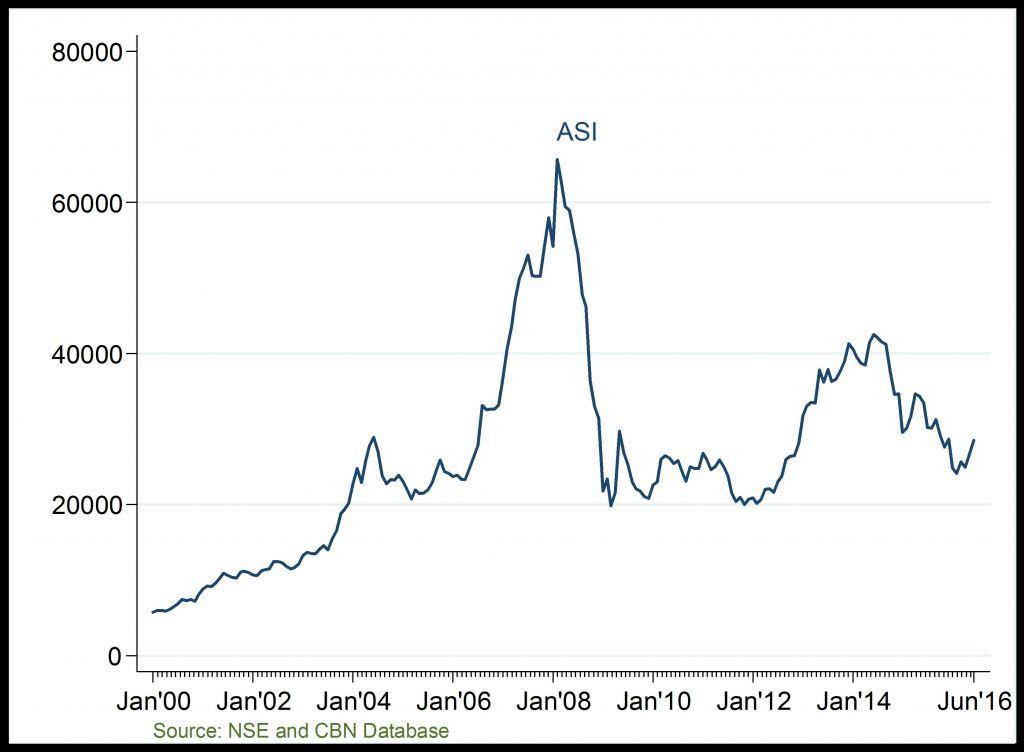

All-Share Index (ASI) (Points)

Stock market underperform post-2014

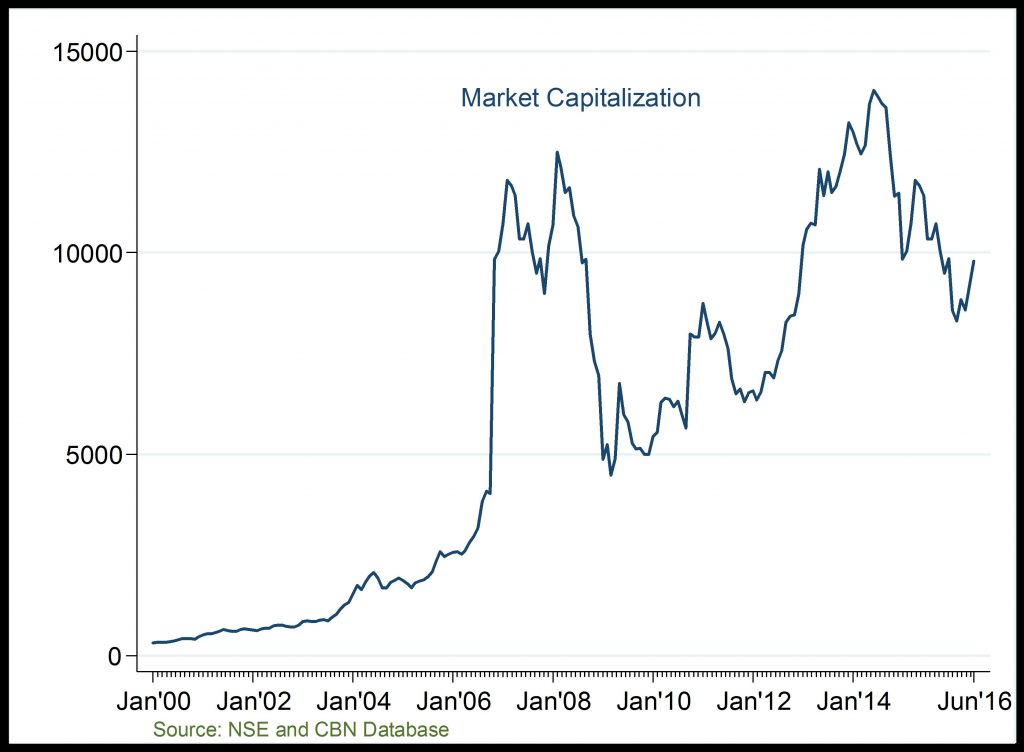

Market Capitalization (Billion )

Declining investor confidence

All-Share Index: In 2016Q1, the decline in ASI was driven by declines in Banking, Insurance, Consumer goods, Oil/Gas, Lotus Islamic, Industrial, AseM, Pension and Premium NSE indices. However, the ASI increased in 2016Q2 on the account of the rise in all sectoral indices which rose above the levels in the preceding quarter, with the exception of the NSE Oil and Gas index.

Market Capitalization: Market capitalization for all listed securities (equities and bonds) has generally maintained an upward trajectory except during the period surrounding 2009 financial crisis, and post-2015. The poor performance, post-2015, was largely driven by unfavourable macroeconomic developments, currency risk, recovery in developed economies, and the effects of quantitative easing by the US Federal reserve. Particularly in 2016Q1, the weak performance was driven by unfavourable economy policies, low oil price and the attendant impact on FOREX, and delay in the signing of budget.