Net Foreign Exchange Flows Through The Nigerian Economy

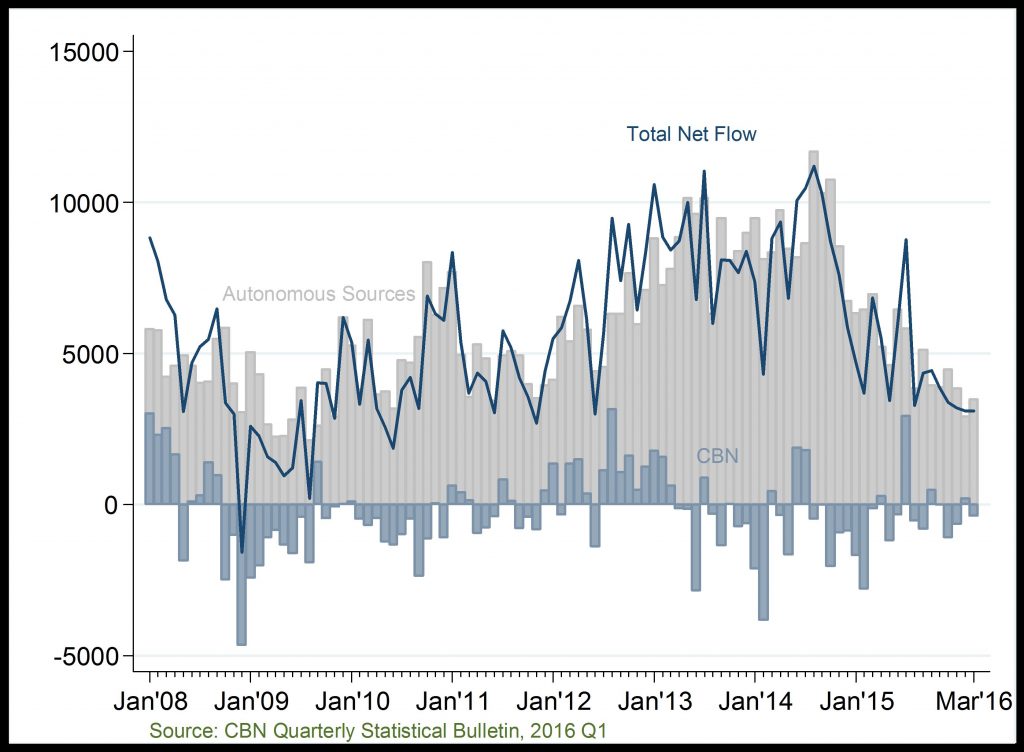

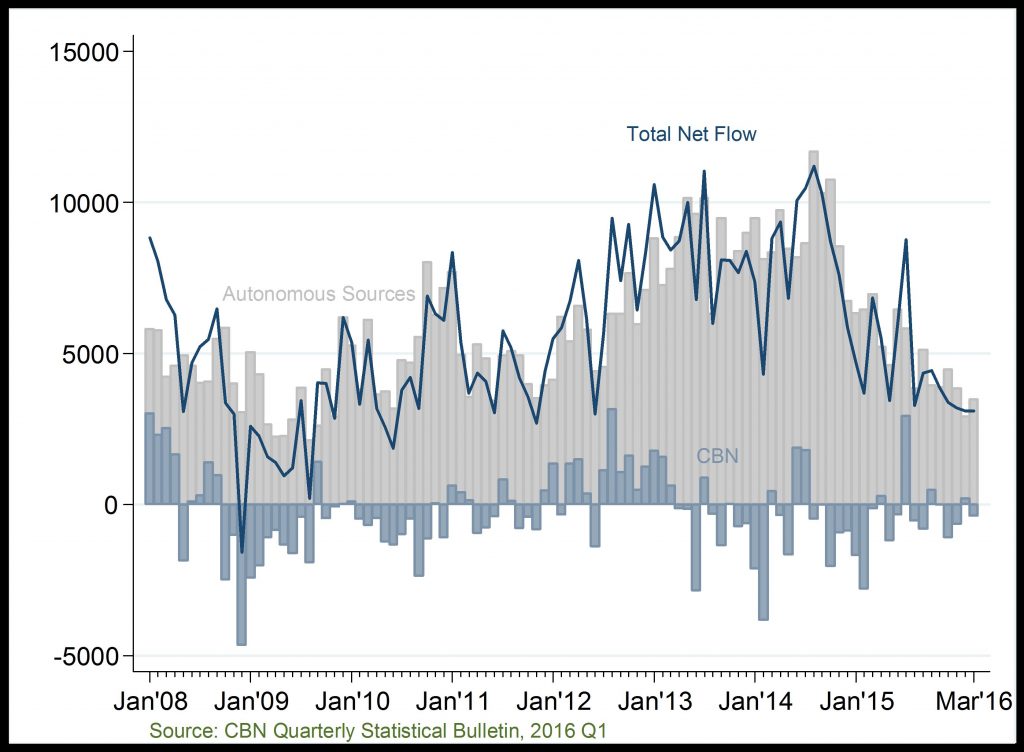

Net Foreign Exchange Flows (US$ Million)

