Unlocking Africa's Digital Potential: The Role of EU-Africa Collaboration

Introduction

The digital economy is on the exponential rise due to its capability to transform and revolutionise economies and societies, influencing how we work, live, and interact. Otherwise known as digitalization, the digital economy refers to economic activities facilitated by digital technologies and digital data in businesses and organizations. One of the sundry blessings of globalisation, as it relates specifically to the thrust of this article, is its ability to necessitate a strategic cross-border collaboration between nations or/and continents in the digital space. It is well-documented that countries such as the United States, China, Singapore, and Chile have developed strategies to integrate their data governance and policy frameworks to drive the growth and development of their digital markets. This trend does not exclude continents like the European Union (henceforth represented in this article as the EU) and Africa.

This article examines the potential benefits of digital collaboration for the sustainable growth and development of Africa's digital economy. It explores the potential outcomes of this collaboration for Africa, such as the integration of data policy and frameworks for economic growth, closing the gender gap, fostering innovation-driven digital entrepreneurship, establishing data governance across Africa, and promoting the adoption of the EU's data model for protecting digital rights. In addition to attracting public-private investment and promoting digital inclusion. The article concludes by identifying the steps that Africa must take to harness the potential of the EU-Africa digital collaboration fully.

The EU-Africa Digital Collaboration – An Exegesis

Precisely on the 22nd of April, 2015, history was made in the faraway Brussels, where the College of the European Commission hosted the College of the African Union Commission for their annual meeting. The EU is never a stranger to Africa. For decades, it has been Africa’s biggest trading partner. Statistics, according to United Nations Conference on Trade and Development (UNCTAD), 2022, claim that almost a fifth of global Foreign Direct Investment (FDI) flows in Africa come from EU companies. The meeting in April 2022 provided these two strategic partners, who share common visions, aspirations and challenges globally, with the opportunity to formally design a political framework of partnership that would yield enduring benefits for each other. Christened the Joint Africa-EU Strategy (JAES), the framework for the EU-Africa partnership, popularly regarded as the first and only intercontinental partnership strategy ever, was aimed at tackling together issues of common concern such as peace and security, democracy, good governance and human rights; human development; sustainable and inclusive developmental growth and continental integration, and other global and emerging issues.

Meanwhile, today, the EU-Africa partnership has extended beyond the scope of the afore-listed concerns. It has birthed a strong and effective digital cooperation aimed at transforming and developing Africa’s digital economy. On different occasions, the continents have demonstrated strong commitment towards promoting exchanges and partnerships with the private sector, civil society organisations, enterprises, and data policy experts in the digital field. For instance, in 2018, both partners launched the EU-AU Digital Economy Task Force (DETF) to identify tangible policy recommendations and propose bona fide steps towards tackling significant barriers and enhancing cooperation in the digital field.The policy recommendations identified by the EU-AU Digital Economy Task Force are mirrored in the AU Digital Transformation Strategy for Africa 2020 – 2030. Some of these policy recommendations include but are not limited to the development and implementation of regional and continental digital strategies, the development and implementation of data protection and privacy policy and regulation in line with the Malabo Convention, the promotion of regional/continental licensing mechanisms to facilitate establishment of regional/continental operators’ networks and service providers, and the facilitation of policy coherence for the achievement of digital transformation in Africa The European Data Strategy mentions EU-Africa cooperation on data, stating, “the EU will support Africa in creating a data economy for the benefit of its citizens and businesses”.

With technological capabilities and dependable workforce (in terms of the concentration of digital policy experts) that can drive the realisation of an innovative digital economy, the EU holds an enviable position as a formidable agenda setter for digital business and digital governance on the global front. It boasts as the world’s most advanced digital regulatory framework. The EU has set notably high data protection and privacy policy standards through its adoption in 2016, General Data Protection Regulation (GDPR) after which most countries, especially in Africa, modelled their respective national data protection standards. Highly committed to the protection of personal data and privacy as a fundamental right of every data subject, the EU understands that setting high standards contributes in no small measure towards ensuring trust in the digital economy. Obviously drawing on the intercontinental appeal of its GDPR, the EU is currently setting an enviable agenda to promote and regulate the Digital Single Market for the next decade. This agenda includes proposals like the Data Governance Act, Digital Markets Act, the Digital Services Act and the Artificial Intelligence Act (the most recent addition).Interestingly, the EU’s data sovereignty provision has helped shape and strengthen its policy space.

