Capital Importation And Budgetary Allocation (Oil And Gas)

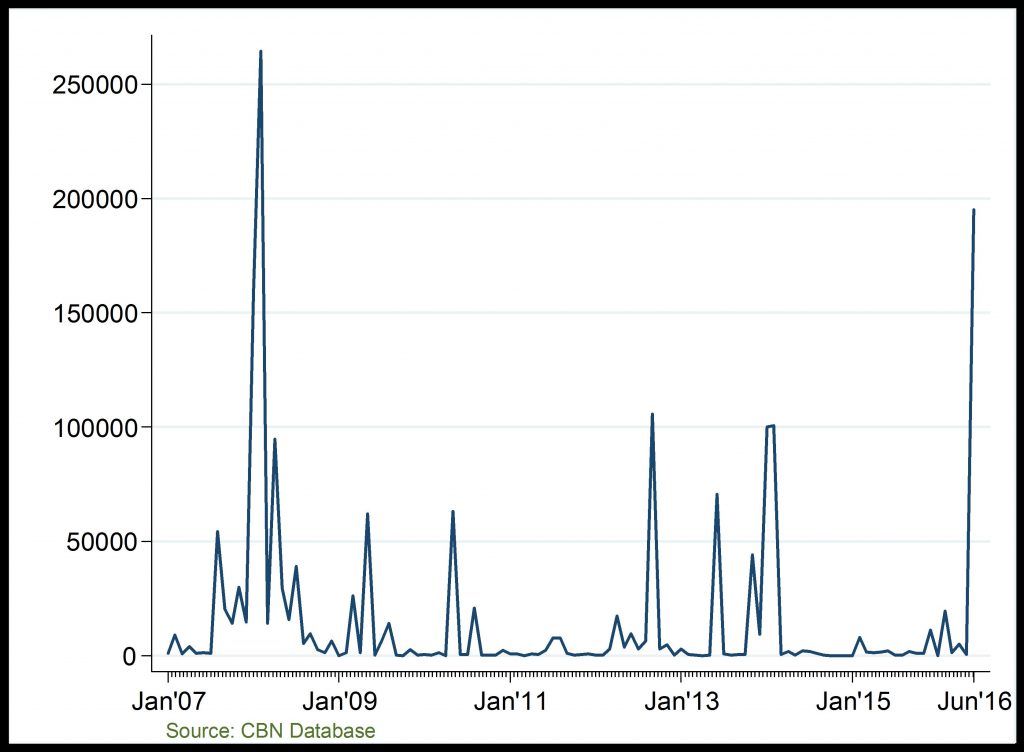

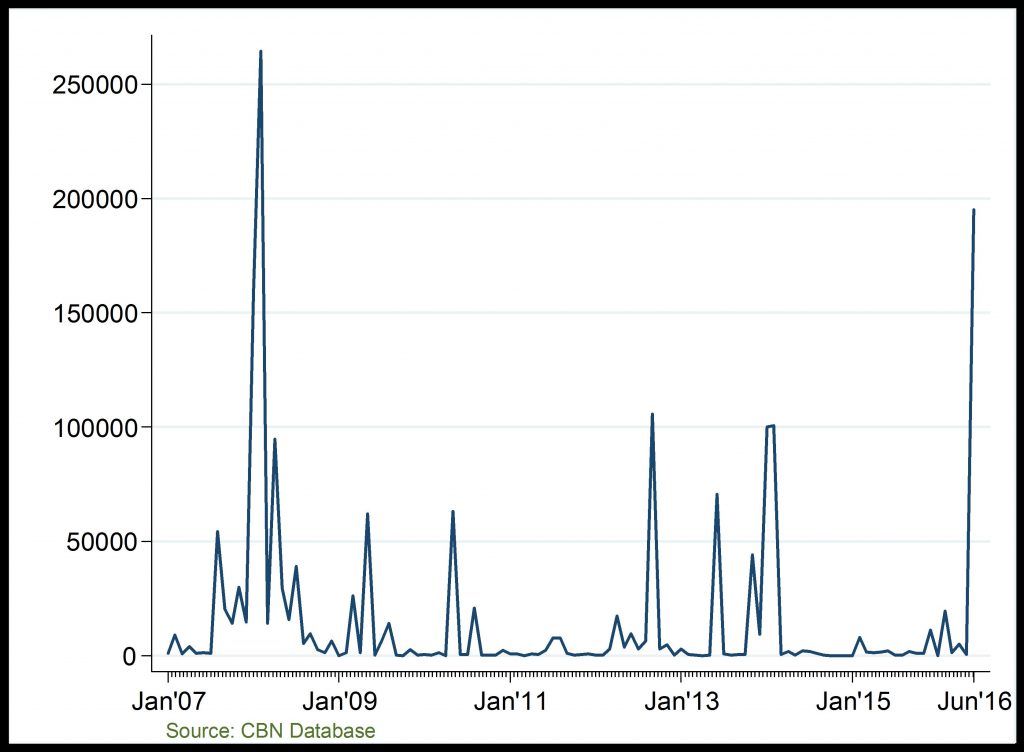

Capital Importation (US$ Thousand)

