Capital Importation And Budgetary Allocation (Oil And Gas)

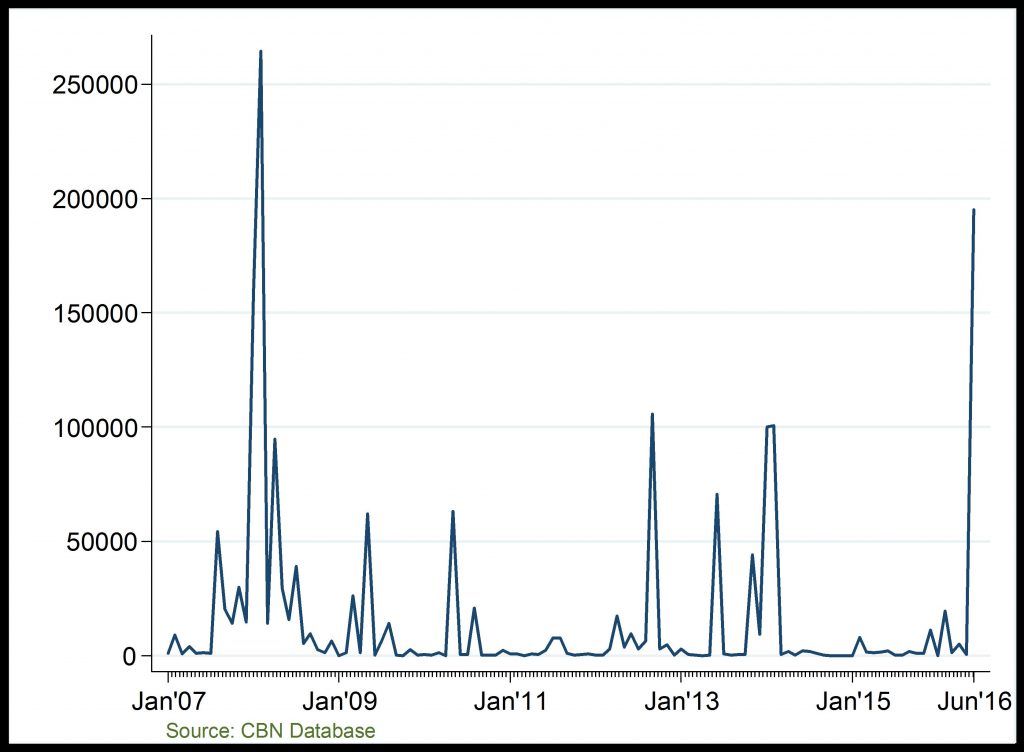

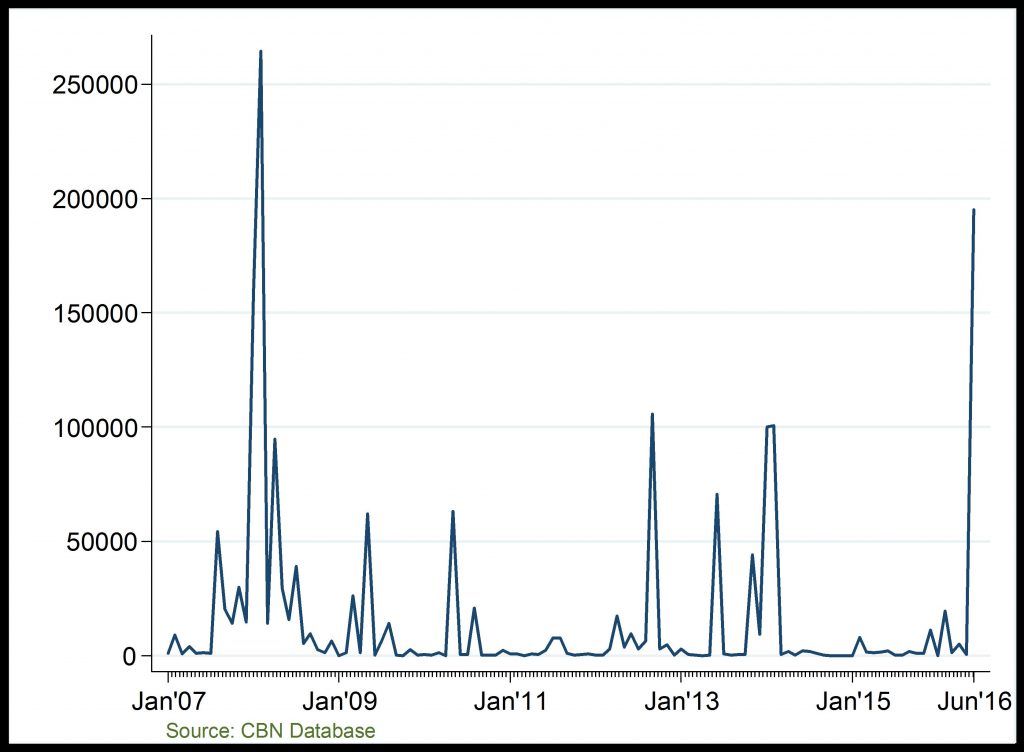

Capital Importation (US$ Thousand)

