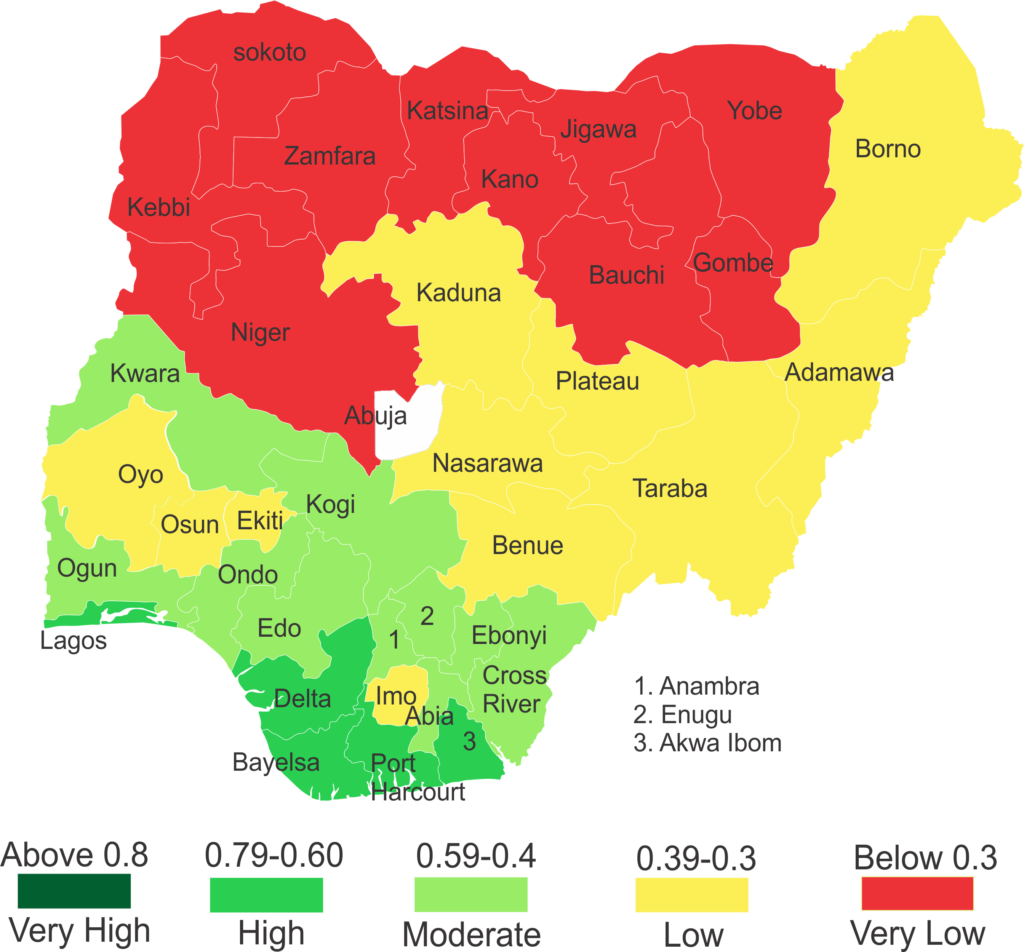

This study develops a comparable Human Development Index for subnational government in Nigeria. While built on the UNDP approach, we extend the generic framework to address challenges at the subnational level such as comparable indicator, data unavailability, and estimation technique. The result shows a wide disparity across states in their human development, with states within the southern region recording more impressive performance. We further examine the key economic and political drivers of the observed variations across the state and found fiscal sustainability and geopolitical zoning as the key determinants.

Policy Brief & Alerts

September 14, 2018

Beyond Country-level Averages: Construction of Sub-National Human Development Index for the Nigerian States

This study develops a comparable Human Development Index for subnational government in Nigeria. While built on the UNDP approach, we extend the generic framework to address challenges at the subnational level such as comparable indicator, data unavailability, and estimation technique. The result shows a wide disparity across states in their human development, with states within […]

Read →

Related

Nigeria Economic Update (Issue 11)

In the crude oil market, OPECs weekly

basket price increased 1.07 percent from $29.02 per barrel in February 19 to

$29.33 per barrel in February 26. A combination of factors were

responsible for the slight price increase. First, a decrease in the number of

active oil rigs in the US2 (the lowest since 2009) may have

marginally eased the glut in the crude oil market. The ongoing efforts by OPEC

and other major oil producers such as Russia to freeze oil production have also

played a significant role in stemming the downward trend in oil prices. With

the current market conditions, the price of crude oil is expected to maintain a

fairly stable and modest upward trajectory in the near term.

Nigeria Economic Update (Issue 27)

The

Naira strengthened against the dollar in the review week. Specifically, the

Naira appreciated by 2.7 percent to N355/$ (parallel market rate) on June 17, 2016,

following the release of the flexible FOREX policy guidelines by the CBN on

June 15, 2016. The new policy effectively adopts a single market structure

hosted at the autonomous/inter-bank market. The inter-bank trading scheduled to

commence on June 20, 2016 will be market-determined, officially eliminating the

N197/$ peg. To ensure foreign exchange liquidity, primary market dealers have

been introduced while the CBN will participate in the market through periodic interventions.