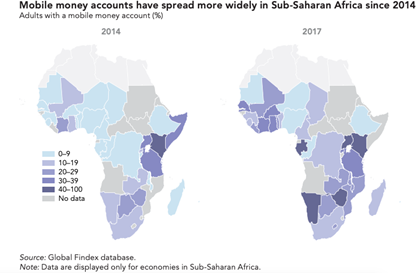

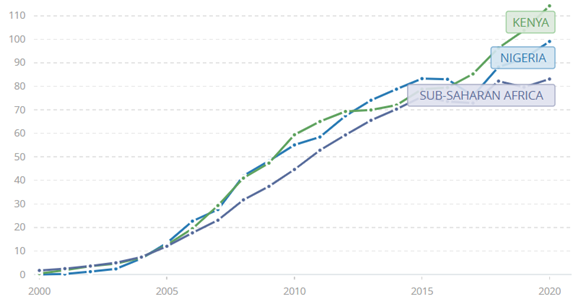

Although moving at its own pace, which is considered somewhat slow when compared to that of the EU or other fast-paced digital economy, Africa is still making efforts to boost its digital economy on the global level. But if Africa, like the EU, the US and China, wants to catch up with the rest of the world, coordinated efforts must be made to bring about its digital transformation, which is being constrained by continent-wide challenges that range from connectivity issues, a crisis of capital to poor data protection regulatory framework. Currently, Africa’s domestic digital economy is being strategically leveraged for economic development. The method for implementing region-wide approaches, to create an enabling environment for digital transformation, is being developed. In line with the European Data Strategy, the EU has expressed its readiness to support Africa in creating a data economy to benefit its citizens and businesses. This reinforcement will give a fillip to the actualisation of the EU-Africa cooperation on data. As expected, the African Union (AU) is genuinely open to a sustainable collaboration with the EU, characterised by respect, transparency and equal opportunity. In the following section, the potential positive effects of the EU and Africa’s digital collaboration on Africa’s journey towards experiencing massive digital transformation in the next decade are discussed.

- Integrating the EU and Africa’s digital markets for economic growth

The EU-Africa digital collaboration proffers a great opportunity for the integration of the continents’ digital markets. This development is, indeed, the pathway to unlocking a chain of economic values for the two continents. However, Africa stands to derive a welter of benefits from this collaboration, which cannot help but accelerate its pace towards the much desired digital transformation. The greatest of these benefits is the integration of all the digital markets across all the African member states to create a single digital market. This is enabled by the creation of legal frameworks, the harmonisation of regulations across countries and the strengthening of the institutions that are required to sustain the digital transformation. There is no gainsaying that, given the potential of this EU-Africa digital collaboration, the goal of inaugurating the African Continental Free Trade Area (AfCFTA) will be accomplished. It is projected that the EU-Africa digital collaboration, by the year 2025, will have grown Africa’s internet economy to $180 billion. African businesses, while engaging with the EU’s technological firepower that is a spinner of accelerated growth and development, would be repositioned to gain strategic access to a large consumers base in the world’s third-largest economy.

