Capital Importation And Budgetary Allocation (Oil And Gas)

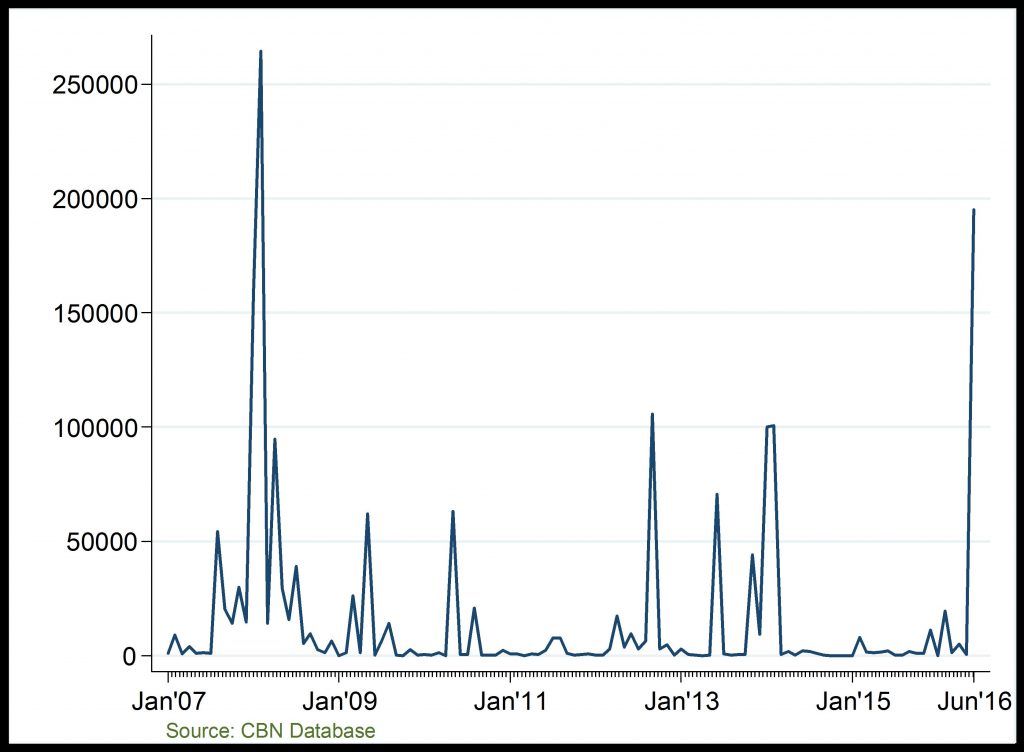

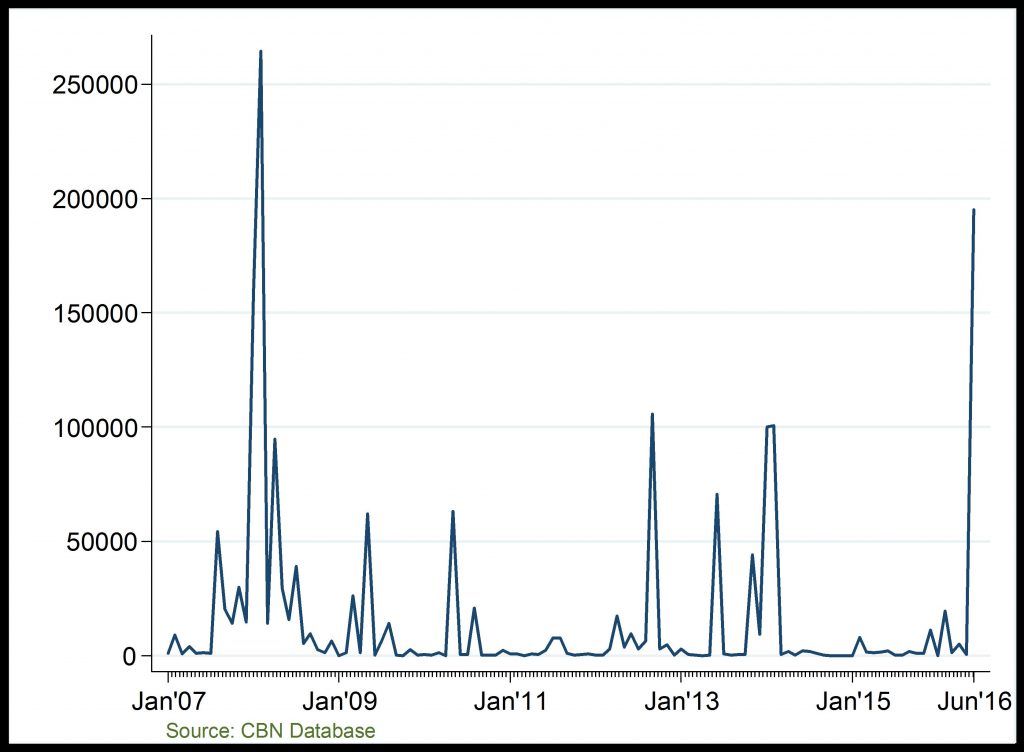

Capital Importation (US$ Thousand)

