The proposed 2023 budget Bill was presented on October 07, 2022. While presenting the budget, President Muhammadu Buhari highlighted the revenue challenge, which may have influenced the size of the budget. This article uses nine charts to highlight the 2023 budget in relation to the amended 2022 budget at the aggregate level. In terms of expenditure size, the 2023 budget is higher than the 2022 budget

Not all elements of expenditure increased; expenditure items relating to productive investment, such as capital expenditure and statutory transfers, were reduced, whereas recurrent expenditure and debt services that had limited impacts on the future growth outlook were increased.

In contrast to expenditure, the proposed revenue for the 2023 fiscal year was reduced in comparison to the amended budget for 2022. The revenue decline reflected challenges in crude oil production and weak revenue mobilisation. The following section provides a detailed breakdown of the 2023 budget.

Overview of the 2023 Budget

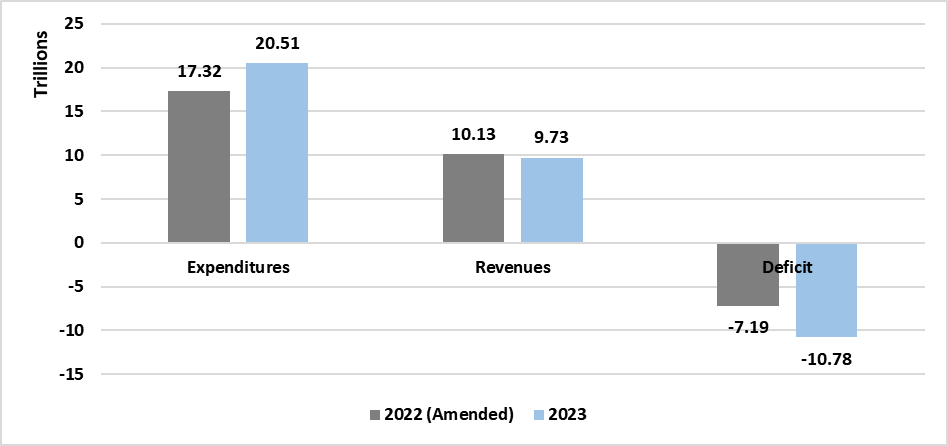

In the 2023 proposed budget, the total expenditure is N20.53 trillion, which is approximately N770 billion more than the N19.76 trillion in the approved Medium Term Expenditure Framework and N17.32 trillion in the 2022 amended budget. The increase in expenditure might be argued to be consistent with the rising prices. However, total revenue in the proposed budget for 2023, fell to N9.73 trillion from N10.13 trillion in the amended budget for 2022. As a result, the budget deficit increased to N10.78 trillion from N7.19 trillion in the 2022 amended budget. This indicates that the rising price level had an increasing effect on the expenditure side while decreasing the revenue outlook of the government. Based on the historical trend of revenue underperforming relative to expenditure as seen in the first quarter of 2022, government borrowing at the end of 2023 is very likely to exceed N10.78 trillion. However, the extent to which the government may borrow, particularly external borrowing, will depend on the interest rate in the international market. If the government is unable to borrow as anticipated, expenditure rationing would be predominant in the next fiscal year.

