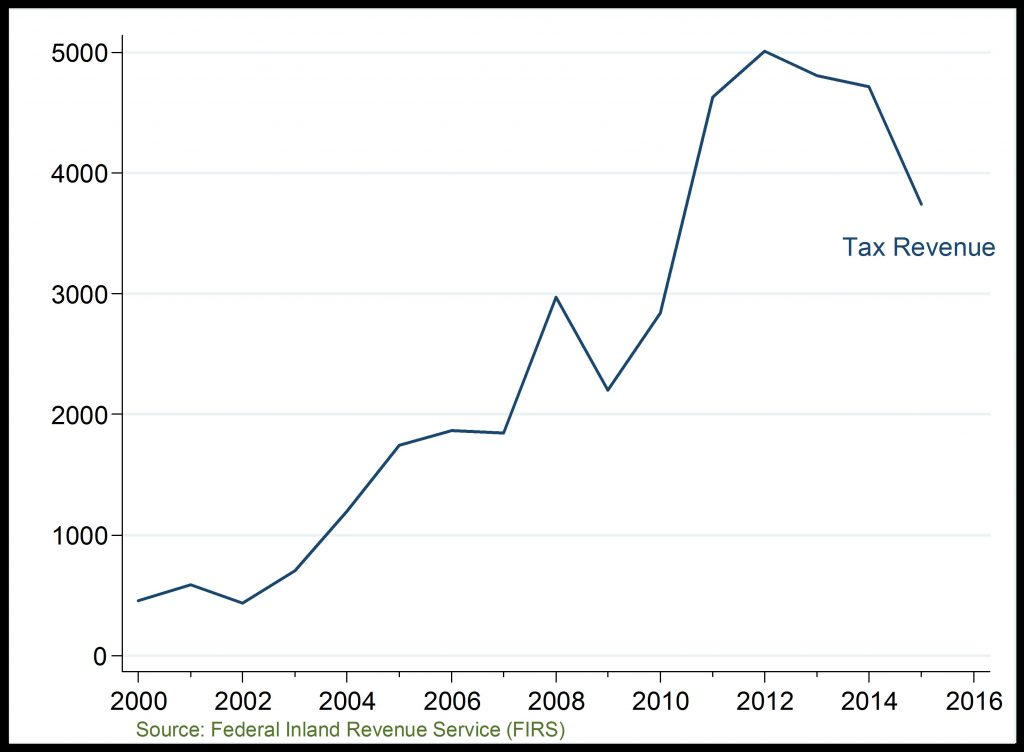

Declining tax revenue, post-2012

Tax Collected (Billion )

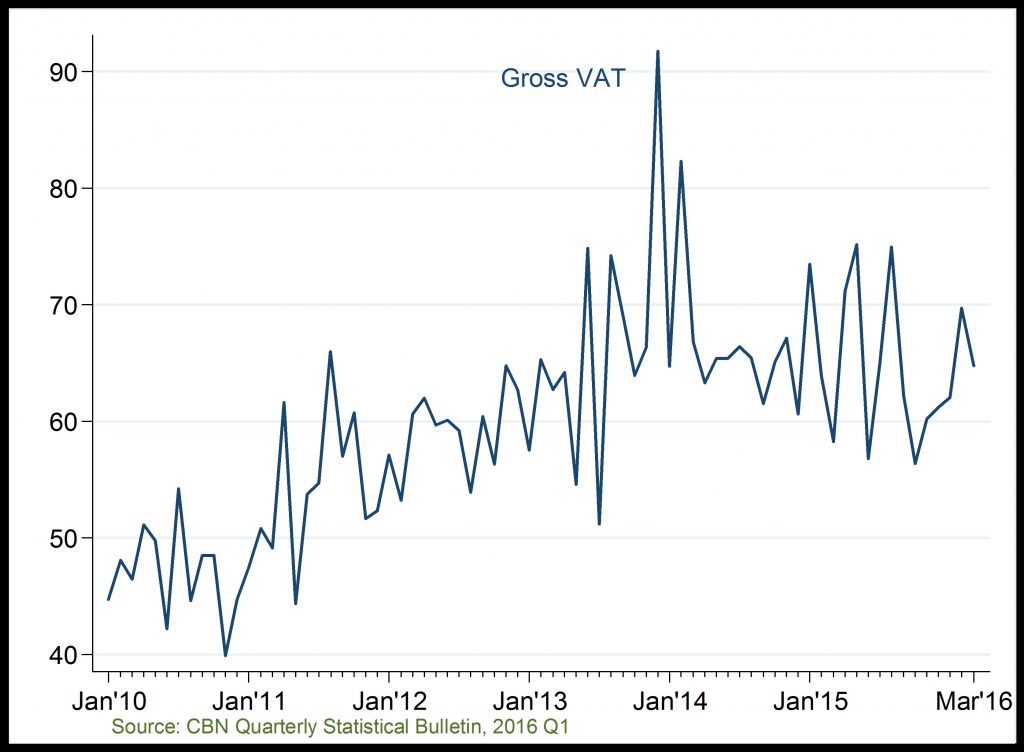

Gross Value Added Tax (VAT) (Billion )

Unstable tax (VAT) collection

Tax Collected: Tax revenue which has relatively maintained an upward trend, fell considerably in 2015 and dipped significantly in early 2016 on the account of economic downturn, as many businesses severely underperformed or shut down operations in the period.

Gross Value Added Tax: Gross Value Added Tax (gross VAT) has maintained fluctuant tempo; reaching a trough at below N40 billion in 2010Q4 and peak of above 90 billion dollars in 2013Q4. In recent times, gross VAT has fallen below N50 billion on the account of falling consumer demand following present macroeconomic challenges.