Net Foreign Exchange Flows Through The Nigerian Economy

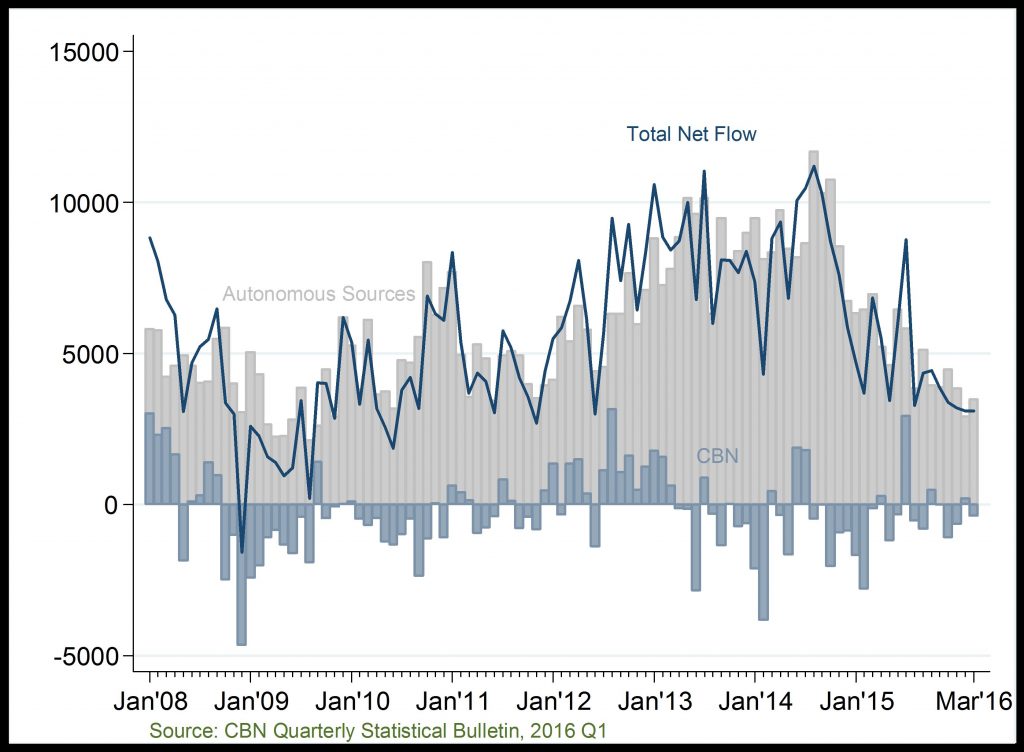

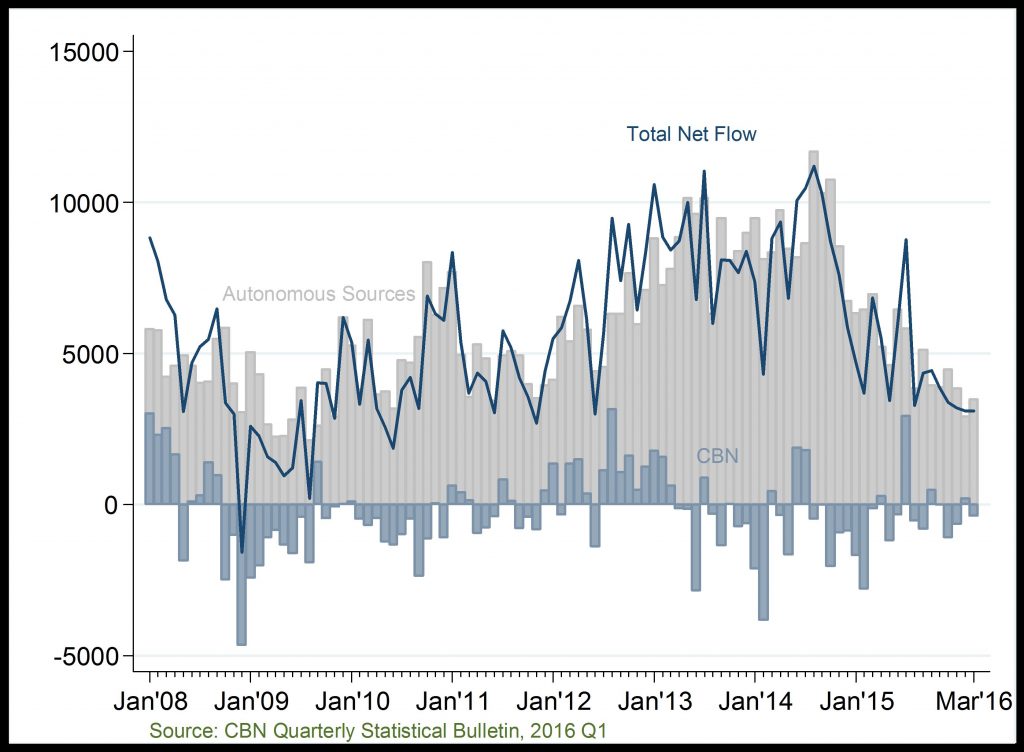

Net Foreign Exchange Flows (US$ Million)