Figure 1: Aggregate Expenditure and Revenue

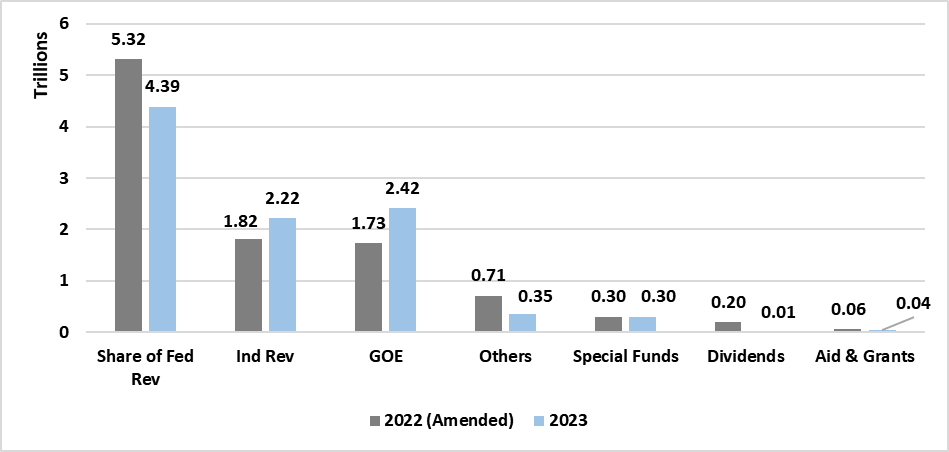

The breakdown of the revenue is shown in Figure 2. The revenue element has seven main categories, and only two items were increased in the proposed 2023 budget compared to the 2022 budget – independent revenues and government-owned enterprise. The government retained the values of special funds and lowered other revenue items such as share of federal revenues, dividends, aid and grants, among others.

The share of federal revenues was cut from N5.32 trillion in the 2022 budget to N4.39 trillion in the proposed budget. On the positive side, the government increased independent revenue from N1.82 trillion in the amended 2022 budget to N2.22 trillion in the proposed budget. Similarly, revenue from government-owned enterprises (GOE) from N1.73 trillion in the amended 2022 budget to N2.42 trillion in the proposed budget. The historical performance of GOEs makes one sceptical of potential revenue from the GOEs in the next fiscal year.

The assumptions that underline crude oil production and prices appear optimistic, especially crude oil production. The benchmark price of crude oil is $70 per barrel and crude oil production is 1.69 million barrels per day (mbpd). Without bold initiatives to reverse the decrease in crude oil production in the past few years, crude oil production in the next fiscal year is likely to be lower than the projected level of 1.69 mbpd. In the third quarter of 2022, Nigeria’s daily crude oil production was an average of 1 trillion mbpd, which is a 23.1 percent decrease from 1.3 mbpd recorded in the first quarter of 2022. The assumed production level in the 2023 budget, which is lower than the OPEC quota of about 1.8 mbpd but slightly higher than the assumption of 1.60 mbpd in the 2022 amended budget seems too high based on the current production level. With the projected low global demand in the next fiscal year and the contribution of high energy prices to the rising price levels, there is a high possibility that crude oil prices might fall below the $70 per barrel assumed in the next fiscal year. Overall, there is an urgent need to overhaul the revenue strategies, especially the GOEs, to attain the revenue projection of N9.73 trillion.

Figure 2: Revenue Breakdown

Notes: Share of Fed Rev denotes the share of federal revenues; Ind Rev denotes independent revenues; GOE denotes government-owned enterprises.