Declining forex flows, post-2014

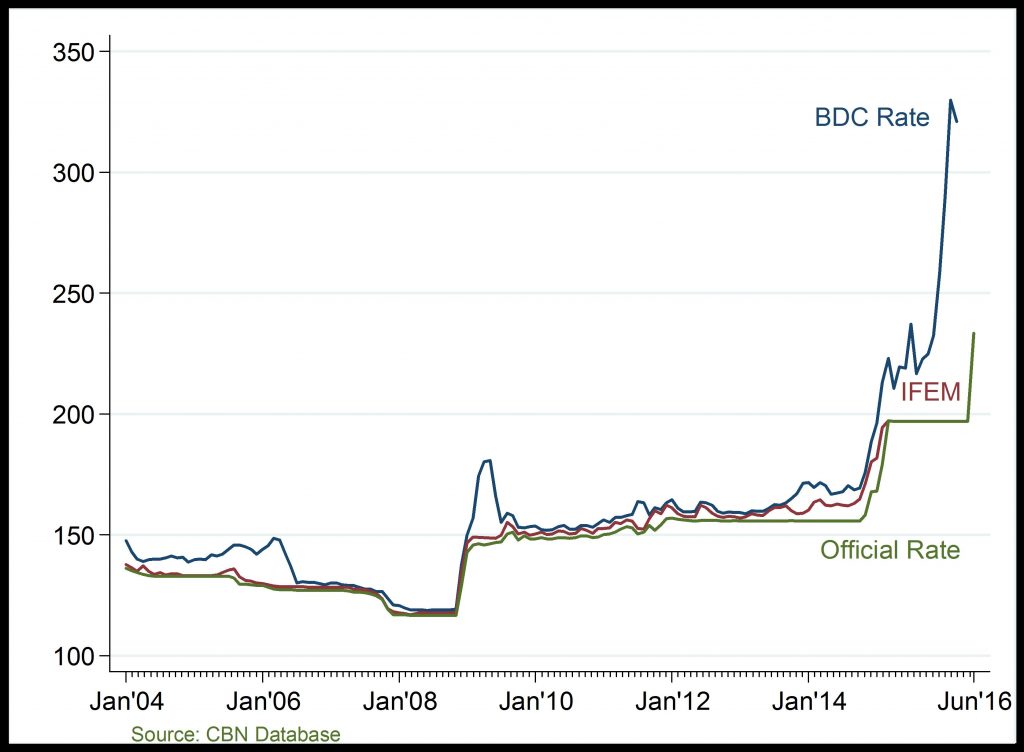

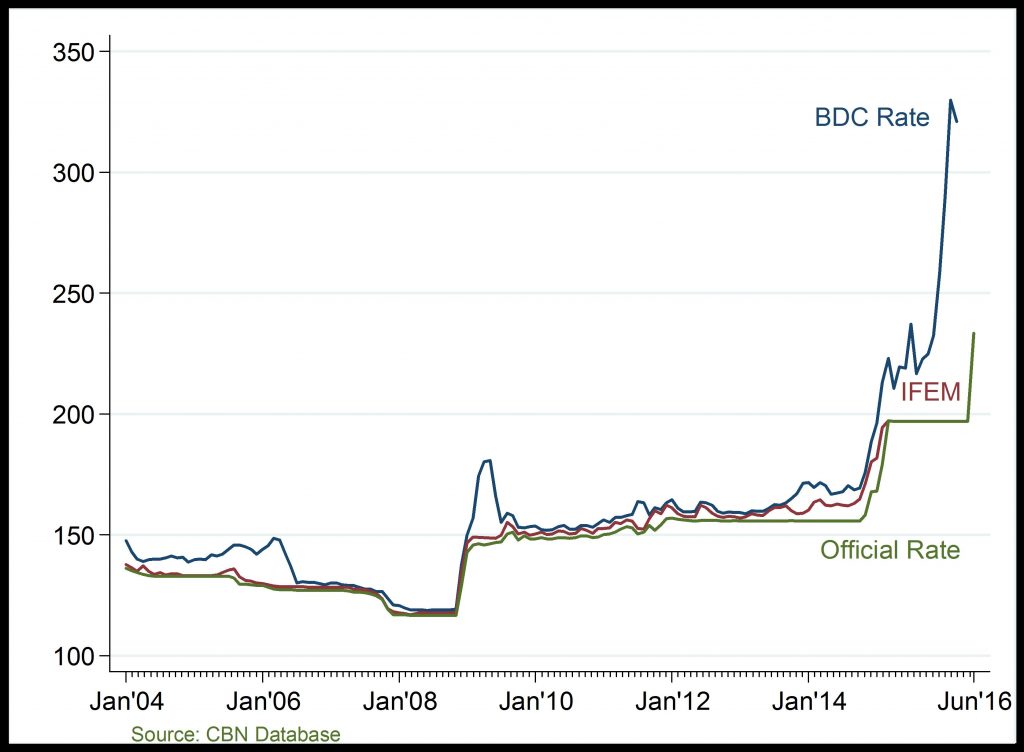

Exchange Rate (/$)

Dramatic rise in exchange rate, post-2014

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonomous sources.

Exchange Rate: The gap between official and parallel market rate (typically, BDC) widened abnormally in 2016Q1. This is attributed to the fall in oil price driving down foreign reserve. Exchange rate worsened in 2016Q2 with the introduction of flexible exchange rate policy in June.

Related

Crude Oil Price: Crude oil price attained a historical low of $30.7 in January 2016 largely due to excess global oil supply.

Crude Oil Production and Export: Oil production has continued to fall in

CPI and its Component: Changes in inflation rate has mostly been driven by the Core sub-index component. Precisely, in 2016 Q1 and Q2, the rising cost of import, electricity and transport drove inflat

FDI, FPI and other Investments: The unusual fall in overall capital importation, especially in equity investment, in the late 2015 and early 2016 is attributable to the tougher macroeconomic and finan

Appropriation Act (Budget): Capital expenditure remarkably increased in 2016 relative to preceding year, on the account of the present governments renewed commitment to infrastructure development.