Investment rise sharply in 2016Q2

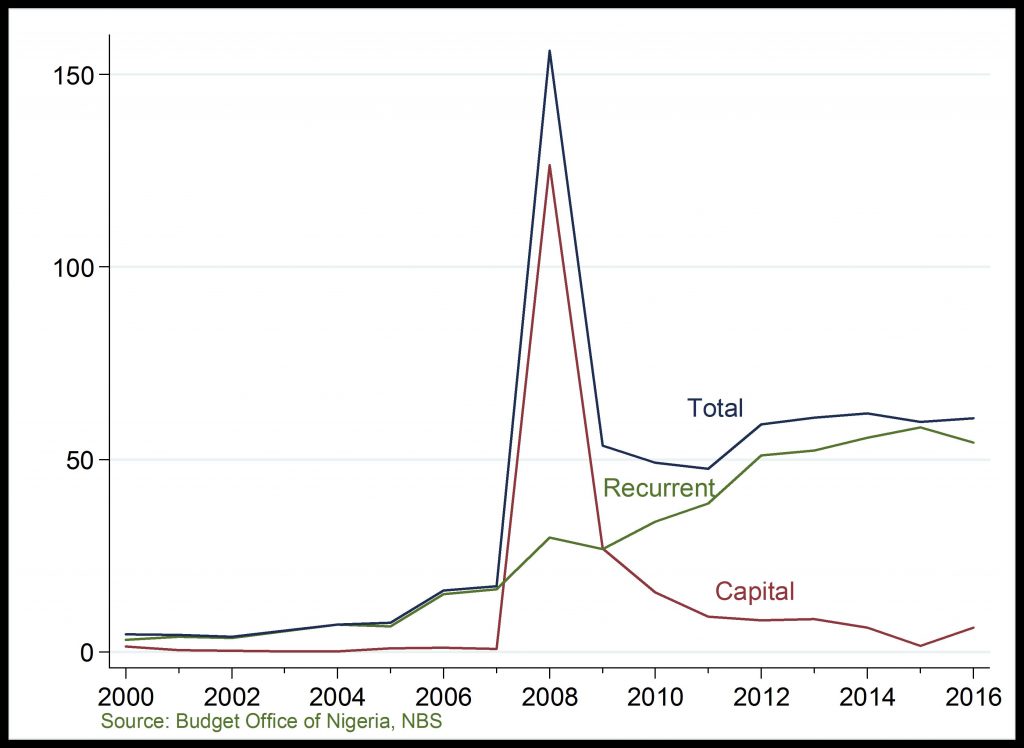

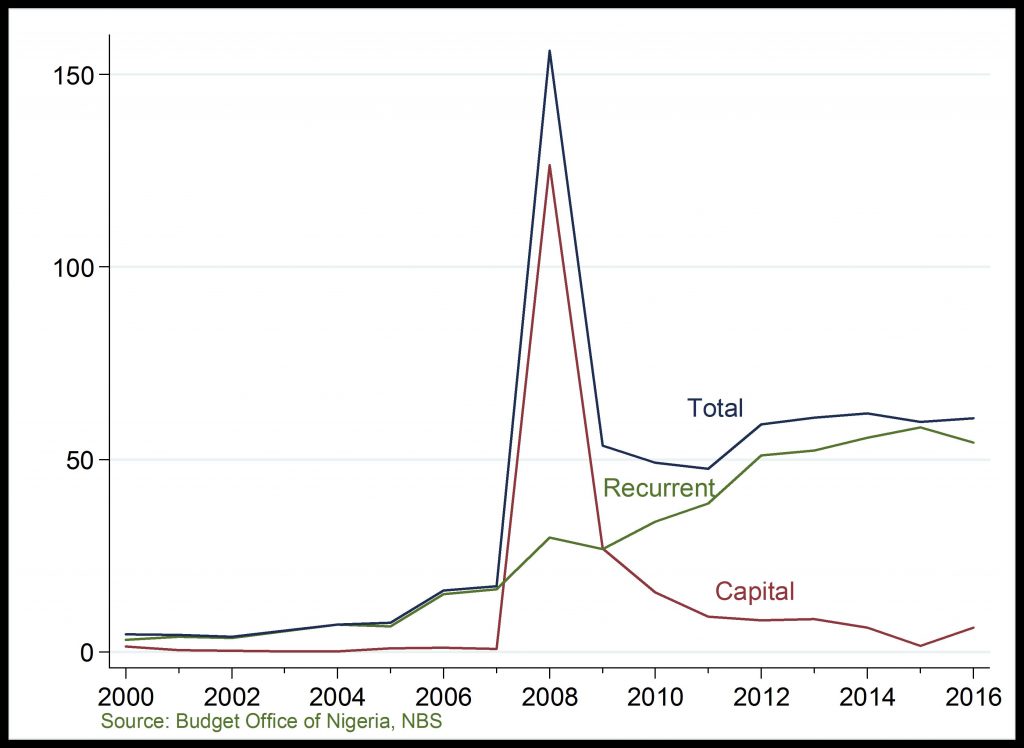

Budgetary Allocation (Billion )

Capital vs Recurrent expenditure, closing the gap?

Capital Importation: Investment in the oil and gas sector has remained low since 2009. However, investments into the sector fell more deeply in 2015, on the account of persistent global and domestic challenges to the sector. However, it increased sharply in 2016Q2 on the account of increased disbursement in the sector by the CBN for the repair of damaged oil and gas pipelines.

Budgetary Allocation: Recurrent spending has continued to rise as capital spending fall (or rise marginally) in annual national budget allocation since 2009. However, considerable convergence capital and recurrent expenditure is recorded in 2016 budget, signalling government interest in improving the oil and gas sector.

Related

Public Debt-to-GDP Ratio: The ratio of Nigerias cumulative government debt to national GDP has maintained an upward trend indicating the countrys declining economic productivity and ability to repay

Purchasing Managers Index: The level of business activities declined sharply in the first half of 2016 on the account of weak economic performance. Particularly, the issues surrounding exchange rates

Capital Importation: Since the dramatic decline in 2013, private and government sector investments in the sector have remained low in 2016.

Budgetary Allocation: Budgetary allocations to the transpo

Capital Importation: Given the positive outlook on the ITC sector in the past few years, investments in the sector reached a 10-year peak in 2014. However, the foreign investment fell marginally in 2