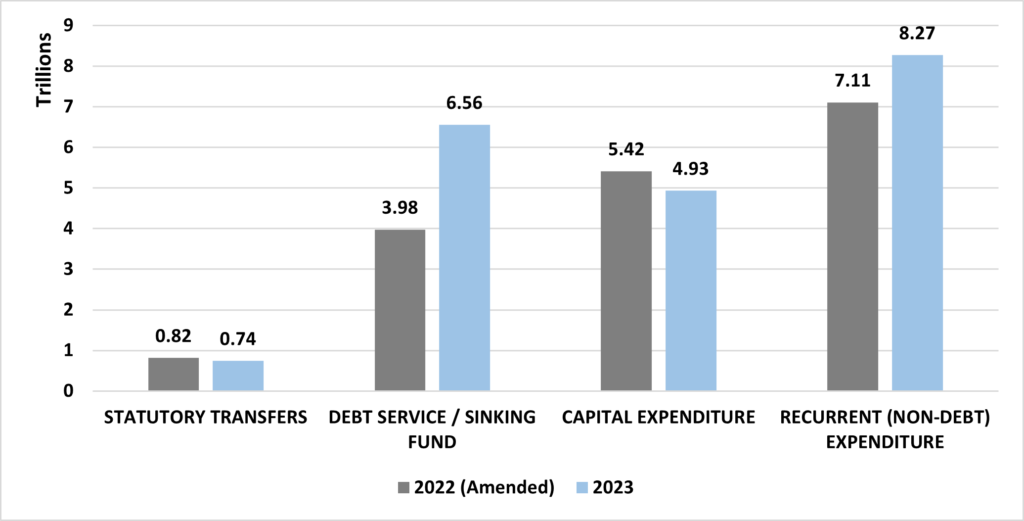

Next is the expenditure side. Government expenditure is broadly grouped into four categories: (i) statutory transfers, (ii) debt service and sinking fund, (iii) capital expenditure, and (iv) recurrent non-debt expenditure. Figure 3 shows that without adjusting for inflation, non-debt recurrent expenditure and debt services increased whereas statutory transfer and capital expenditures were reduced in the proposed 2023 budget relative to the 2022 amended budget. The Statutory transfers and capital expenditure were reduced by about N73.6 billion and 480.9 billion, respectively, making a total of N554 billion. In contrast, debt service and recurrent non-debt expenditure increased by about N2.58 trillion and N1.16 trillion, respectively, making a total of N3.74 trillion. However, the magnitude of the latter (N3.74 trillion) is higher than the former (N554 billion), resulting in an increase in government spending in the proposed budget by about N3.19 billion. The analysis suggests that the increment in the proposed budget is not driven by productive expenditure items, which are critical in enhancing a nation’s competitiveness and productive capacity, casting doubt on the country’s future growth and development.

