Net Foreign Exchange Flows Through The Nigerian Economy

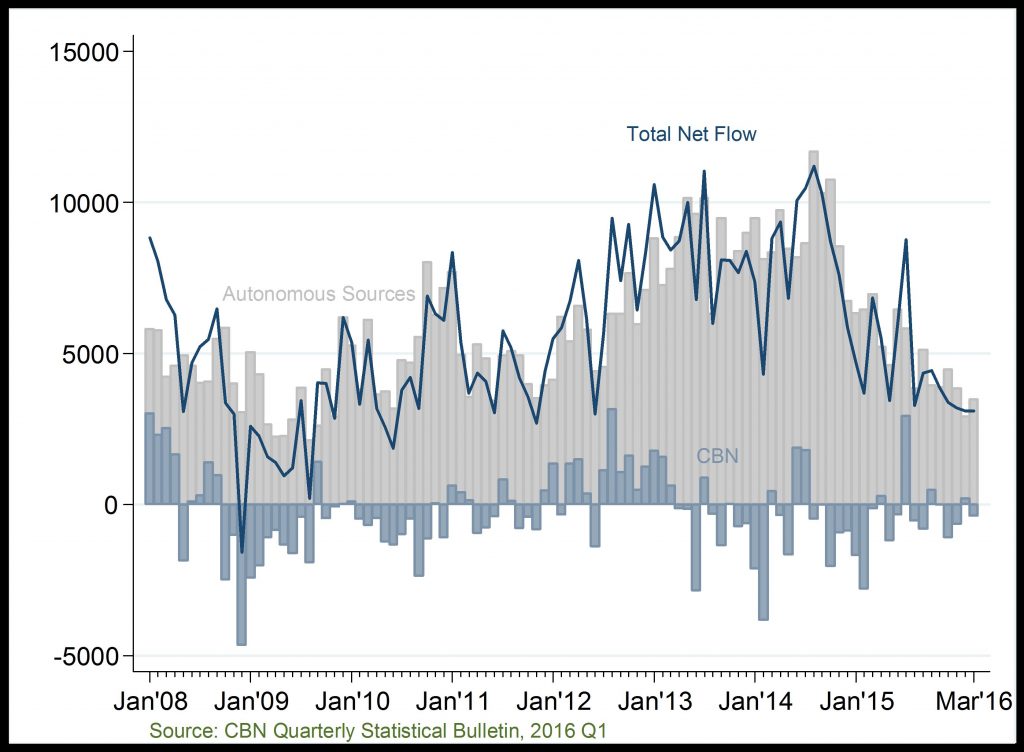

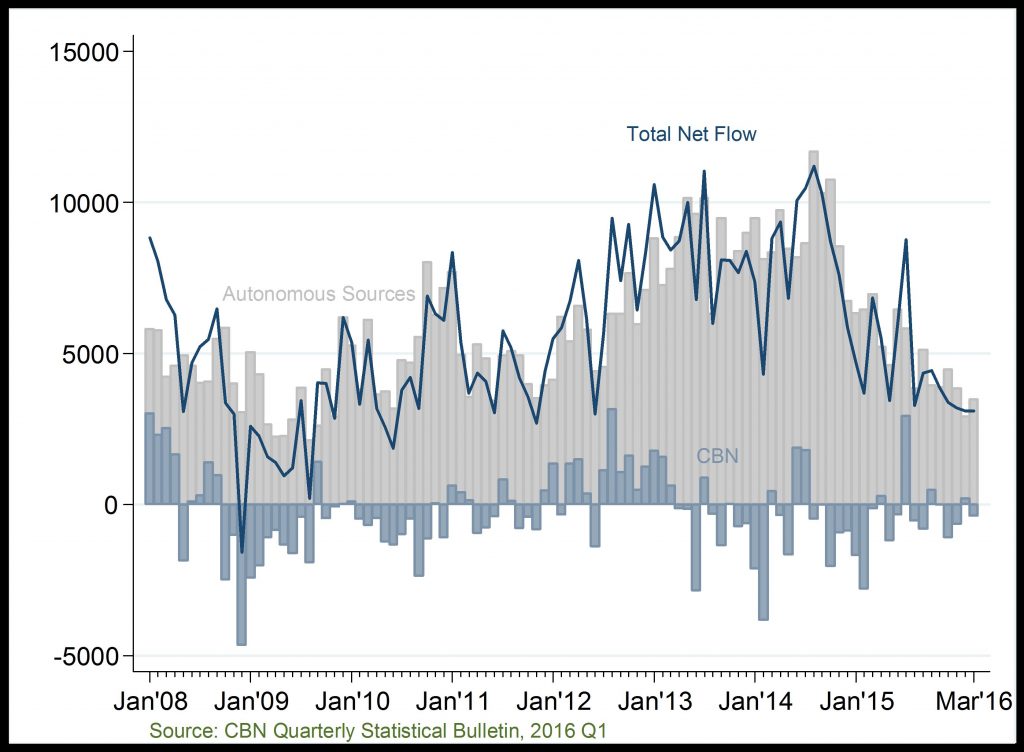

Net Foreign Exchange Flows (US$ Million)

