FDI, FPI And Other Investments 2

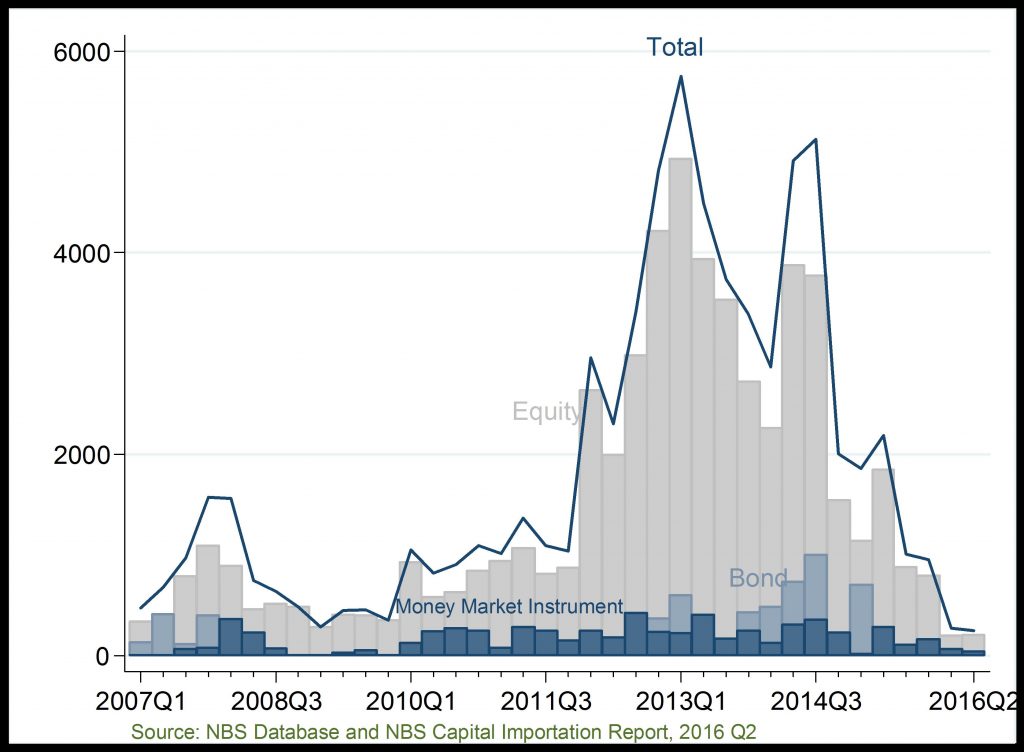

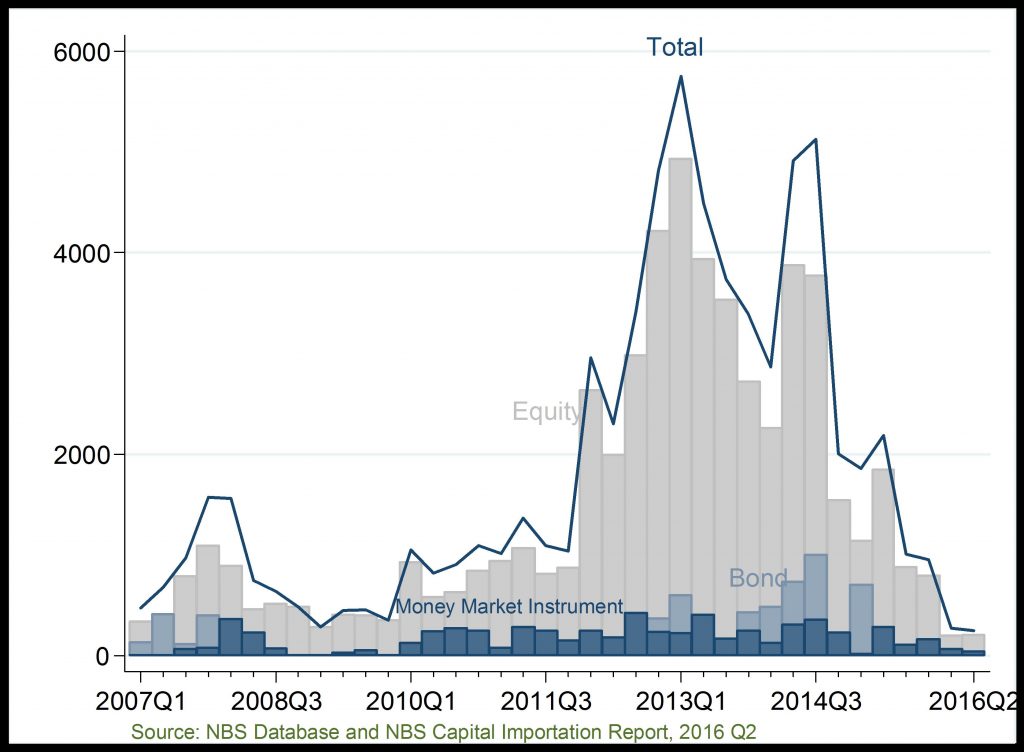

FPI and its Components (US $ Million)

