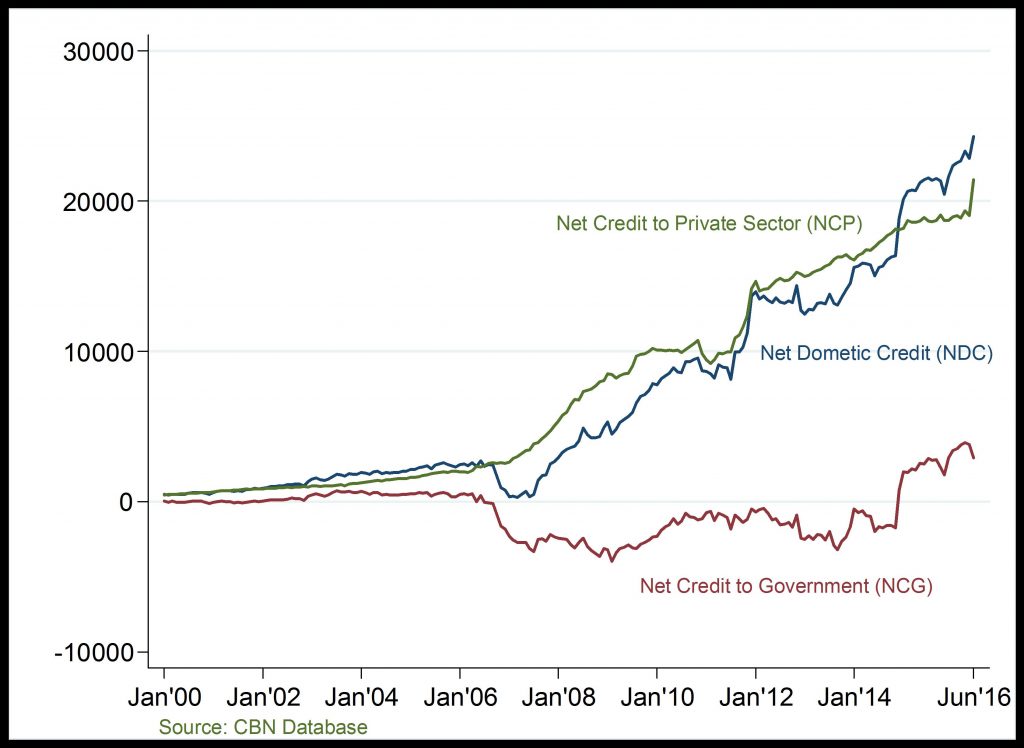

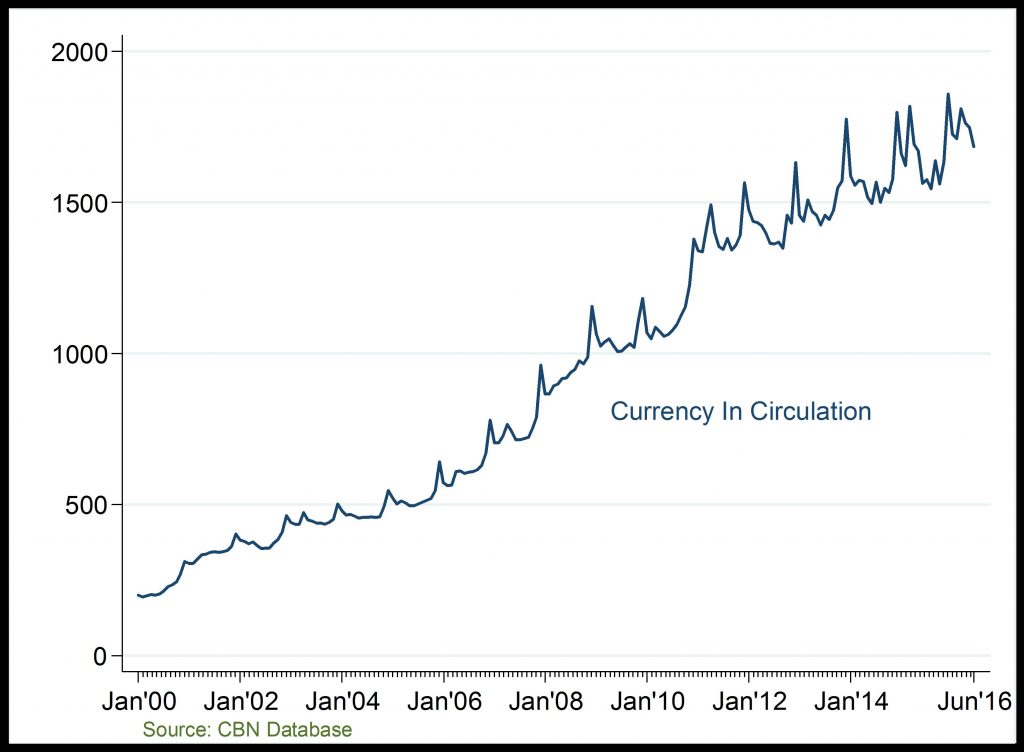

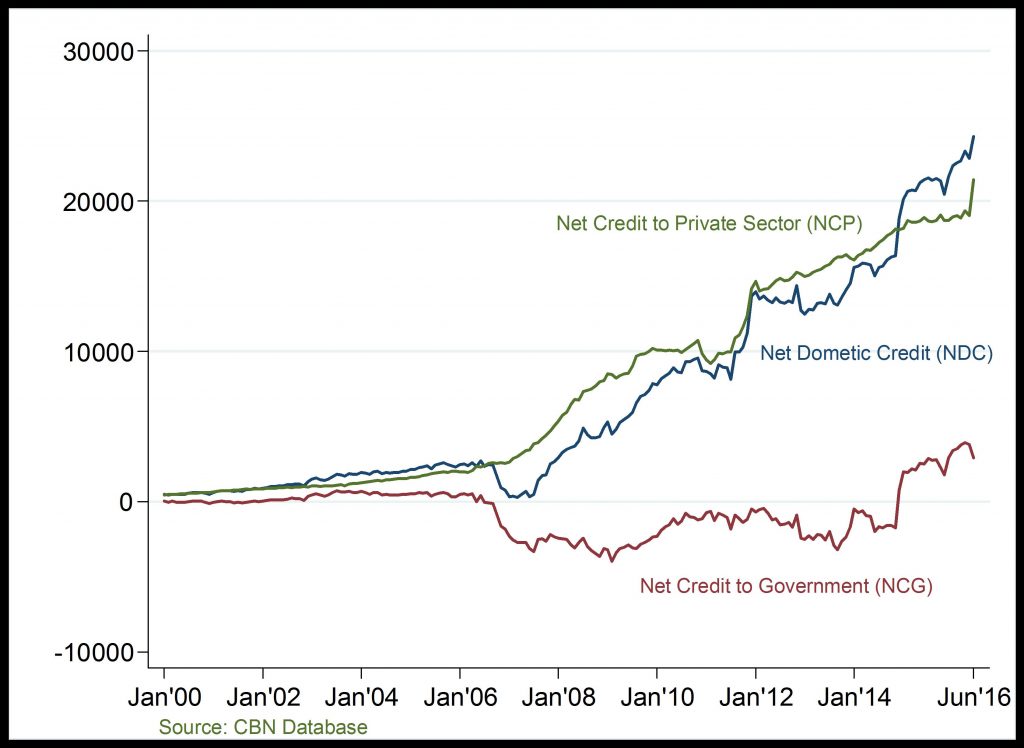

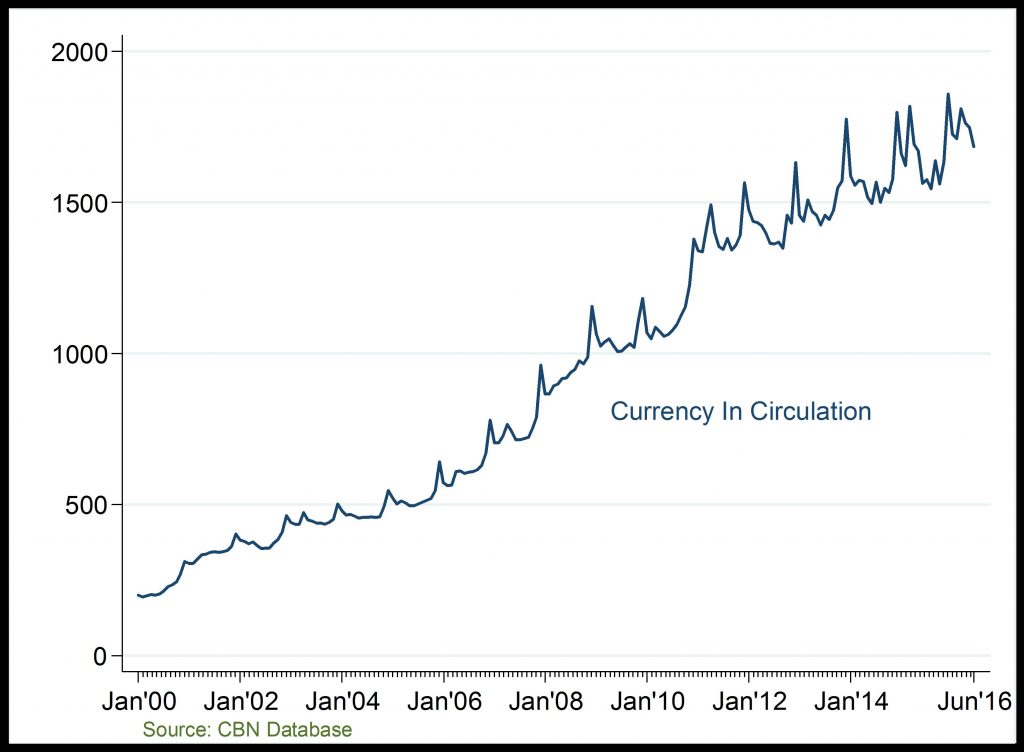

Net Domestic Credit And Currency In Circulation (CIC):

Domestic Credit (Billion )

Steadily rising domestic credit

Currency in Circulation (Billion )

Steadily rising money in circulation

Net Domestic Credit: Rising net credit to government and private sector have driven the upward trend in NDC, especially post-2008. In 2016Q1, NDC grew largely on the account of the rise in banking sector credit to the Federal Government, especially through treasury bills and government bonds.

Currency in Circulation (CIC): CIC has mildly fluctuated overtime due to changes in seasonal factors and regular monetary injections/ejection into/out of the economy which leads to changes in CIC vault-cash and currency-outside-banks components. Particularly, the decline in CIC at the end of 2016Q1 is attributed to the decline in the vault cash component of CIC following monetary ejections.

Related

FDI, FPI and other Investments: The unusual fall in overall capital importation, especially in equity investment, in the late 2015 and early 2016 is attributable to the tougher macroeconomic and finan

On average, Nigerias GDP growth rate has averaged about 5 percent; attaining an unusual trough of nearly -10 percent in 2003Q4 and a peak of nearly 20 percent in 2004Q4. However, the Nigerian economy

Tax Collected: Tax revenue which has relatively maintained an upward trend, fell considerably in 2015 and dipped significantly in early 2016 on the account of economic downturn, as many businesses sev

Capital Importation: Overall capital imported into the manufacturing sector fell deeply in 2015 and has remained low in 2016H1 on the account of present FOREX issues affecting businesses in the sector