Investment rise sharply in 2016Q2

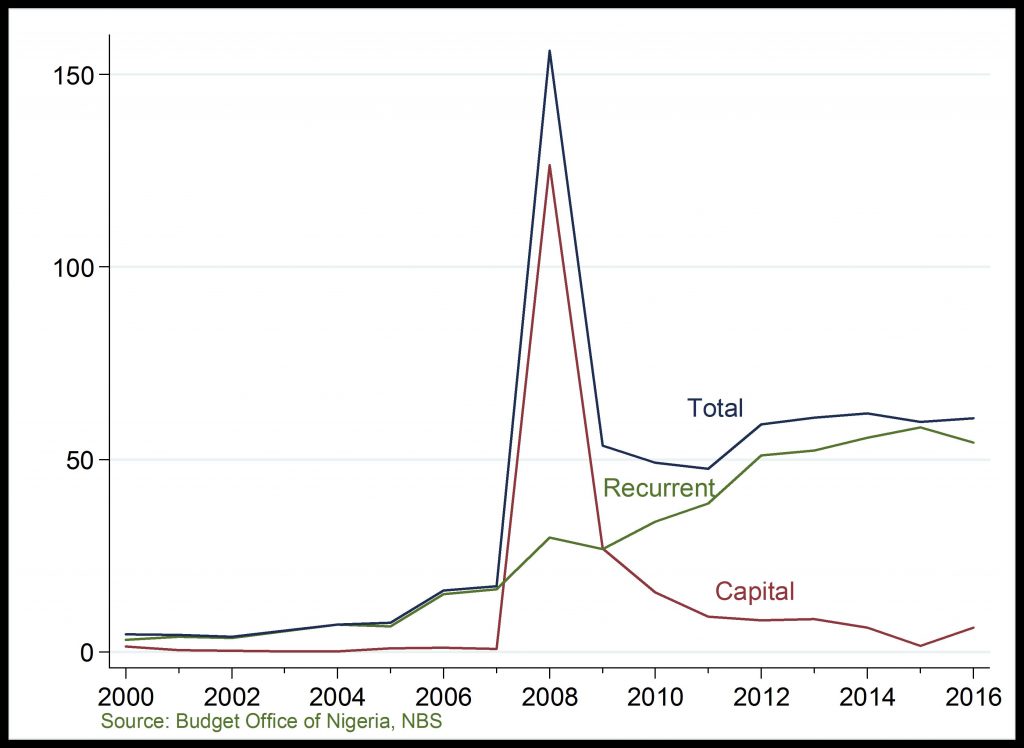

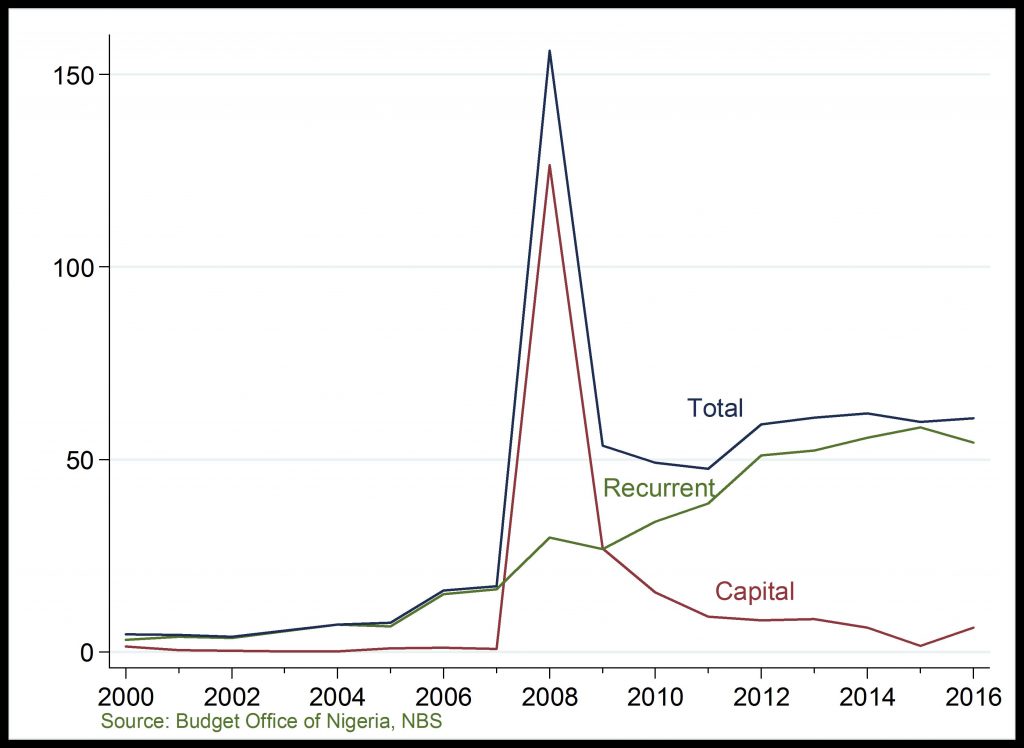

Budgetary Allocation (Billion )

Capital vs Recurrent expenditure, closing the gap?

Capital Importation: Investment in the oil and gas sector has remained low since 2009. However, investments into the sector fell more deeply in 2015, on the account of persistent global and domestic challenges to the sector. However, it increased sharply in 2016Q2 on the account of increased disbursement in the sector by the CBN for the repair of damaged oil and gas pipelines.

Budgetary Allocation: Recurrent spending has continued to rise as capital spending fall (or rise marginally) in annual national budget allocation since 2009. However, considerable convergence capital and recurrent expenditure is recorded in 2016 budget, signalling government interest in improving the oil and gas sector.

Related

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonom

Purchasing Managers Index: The level of business activities declined sharply in the first half of 2016 on the account of weak economic performance. Particularly, the issues surrounding exchange rates

Capital Importation: Foreign investment into the agricultural sector was relatively flat between 2007 and 2012 but gained unusual momentum in September 2015. The spike in 2015 is likely driven by the

Tax Collected: Tax revenue which has relatively maintained an upward trend, fell considerably in 2015 and dipped significantly in early 2016 on the account of economic downturn, as many businesses sev