Figure 3: Sources of changes in aggregate expenditure

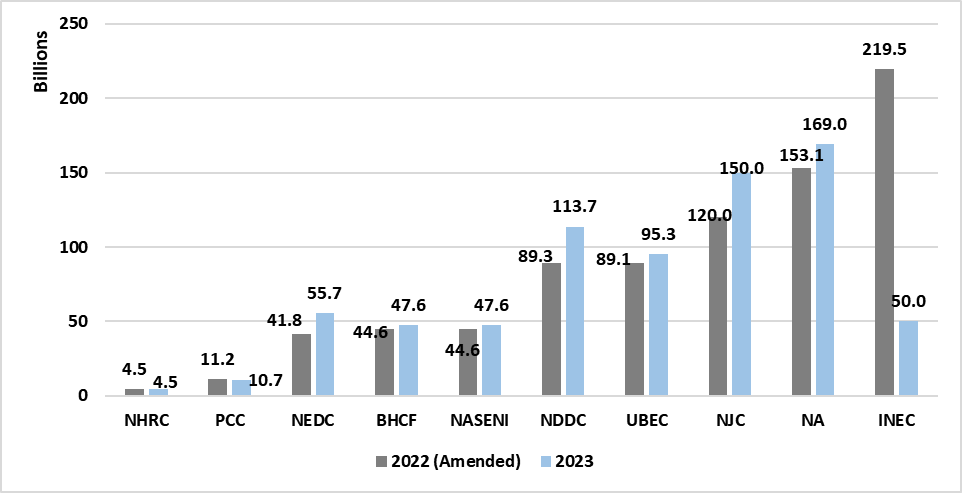

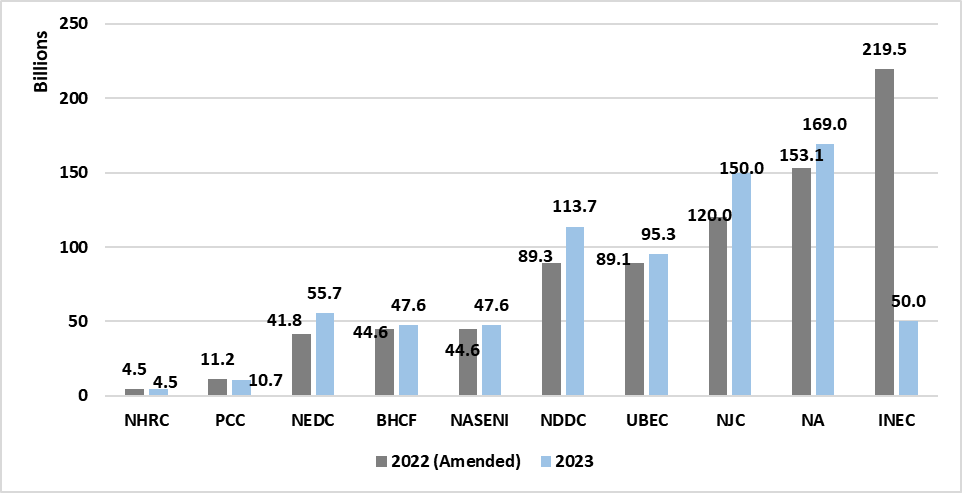

Statutory transfers are funds apportioned to government institutions that do not receive direct funding from the executive due to the nature of their functions. Currently, ten institutions receive funding through the statutory transfers depicted in Figure 4. The year-on-year decrease in the proposed budget is driven by the cut in two institutions (Public Complaints Commission (PCC), and Independent Electoral Commission (INEC)). For instance, the budgetary allocation to INEC in the proposed budget is N50 billion, which is about a quarter of the amount budgeted in 2022. The sharp decline in INEC exceeds the increase in the other statutory transfer items that increased.

Figure 4: Composition of statutory transfer

Notes: NHRC is the National Human Rights Commission; PCC is the Public Complaints Commission; NEDC is the Niger-Delta Development Commission; BHCF is Basic Health Care Fund; NASENI is National Agency for Science and Engineering Infrastructure; NDDC is Niger-Delta Development Commission; UBEC is Universal Basic Education; NJC is National Judicial Council; NA is National Assembly; INEC is Independent Electoral Commission.

Every fiscal year, the government appropriates funds to ensure the timely payment of loan interest and principal. Nigeria’s debt service is divided into two categories: domestic debt service and foreign debt service. Budgetary allocations for both domestic and foreign debt services were increased in the proposed budget relative to the amount stipulated in the 2022 amended budget, as shown in Figure 5. The increase implies that the limited government revenue would be used to service the debt. Domestic debt service was increased by 75% to N4.5 trillion in the proposed budget, while foreign debt service was increased by 62% to N1.8 billion.

However, the sinking fund was decreased by 15 percent to N247.7 billion. As a result, the amount allocated for sinking funds and debt service stood at N6.56 trillion and 67.4 percent of the proposed revenue. Of the N3.19 trillion increase in total expenditure, debt services accounted for about 80.9 percent of the increase. Given that budgeted debt service is usually higher than actual, whereas budgeted revenue is less than actual, debt service as a ratio of government revenue might exceed 100 percent.