Equity-based investment dropping rapidly

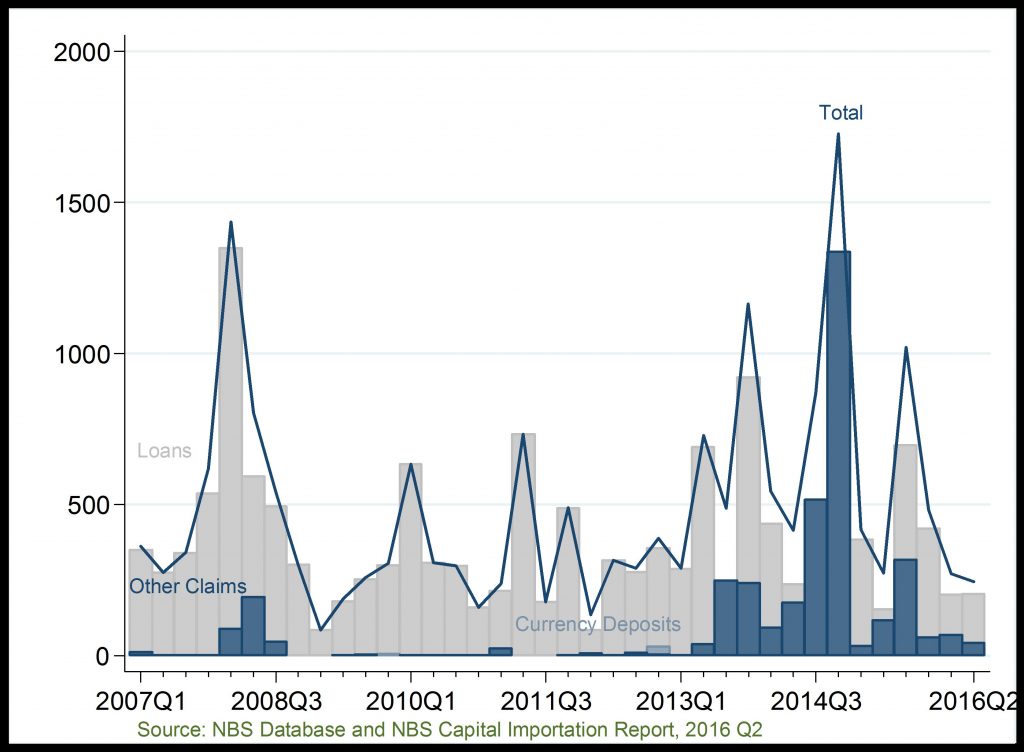

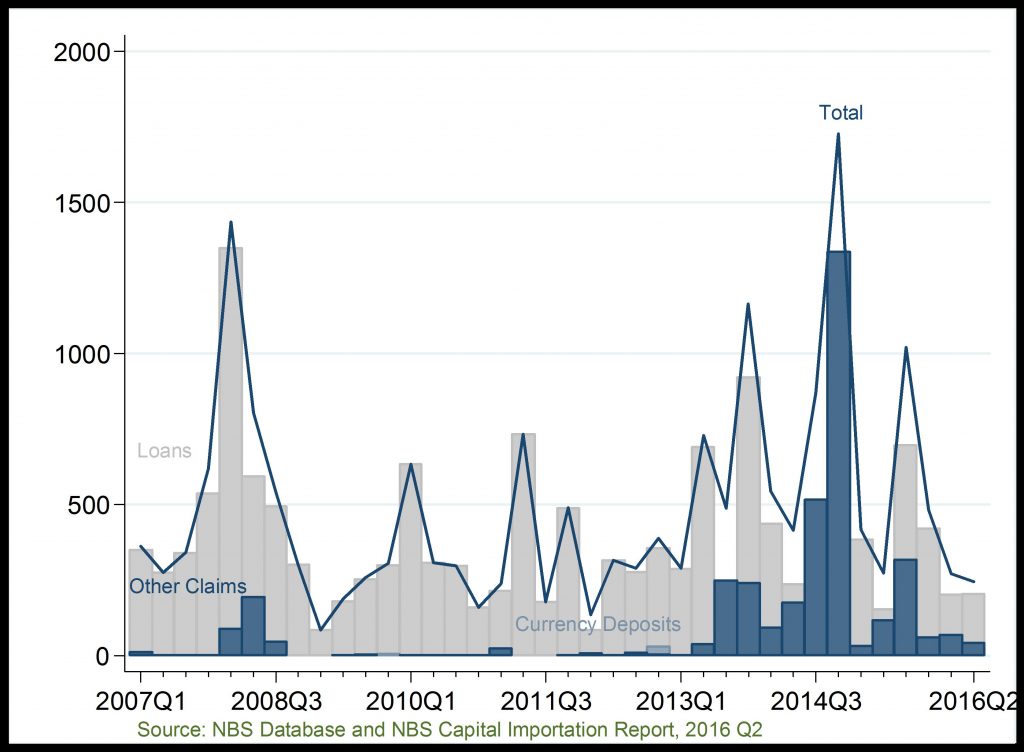

Other Investments (US $ Million)

Loans and currency deposit declining lately

FDI, FPI and other Investments: The unusual fall in overall capital importation, especially in equity investment, in the late 2015 and early 2016 is attributable to the tougher macroeconomic and financial conditions occasioned by lower oil price, and changes in external factors such as the anticipated hike in US interest rate and the delisting from JPMorgan EM Bond index.

Related

Tax Collected: Tax revenue which has relatively maintained an upward trend, fell considerably in 2015 and dipped significantly in early 2016 on the account of economic downturn, as many businesses sev

Capital Importation: Foreign investment into the agricultural sector was relatively flat between 2007 and 2012 but gained unusual momentum in September 2015. The spike in 2015 is likely driven by the

FDI, FPI and other Investments: Portfolio investment has continued to fall rapidly since 2014, while FDI inflows remain subdued since 2010

Public Debt-to-GDP Ratio: The ratio of Nigerias cumulative government debt to national GDP has maintained an upward trend indicating the countrys declining economic productivity and ability to repay