- Bridging the gender divide in the African digital space

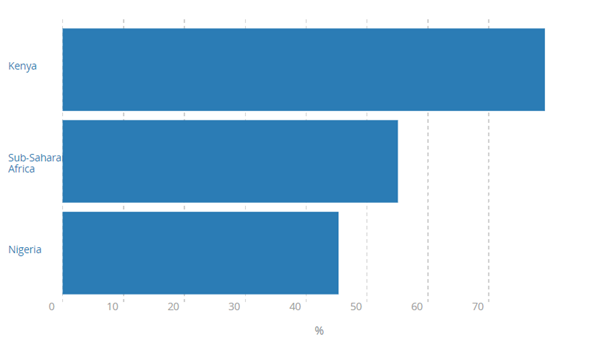

Findings from evidence-based research revealed that, in Africa today, the men use digital technologies more than the women do, thus bringing about a manifest gender digital divide. It is claimed that, as gender inequality pervades the physical world, so it does in the digital world. In Sub-Saharan Africa, there is a wide gap in women’s digital access when compared with men’s. Also, the digital penetration rate for the women is by far lower than for men. Many women in Africa either use simpler feature phones that do not support mobile internet use or do not have any. Women have been discovered to be much less likely than men to own a smartphone. Given their ownership of smartphones, African men have far more access to digital platforms and services than African women do. This development is not unconnected with the glaring disparities between both genders in terms of digital literacy and economic attainment. The EU-Africa digital collaboration will steer African organisations, businesses and governments towards building a shared digital future that promotes high digital inclusion and adoption, thus bridging the manifest gender digital divide in Africa’s digital space. When men and women have equal digital adoption, women will have access to the same diverse opportunities as men do.

- Boosting digital entrepreneurship and innovation (growth of digital SMEs)

One of the four pillars upon which the aspiration of the EU-AU Digital Economy Task Force for the transformation of Africa is anchored is innovation-driven digital entrepreneurship. The other three are access to affordable broadband connectivity, digital infrastructure, digital skills, and e-services, which include e-government, smart cities, e-commerce and e-health. The EU-Africa digital collaboration will help create the required environment for entrepreneurs and businesses to thrive, as well as encourage innovation that will generate many socio-economic opportunities for the development of each African nation and the continent as a whole. A development such as this will promote small and medium-sized businesses, protecting them from digital-related threats which constantly put their operations in harm's way.

- Capacity building and job creation

With the improved and affordable internet broadband connectivity, which will be one of the benefits of the EU-Africa digital collaboration, Africa will greatly benefit from improved internet connectivity for teaching students and learning in African training institutions. Access to virtual or online training, which will boost capacity, will be enhanced. This development will help Africa catch up with the developed nations, given its ability to pioneer groundbreaking research in the areas of science, technology and even humanity, all of which will attract growth and development to the continent. Also, job opportunities will be created as a result of accelerated digital infrastructural development, which will enhance employment and productive engagement of citizens.

- Unlocking data governance in Africa

Today, the EU, alongside other global digital market giants like the US and China, is a model for digital governance. It has succeeded in making its mark in the global digital economy. The EU’s approach to governing the digital market and the regulatory legislation it has enacted to manage cross-border data flows is enviable. As earlier noted, the EU’s GDPR is so effective that most countries of the world have adopted it as their national standard of the regulatory framework of managing cross-border data flows in order to prevent data-related harms. This amazing digital capability of the EU, if it were to be adopted by Africa, would result in the latter having an effective data governance framework which would guarantee strategic digital transformation in the continent. Further, Africa will be stimulated to steer its states towards harmonising their disparate legislations into central or regional data legislation which ensures effective data protection in all the states.

Conclusion: Making the EU-Africa digital collaboration count

Given the aforementioned benefits that Africa stands to derive from its digital collaboration with the EU, Africa must do its utmost to ensure that this collaboration is successful. It must put in place strategic measures that will enable the collaborative efforts to yield the desired result. Hence, the hands of all the major stakeholders in Africa’s digital market must be on deck. Both policymakers and the private sector players in Africa’s digital space must demonstrate commitment towards creating a digital transformation-enabling environment that promotes the stakeholders’ dialogue; strengthens the standards for regional data use and cross-border data flows. Africa’s digital collaboration with the EU would undoubtedly be seen as a step towards a great economic boom for the continent, given the EU’s high global standing for having an advanced regulatory framework for data protection. Therefore, it is crucial for Africa to embrace this golden opportunity to truly become the next frontier for digital revolution.

This article was written by Kunle Balogun

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China