Figure 5: Proposed 2023 budget: Rising sinking fund and debt service

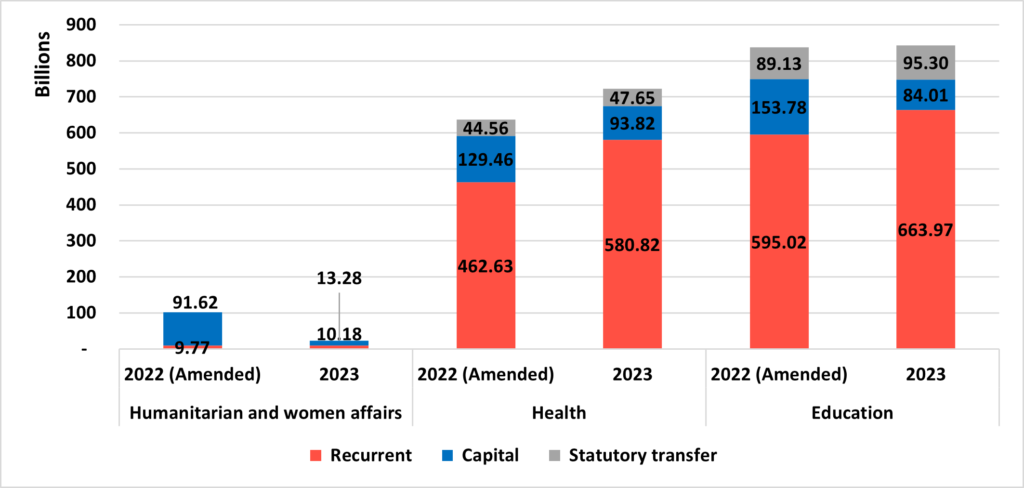

Budgetary allocation to critical economic sectors is examined in the following four charts. In Figure 6, we presented information about humanitarian and women’s affairs, health, and education. Adequate budgetary allocations, especially capital expenditure, to these sectors, are essential in having enlightened citizens in good health. In the proposed 2023 budget, it is evident that all the sectors recorded a decrease in capital expenditure, reducing the ratio of capital expenditure to recurrent expenditure. However, the recurrent expenditure increased in all the sectors. The increase in recurrent expenditure for both the health and education sectors exceeded the cut in capital expenditure. The increase in the education sector’s recurrent expenditure is partly consistent with the recent upward review in the retirement age (to 65 years) and elongation of service years (to 40 years) for teachers in the Harmonised retirement age for teachers in Nigeria Act. The decrease in the ratio of capital expenditure to total expenditure for the social sector indicates that actors in the sector would be faced with situations of working with old and ageing equipment with no hope of replacement. Also, newly developed modern pieces of equipment are less likely to be acquired, which ought to enhance their productivity.

For example, doctors are more likely to be denied access to new w surgical tools that could make them attend to more patients in a day, which in turn, would increase patients waiting time in hospitals. Furthermore, the low budgetary allocation for teachers indicates that teachers in unity schools are less likely to have access to the most up-to-date digital teaching tools.

Figure 6: Social sector

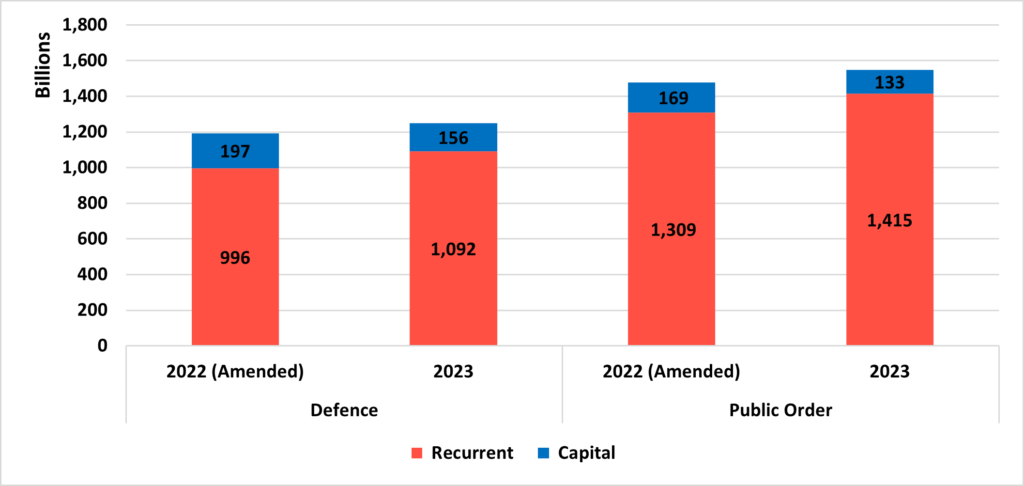

Nigeria is dealing with insecurity, which to a large extent, has limited the economy’s rate of expansion. The proposed budget for security in 2023, depicted in Figure 7, provides guidance on how the government will address insecurity. The allocation to defence and public order mirrors what was previously observed in the education and health sector, where less than a quarter of budgetary allocation was assigned to capital spending. In the proposed budget, capital spending was reduced for both defence and public order, whereas the recurrent expenditure was increased. The pattern is like what was earlier reported for the aggregate expenditure. The public order consists of the Ministry of Interior, the Office of the National Security Adviser, the Federal Ministry of Justice, Police Services, the Federal Ministry of Police, the National Judicial Council, and the Police Service Commission. A source of concern here is that an economy with an upcoming election year that has been characterized by uncertainties and embroiled with high insecurity should prioritise spending on capital expenditure for security agencies in 2023 to facilitate investment in modern-day equipment and strengthen intelligence gathering to effectively protect lives and properties.

