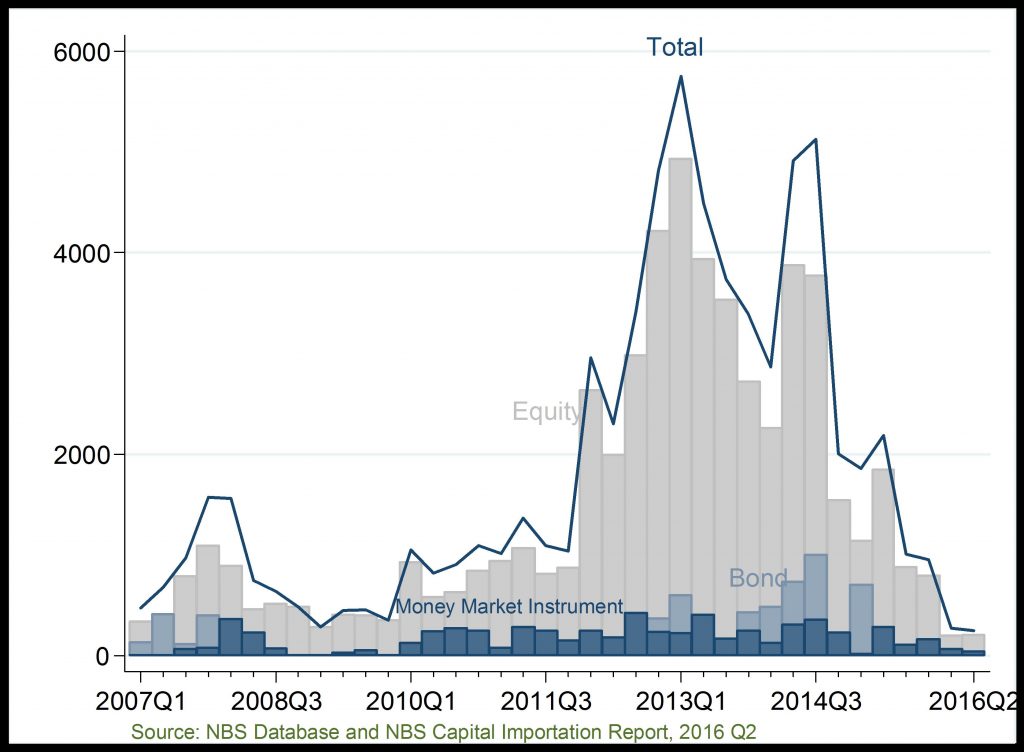

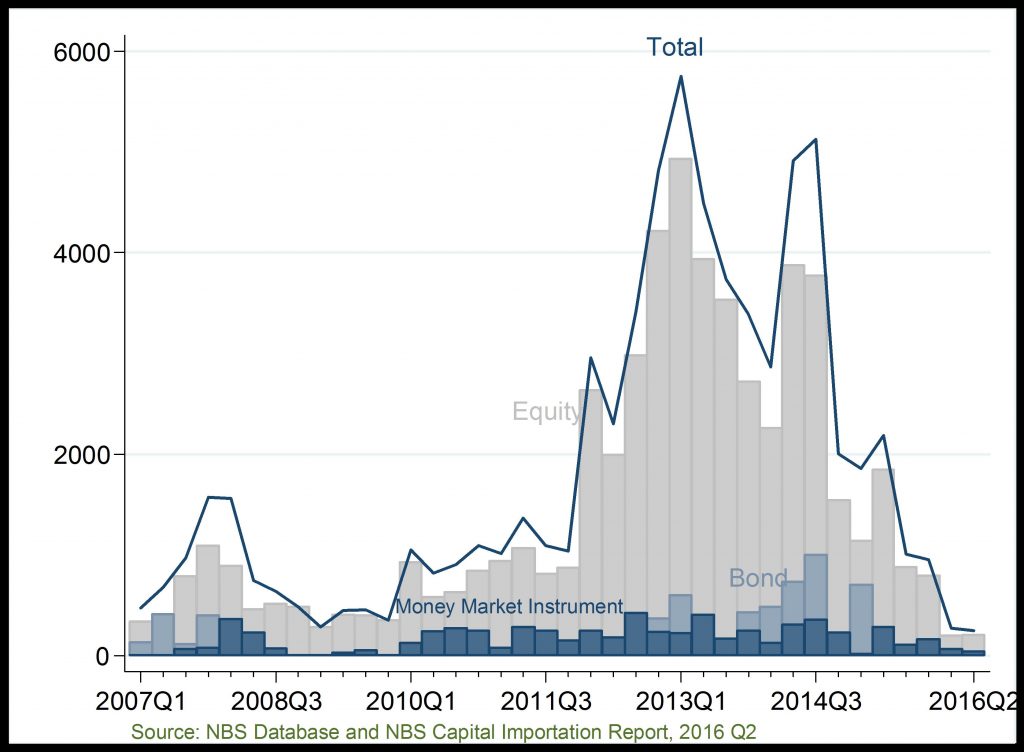

FPI and its Components (US $ Million)