Investment rise sharply in 2016Q2

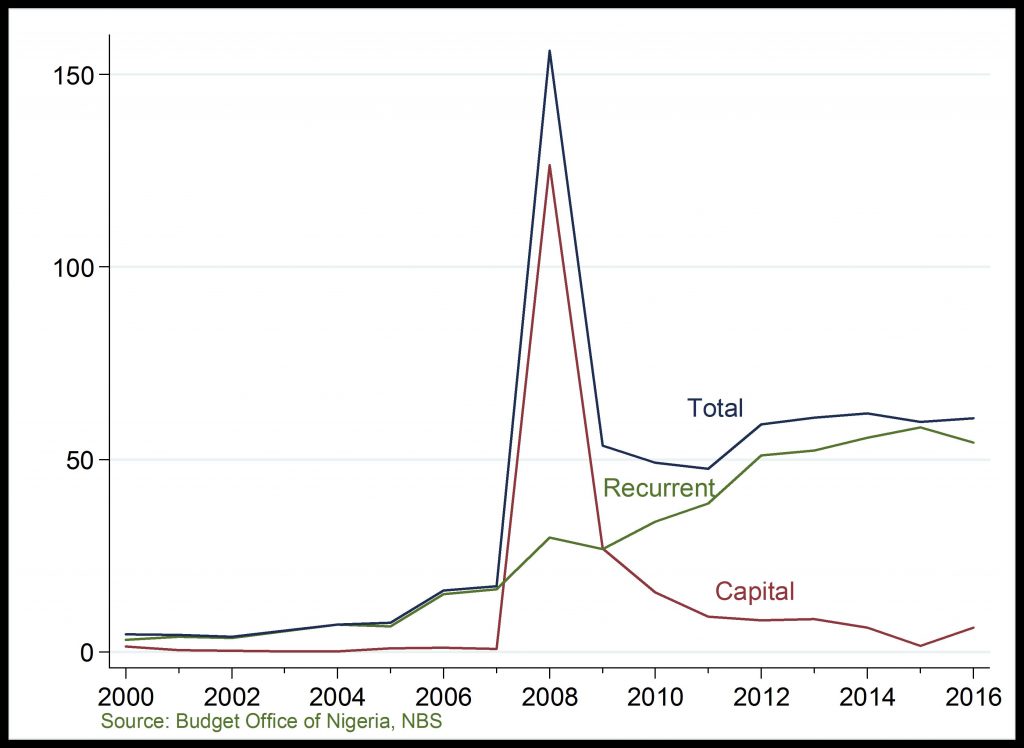

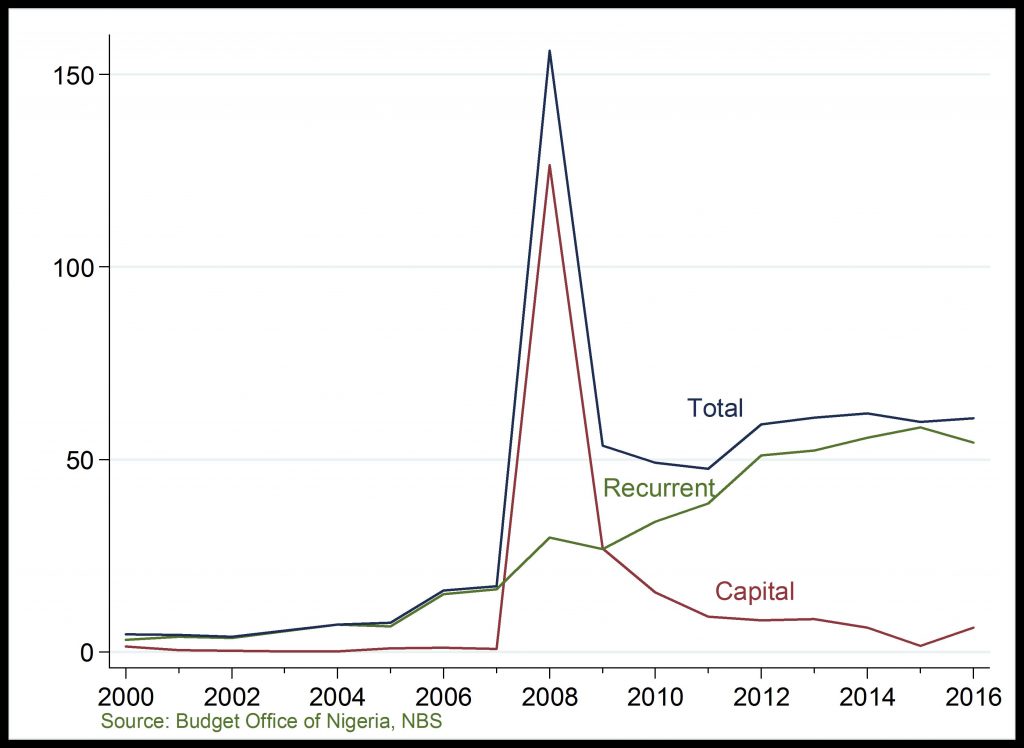

Budgetary Allocation (Billion )

Capital vs Recurrent expenditure, closing the gap?

Capital Importation: Investment in the oil and gas sector has remained low since 2009. However, investments into the sector fell more deeply in 2015, on the account of persistent global and domestic challenges to the sector. However, it increased sharply in 2016Q2 on the account of increased disbursement in the sector by the CBN for the repair of damaged oil and gas pipelines.

Budgetary Allocation: Recurrent spending has continued to rise as capital spending fall (or rise marginally) in annual national budget allocation since 2009. However, considerable convergence capital and recurrent expenditure is recorded in 2016 budget, signalling government interest in improving the oil and gas sector.

Related

Gross Domestic Product Growth Rate: Growth in the sector which stalled in the second and third quarters of 2015 witnessed a considerable decline in 2015Q4; the stall in growth in 2015 is attributable

Money Supply: On a month-on-month basis, growth in M2 have accelerated overtime; reaching over N20,000 billion by April 2016. The rise in M2 at the end of 2016Q1 reflects the fast-paced rise in aggre

Export and its Components: In 2015 and 2016Q1, overall export earnings declined significantly to a record low of less than $3000 million in 2016Q1, as against the peak of above $10,000 million in 2008

91-Day Treasury Bills: T-bill rate has highly fluctuated overtime on the account of the rise and fall in investor confidence, monetary policy easing/tightening, governments demand for funds, and infl