Figure 7: Defence and public order

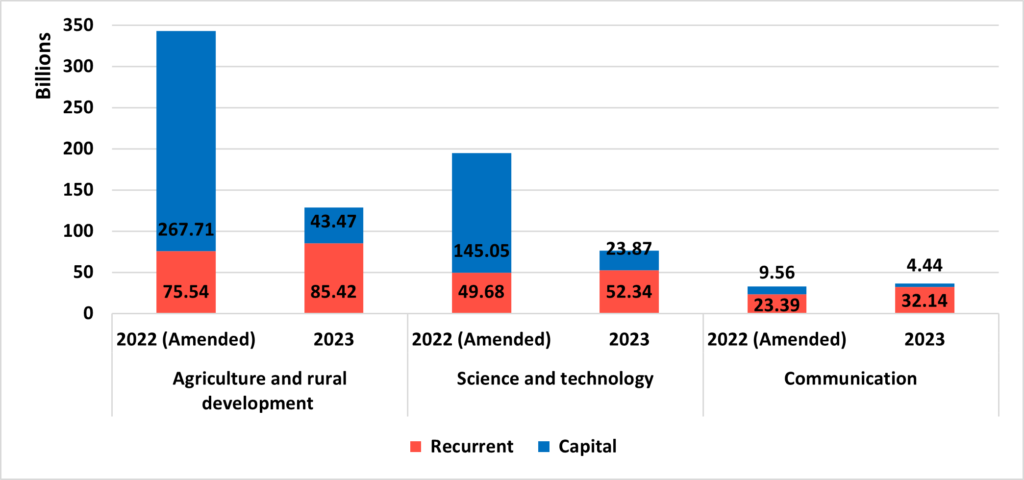

Nigeria is an agrarian society with agriculture accounting for more than a quarter of the domestic output and employing more than a third of the labour force, especially in rural areas. As the economy advances and with the emergence of new industries, the share of employment in agriculture is decreasing. The disruption associated with the pandemic is projected to increase the transition away from agriculture as technological space expands. The extent to which an economy would develop depends mainly on investment in science and technology, including communication. In the proposed 2023 budget, the allocation to Science and Technology decreased by N118.5 billion to N76.2 billion from N194.7 billion in the 2022 amended budget. The decrease was mainly driven by the cut in capital expenditure which declined by about N121.2 billion to N23.9 billion in the proposed budget. Further, the government reduced capital expenditure allocation for agriculture and rural development and communication. As a result, in these sectors, the ratio of capital expenditure to total expenditure decreased by about half. The ratio decreased from 78 percent in the 2022 amended budget for agricultural and rural development to 33.7 percent in the proposed 2023 budget. Similarly, for the communication sector, the ratio decreased from 29 percent in the 2022 amended budget to 12 percent in the proposed 2023 budget.