Declining forex flows, post-2014

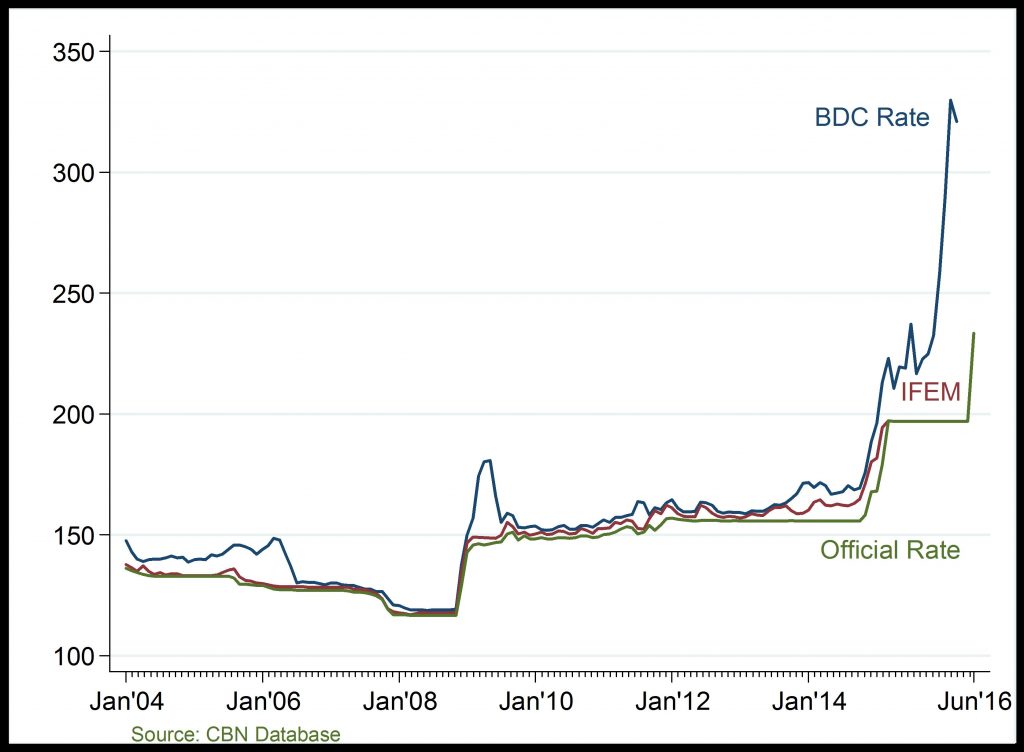

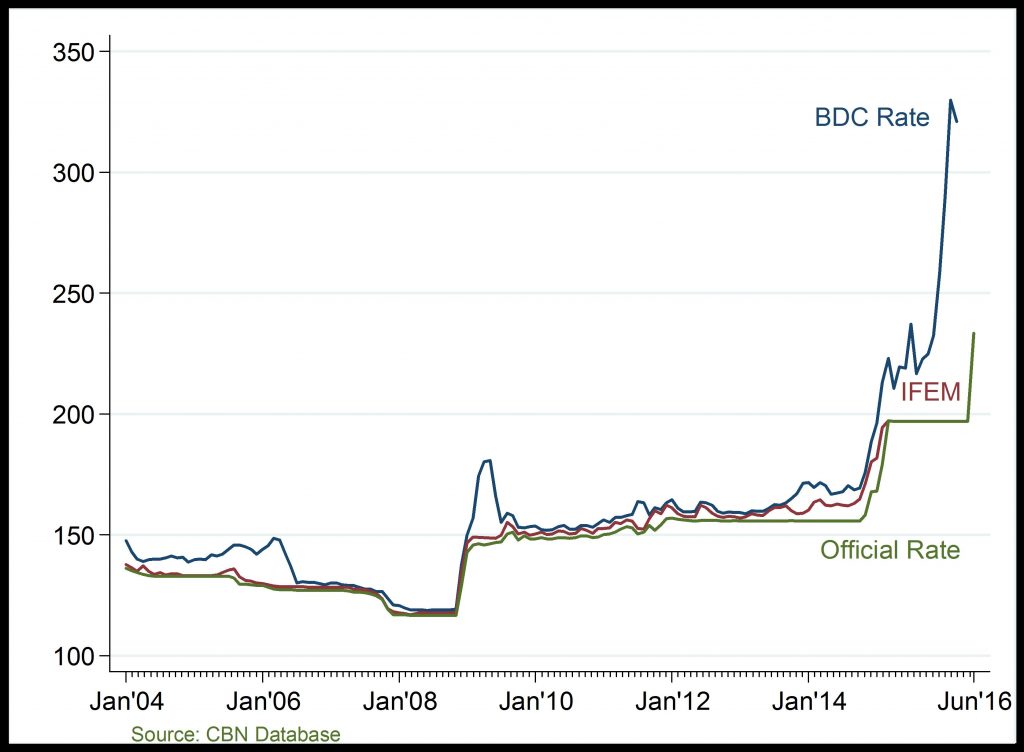

Exchange Rate (/$)

Dramatic rise in exchange rate, post-2014

Net Foreign Exchange Flows through the Nigerian Economy: The recent fall in foreign exchange earnings reflects the decline in both oil sector receipts from CBN, and non-oil sector inflows from autonomous sources.

Exchange Rate: The gap between official and parallel market rate (typically, BDC) widened abnormally in 2016Q1. This is attributed to the fall in oil price driving down foreign reserve. Exchange rate worsened in 2016Q2 with the introduction of flexible exchange rate policy in June.

Related

On average, Nigerias GDP growth rate has averaged about 5 percent; attaining an unusual trough of nearly -10 percent in 2003Q4 and a peak of nearly 20 percent in 2004Q4. However, the Nigerian economy

Tax Collected: Tax revenue which has relatively maintained an upward trend, fell considerably in 2015 and dipped significantly in early 2016 on the account of economic downturn, as many businesses sev

Capital Importation: Overall capital imported into the manufacturing sector fell deeply in 2015 and has remained low in 2016H1 on the account of present FOREX issues affecting businesses in the sector

91-Day Treasury Bills: T-bill rate has highly fluctuated overtime on the account of the rise and fall in investor confidence, monetary policy easing/tightening, governments demand for funds, and infl