Declining forex flows, post-2014

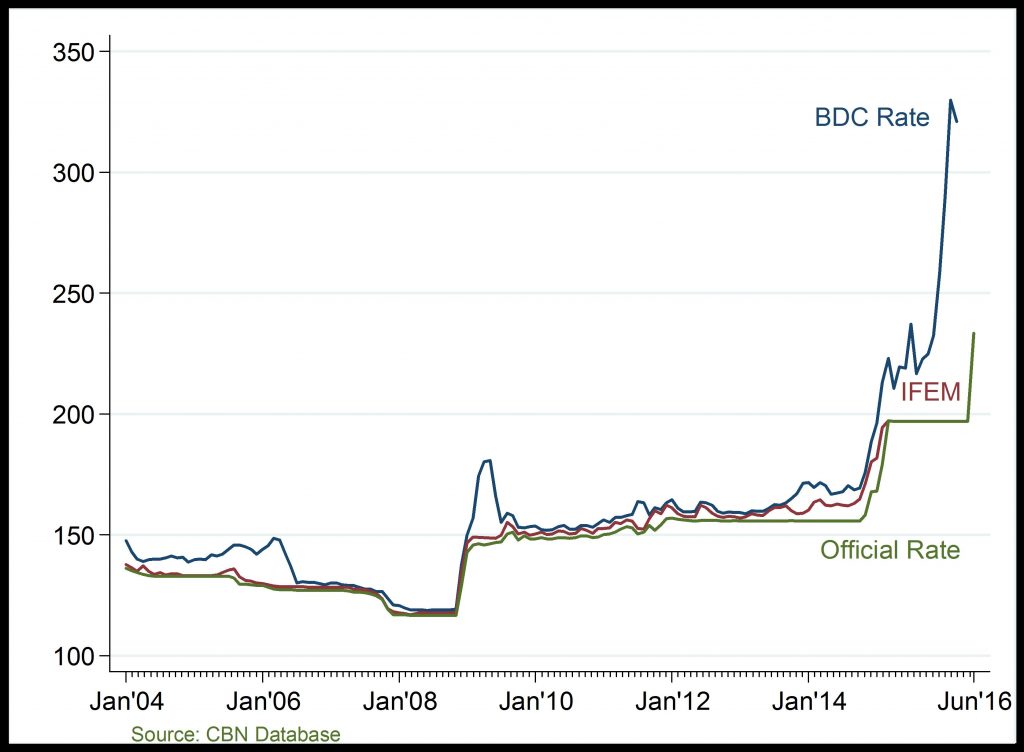

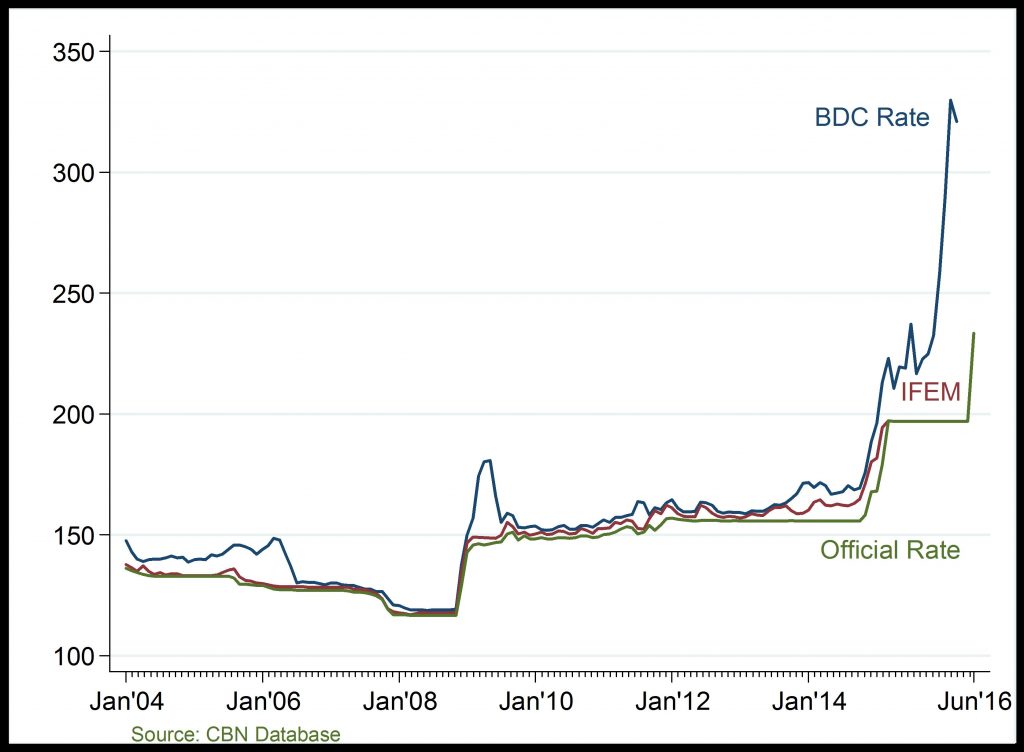

Exchange Rate (/$)

Dramatic rise in exchange rate, post-2014

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonomous sources.

Exchange Rate: The gap between official and parallel market rate (typically, BDC) widened abnormally in 2016Q1. This is attributed to the fall in oil price driving down foreign reserve. Exchange rate worsened in 2016Q2 with the introduction of flexible exchange rate policy in June.

Related

FDI, FPI and other Investments: Portfolio investment has continued to fall rapidly since 2014, while FDI inflows remain subdued since 2010

Public Debt Stock and Debt Servicing: Public debt stock has steadily increased overtime; reaching over N12, 000 billion naira by 2015Q4. With the persistent fall in crude oil price and the attendant d

Internally Generated Revenue: Total internally generated revenue particularly declined across the 36 states in Nigeria, in 2015. This is attributable to the weak macroeconomic and financial conditions

Capital Importation: Given the positive outlook on the ITC sector in the past few years, investments in the sector reached a 10-year peak in 2014. However, the foreign investment fell marginally in 2