Figure 8: Enabling sectors: Agriculture, Communication and Science

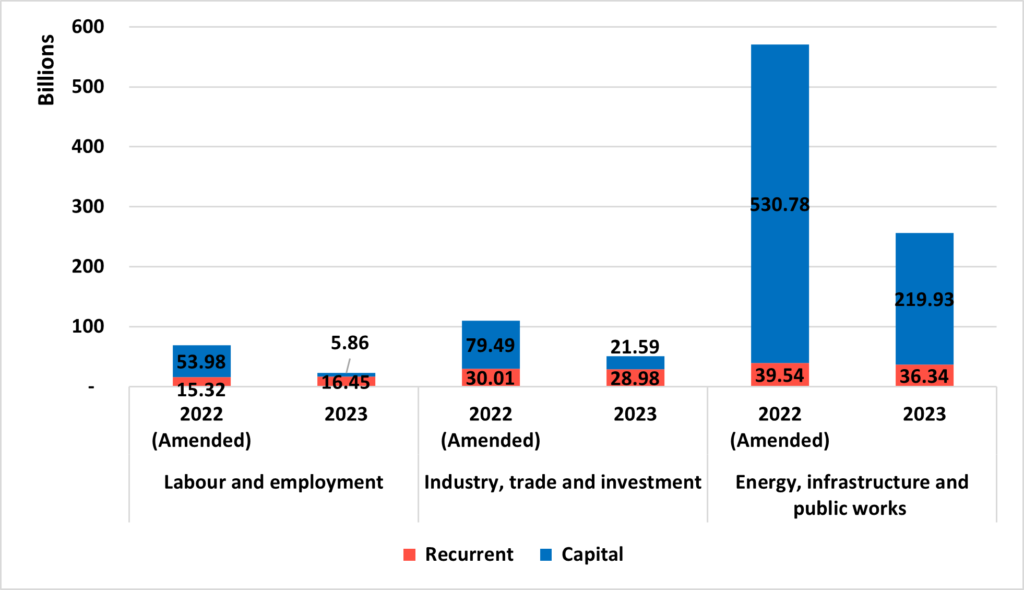

The potential growth of an economy is informed by labour and capital investment. Figure 9 shows proposed budgetary allocation to (i) labour and employment; (ii) industry, trade, and investment; and (iii) energy, infrastructure, and public works in the 2023 fiscal year. Unlike the pattern observed for social sectors and defence and public order, allocation to recurrent and capital expenditure decreased in (i) industry, trade, and investment; and (ii) energy, infrastructure, and public works. The decrease in budgetary allocation to these sectors in the face of rising price levels indicates that limited projects might be executed in the 2023 fiscal year compared to 2022. Also, the government may not be able to execute enough projects that are critical to starting industrialisation necessary to create jobs and reduce poverty, as envisioned in the Medium-Term National Development Plan, 2021 – 2025.

Figure 9: Engine of growth: Labour, Investment, and Infrastructure

Implications

The 2023 proposed budget has two key implications for the 2023 fiscal year:

- Rising Debt: Without significant improvement in the government’s revenue position by 2023, the debt will reach an unsustainable threshold. The continued reliance on the debt-to-GDP ratio rather than the debt service to revenue ratio in describing the debt situation limits hiding Nigeria’s unsustainable debt position. While the debt accumulation is part of the development process, especially when funding capital expenditure, the recent recourse to borrowing to pay salaries indicates how weak the revenue mobilisation capacity of the government is. As a matter of urgency and priority, there is a need to strengthen public management of the national treasury to ensure that funds are used as efficiently.

- Recurrent Account VS Capital Account: The amended budget shows the government’s priority tilts toward spending that affect immediate needs rather than those that support future productive capacity. Nigeria’s infrastructural deficit is enormous and increases with time due to past negligence and a growing population. In the amended budget, the government reduced capital expenditure in nearly all the critical sectors of the economy. While capital expenditure is the most common method used in diverting public funds into private pockets, the reduction in the budgetary allocation indicates the Nigerian government’s unpreparedness to provide the needed infrastructure for economic development. With the current expenditure path, it is unlikely that the federal government will be able to achieve its allocated investment outlay ofN29.6 trillionover the next five years as projected in the 2021 – 2025 National Development Plan. With the dwindling revenue sources, the government needs to create policies and develop more initiatives such as the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, to incentivize the private sector to participate more in the provision of infrastructural facilities.

Conclusion

This article highlights how imperative it is for the government to effectively mobilize all available revenue sources; otherwise, more than half of the 2023 budget will be financed through high-interest-rate borrowing, increasing future debt service. Furthermore, to realize the federal government’s investment commitment in the National Development Plan, budgetary allocation for capital expenditure must be significantly increased in 2023 and beyond. Hence, in the deliberation and preparation of the implementation framework for the 2023 budget, due consideration should be given to two keys: (i) revenue mobilisation and debt management and (ii) performance of capital expenditure and incentivization of the private sector participation in the provision of infrastructure.