Equity-based investment dropping rapidly

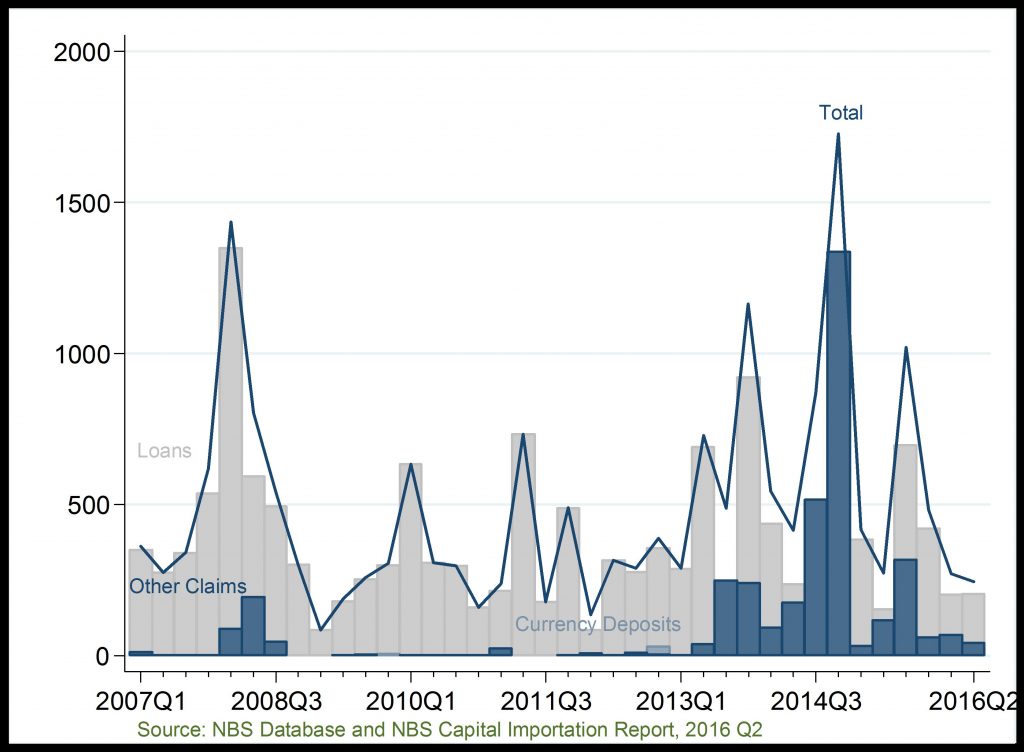

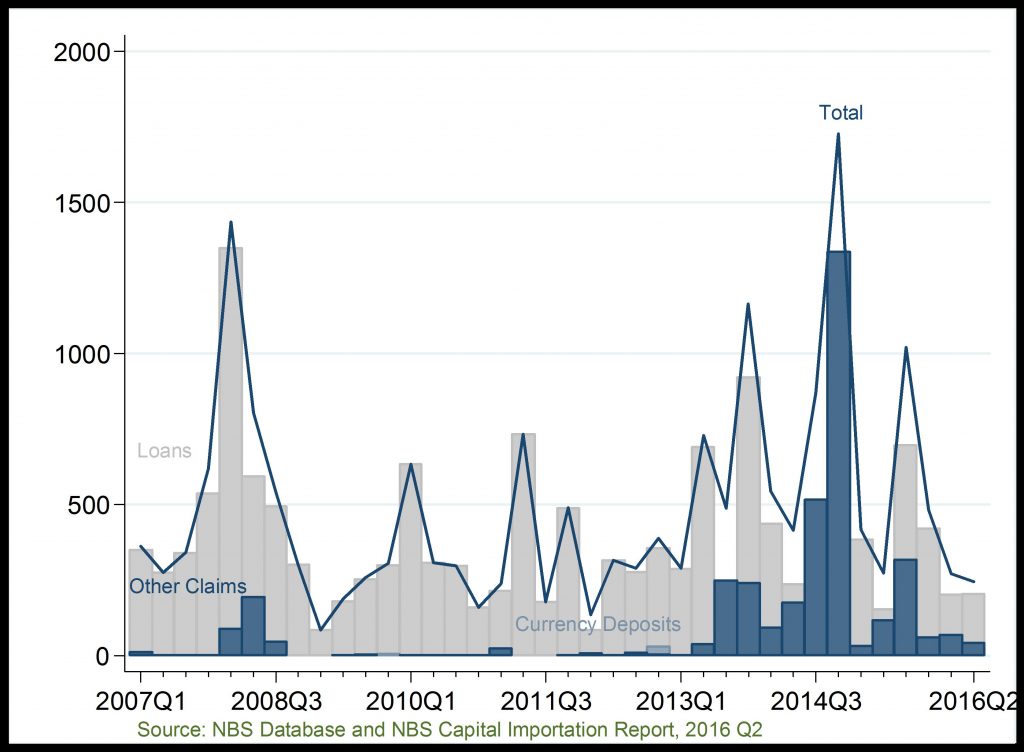

Other Investments (US $ Million)

Loans and currency deposit declining lately

FDI, FPI and other Investments: The unusual fall in overall capital importation, especially in equity investment, in the late 2015 and early 2016 is attributable to the tougher macroeconomic and financial conditions occasioned by lower oil price, and changes in external factors such as the anticipated hike in US interest rate and the delisting from JPMorgan EM Bond index.

Related

Business Confidence Index: After its peak in 2011, business confidence fell sizeably in 2012 as well as 2015Q2. Most recently, BCI has declined to a negative levels in 2016Q1 and Q2. The recent declin

Balance of Trade (Export and Import): With export and, to lesser extent, import declining balance of trade fell deeply in 2015 and, to lesser extent, in 2016Q1.

Export and its Components: In 2015 and 2016Q1, overall export earnings declined significantly to a record low of less than $3000 million in 2016Q1, as against the peak of above $10,000 million in 2008

Capital Importation: Overall capital imported into the manufacturing sector fell deeply in 2015 and has remained low in 2016H1 on the account of present FOREX issues affecting businesses in the sector