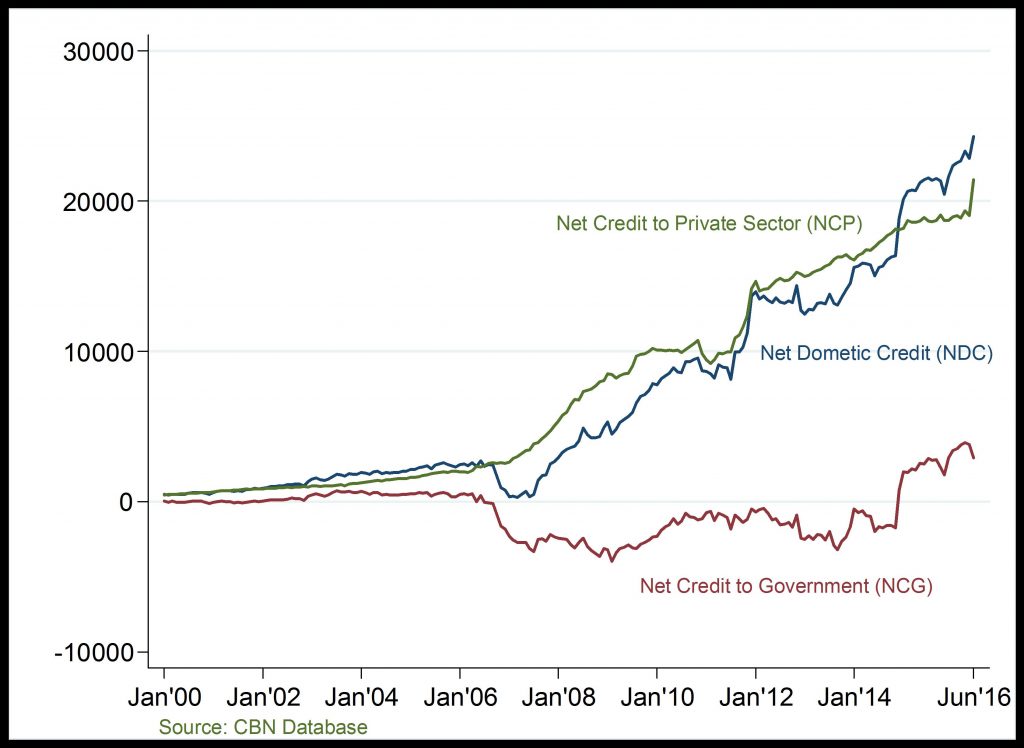

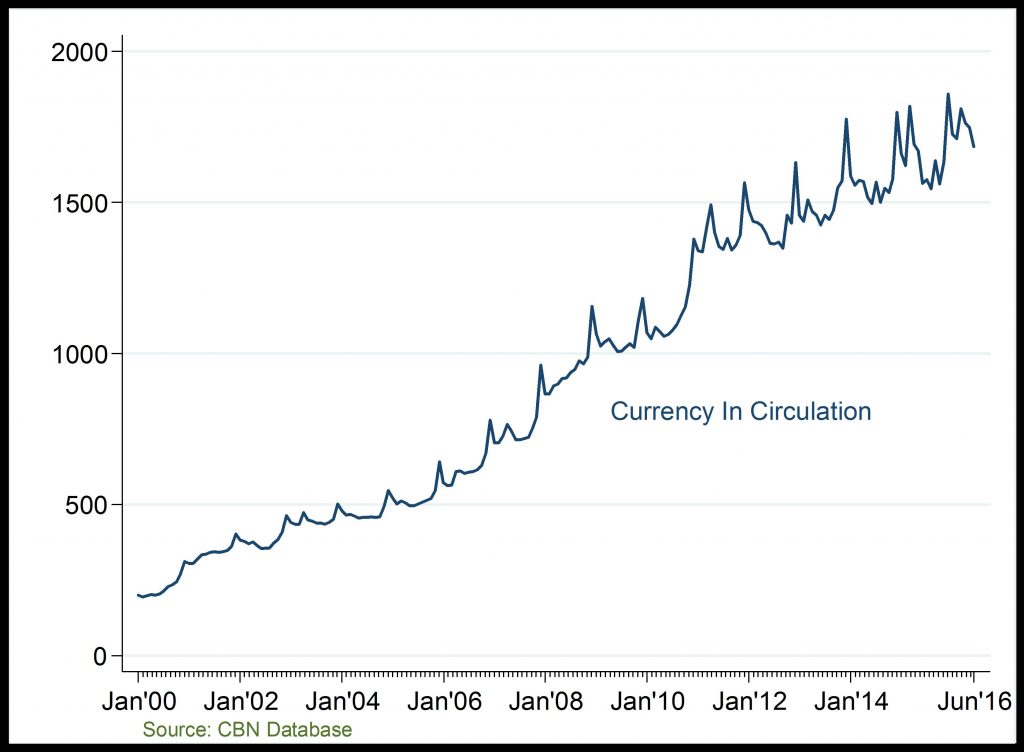

Net Domestic Credit And Currency In Circulation (CIC):

Domestic Credit (Billion )

Steadily rising domestic credit

Currency in Circulation (Billion )

Steadily rising money in circulation

Net Domestic Credit: Rising net credit to government and private sector have driven the upward trend in NDC, especially post-2008. In 2016Q1, NDC grew largely on the account of the rise in banking sector credit to the Federal Government, especially through treasury bills and government bonds.

Currency in Circulation (CIC): CIC has mildly fluctuated overtime due to changes in seasonal factors and regular monetary injections/ejection into/out of the economy which leads to changes in CIC vault-cash and currency-outside-banks components. Particularly, the decline in CIC at the end of 2016Q1 is attributed to the decline in the vault cash component of CIC following monetary ejections.

Related

Gross Domestic Product: Agriculture Gross Domestic Product growth rate recorded its highest point in 2006Q1 but fell sharply subsequently. Particularly, the slow growth recorded in 2015 and 2016Q1 is

Balance of Trade (Export and Import): With export and, to lesser extent, import declining balance of trade fell deeply in 2015 and, to lesser extent, in 2016Q1.

Public Debt Stock and Debt Servicing: Public debt stock has steadily increased overtime; reaching over N12, 000 billion naira by 2015Q4. With the persistent fall in crude oil price and the attendant d

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonom