Nigeria’s Ease of Doing Business Ranking: Behind the Numbers

On 24th October 2019, the World Bank’s 2020 Ease of Doing Business report was released announcing that Nigeria has climbed 15-places up to 131 rank out of 190 countries globally. This piece throws more light on the ease of doing business in Nigeria and recommends a manageable three-prong strategy for further reforms – automate, simplify, and inform!

As indicated in the report, a high ease of doing business ranking implies that a country’s regulatory environment is more conducive for starting, operating and expanding local businesses; compared to other countries and the preceding years. Countries that have implemented regulatory reforms in 2018/19 making it easier or harder to do business in three or more of the ten topics compared to preceding years, recorded a growth or decline in the ranking respectively.

In total, 42 countries implemented regulatory reforms improving the ease of doing business over the period. For sub-Saharan Africa (SSA), thirteen countries – including Nigeria, Togo and Rwanda – recorded significant improvements. Although Mauritius is the highest-ranked SSA economy in the ease of doing business, Togo was the biggest improver this year – climbing by 40-places up the rank to the 97th. For Nigeria, which sits 15-places higher on the Ranking, it recorded improvement in six out of the ten topics for evaluation: Starting a business; Dealing with construction permits; Getting electricity; Registering a property; Trading across borders; and Enforcing contracts.

The ranking report presenting Nigeria as one of the top improvers in creating an enabling business environment globally was a welcomed news for the Federal Government. Some spheres of the business community corroborate on the progress in the ease of doing business in the country, citing improvements such as visa-on-arrival reforms. However, some business leaders argue that the business environment has not improved, highlighting the presence of counter-productive reforms that restrict business operations; thus, questioning the reflectiveness of the Ranking.

It is important to highlight that the Ranking only measures improvements in the laws and official practices that support formal sector business processes. The scoring mostly accounted for the changes implemented by the Presidential Enabling Business Environment Council (PEBEC) set up in 2016 by the Nigerian government to progressively remove bureaucratic constraints to doing business. Some of the regulatory progress that informed the Ranking for Nigeria include:

- Starting a business: It now takes just 24 hours (not 10 days) to register a business with the Corporate Affairs Commission (CAC). The registration process now allows for online self-application without the need for a legal adviser. This change reduces the formal cost of starting a business by at least N64,000 ($177); representing the foregone cost of hiring a lawyer and the consolidation of registration documents to a single CAC form. It also reduces some informal costs incurred in the interaction with government officials including transportation, unofficial tips and unnecessary delays. The automated process also makes it easier to link business with tax authorities, dispensing the need for physical registration at the tax office.

- Dealing with construction permit: By automating and simplifying registration and payment processes, the cost and number of required documentations for obtaining a construction permit reduced. For instance, the cost of warehouse (small business) construction in Lagos dropped from 26% to 2% of warehouse value.

- Getting electricity: This does not imply improvement in the reliability of electricity in the country; it only covers the ease of getting new connection to national electricity grid. The online application platform has reduced the connection process to 30 days as opposed several months; particularly in Lagos and Kano.

- Registering property: The use of professional consultants in the process has helped reduce the time and cost for registering properties in Lagos and Kano.

- Trading across border: Regulatory reforms led to the reduction of documents for export (from 10 to 7) and for import (from 14 to 8) enabling slightly quicker movement of goods across borders. In addition, the Apapa port in Lagos began 24/7 operation and the Request for Information (RFI) export form was digitized; leading to a 48-hour reduction in time spent for border compliance. The implementation of the single joint cargo reducing the number of touch points for import clearing (from 8 to 1) was also a score point for Nigeria on the rank. Given that the data collection for the Ranking was concluded in May 2019, the impact of the recent closure of Nigerian borders affecting Benin, Cameroon and Niger were not accounted for.

- Enforcing a contract: The score points for Nigeria was mainly due to the introduction of small claims commercial court in Lagos and Kano instituted in 2018 and January 2019 respectively. The small claims court allows for faster liquidated damage claims of below N5 million (in Lagos) and below N10 million (in Kano) for small- and medium- size enterprises (SMEs) within 60-days. There is also an opportunity for self-representation in the court. This decongests the High Court and improves entrepreneurs’ ease of taking legal action and getting justice.

However, the country did not experience significant improvement in other Ranking metrics: Paying Taxes, Getting Credit, Resolving Insolvency, and Protecting Minority Investors.

Key Limitations of the Ranking

The Ranking does not cover a broad range of areas pertinent to businesses. As the Ranking report clearly notes, its methodology has two key limitations; suggesting that the skepticism of some Nigerians over the reflectiveness of the Ranking may not be entirely misplaced:

- It focuses only on the formal sector and formal processes: It does not reflect the informal sector which makes up to 65% of the Nigerian economy in terms of Gross Domestic Product (GDP). Also, studies show that 90% of employees in Sub-Saharan Africa operate in the informal sector. Particularly, firms in the informal sector typically grow more slowly, have poorer access to credit, do not follow the formal process of business registration – and thus the business and its employees remain outside the legal protections of the law compared to their counterparts. As such, SME owners in the formal and informal sectors face different realities as they set up and operate their businesses –with the latter more likely to record negative experiences.

- It omits a full range of factors, policies, and institutions that affect the quality of an economy’s business environment or its national competitiveness: It does not account for the difficulties caused by some of the biggest challenges in doing business which Nigeria and many countries face globally including: macroeconomic stability, security, state of the financial system, and prevalence of bribery and corruption.

Nevertheless, the Ranking can be deemed reflective for the metrics it covers given that it involves multiple points of information collection and a data verification/validity process. Information is typically sourced from: legal practitioners, private sector respondents, the government and World’s Bank’s regional staff in the country; with an internal review processes and a transparent complaint procedure allowing people to challenge the data.

Recommendations

Although certain key aspects of an enabling business environment are not reflected in the Ranking, the six areas of reforms where Nigeria has recorded improvement were felt by many formal business owners, especially in Lagos and Kano. These reforms not only minimizes the time and cost of doing business for entrepreneurs and the government (in the areas it covers), but also strengthens transparency in payment and government revenue generation.

However, these reforms have been largely limited to Lagos and Kano – which are the only two states the Ranking accounts for. To ensure that these reforms are not aimed at ‘gaming’ the Rankings, these improvements should be extended to other states in the country including southeastern states. Enhancing other government procedures and services for local businesses is required to ease business difficulties in the country, including taxation and obtaining credit – for which the country did not show any significant score progress. Although the Ranking does not cover infrastructure constraints, it remains one of the biggest challenges at a significant cost to Nigerian businesses, particularly electricity reliability and transport network.

Finally: drawing from the case study of the reforms in the Ease of Doing Business, successes in reforming other areas of government services require a three-prong approach:

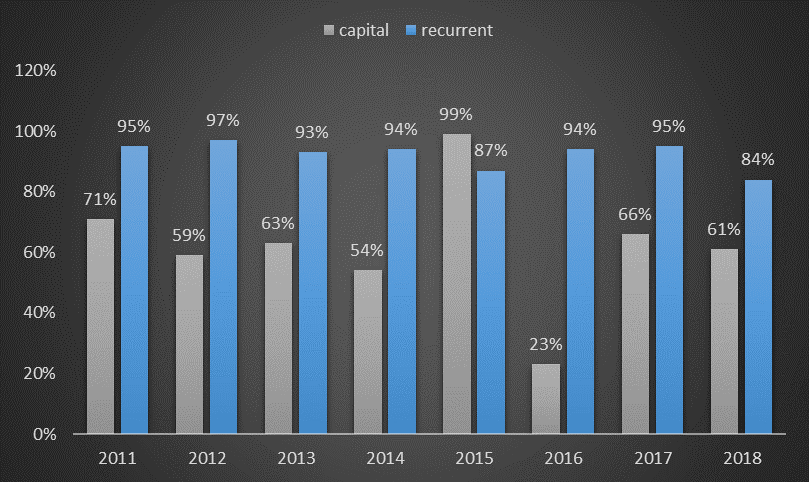

Automation: Entrepreneurs typically resort to informal activities, when regulatory processes limit their ability to freely operate private businesses, whether by intent or ignorance. Deploying technology and making processes accessible online makes a great deal of difference. The use of modernized information technology infrastructures increases efficiency, reduces physical interactions between government officials and service beneficiaries, and eliminates the physical exchange of cash --which can reduce rent-seeking behaviors. Ensuring little or no human contact in obtaining government services would make a great difference in the ease of doing business; particularly eroding the “unofficial but almost compulsory tips” paid to receive services. Automating processes can also help cut down the number of officials required for a given service, with a significant impact in reducing the huge sum (nearly 50% of budget expenditures) spent annually on government recurrent expenditures.

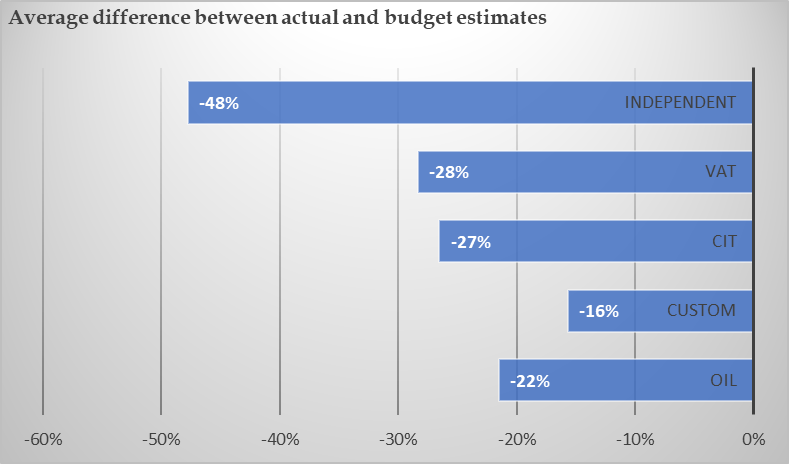

- Simplification: Several required processes for receiving a government services can be consolidated into a fewer processes to reduce the hassle for business and rent-seeking opportunities for officials. Firms tend to opt for informal or unofficial arrangements to bypass rules where regulation is tedious; thus, economies with burdensome regulations typically have higher levels of informality. Reforms that seek to simplify regulatory processes can make a great difference in serval government services including taxation.

- Information: Before, during and after reforms are implemented, end-users or beneficiaries must be made aware of prospective and ongoing changes. Information about the reform should be well-disseminated, first, among the implementers (the agency carrying out the reform) at all levels, then relayed to beneficiaries using the most effective communication channels. While improvement in the ease of registering with CAC was implemented two years ago, for instance, the information only just begone to trickle down to users, and many Nigerians still remain unaware. For a seamless reform, implementers need to be transparent in communicating the benefits and downsides of the change, with complaint procedure to welcome feedback to be improved upon.

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China

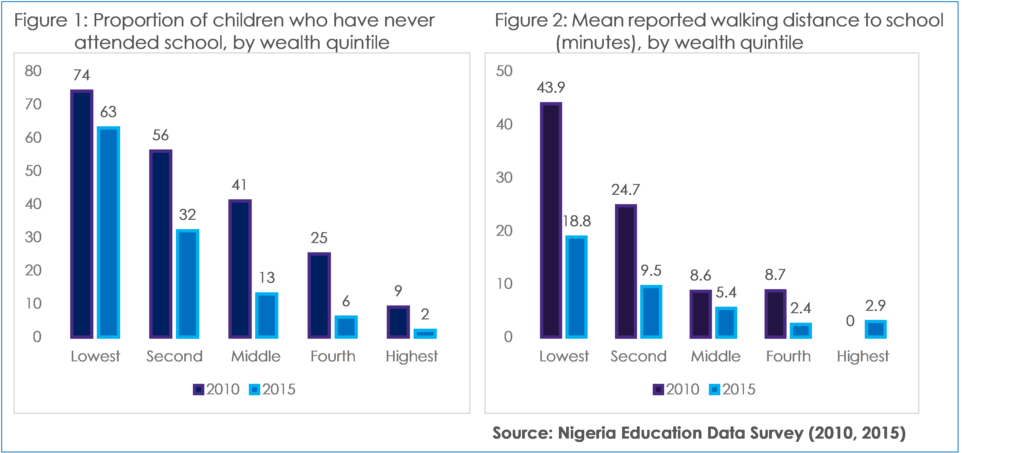

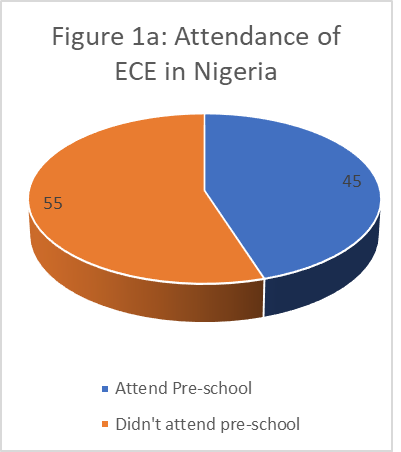

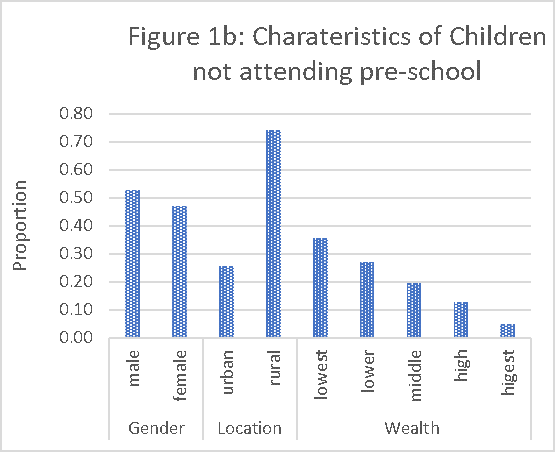

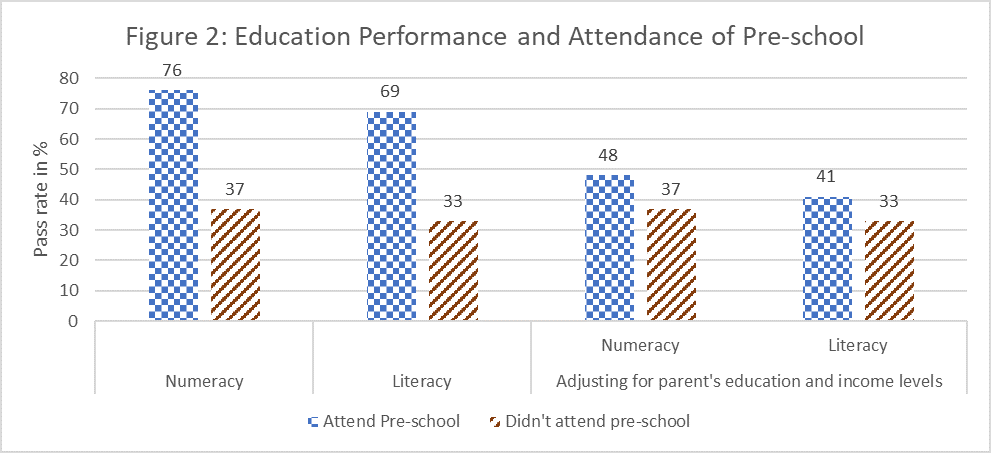

Source: Nigeria Education Survey (2015)

Source: Nigeria Education Survey (2015) Source: Nigeria Education Survey (2015)

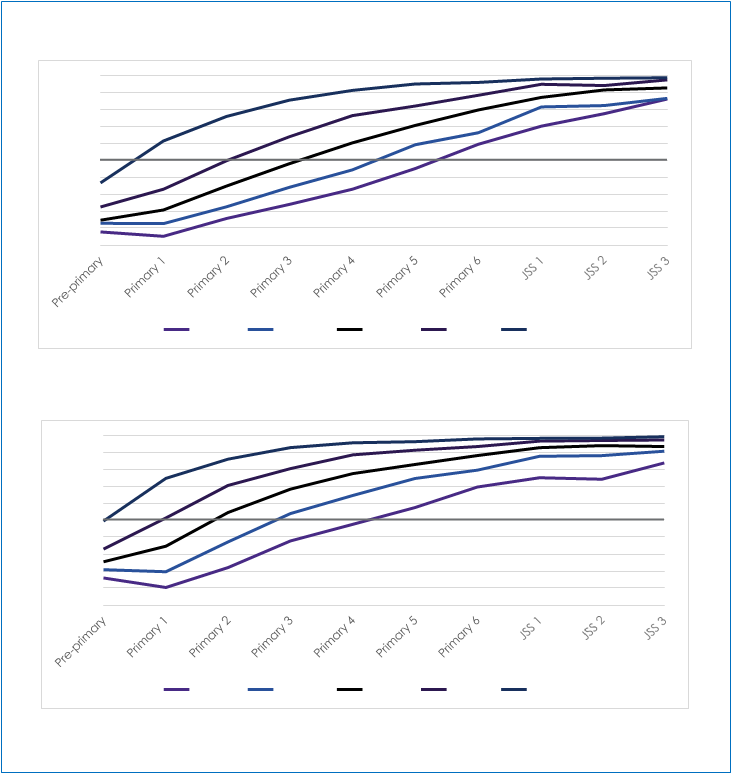

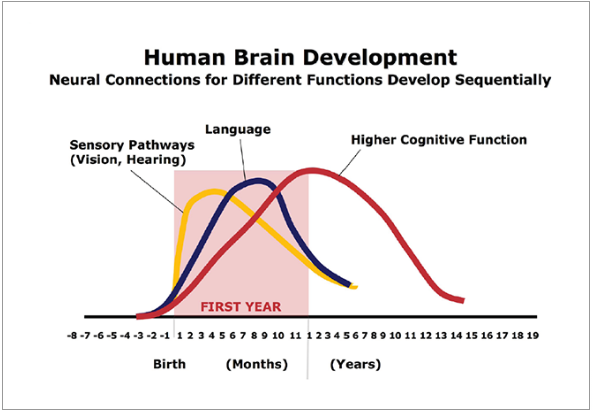

Source: Nigeria Education Survey (2015) Figure 3: Human Developmental Phases

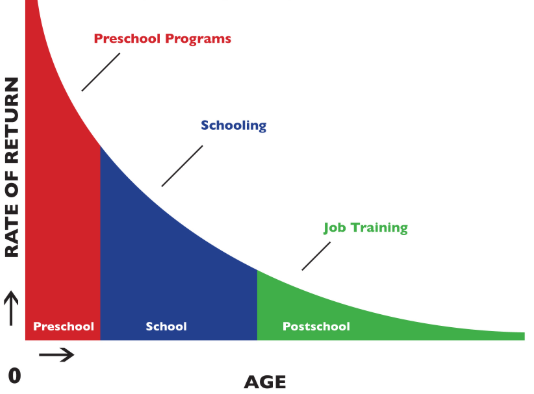

Figure 3: Human Developmental Phases Heckman curve

Heckman curve