The need to boost political will for tobacco control policies in Nigeria

Tobacco use and the exposure to secondhand smoke is associated with the rising prevalence of non-communicable diseases some of which are the leading cause of preventable death in Nigeria. In 2018, tobacco use in Nigeria has been linked to 16,100 deaths. According to Tobacco Atlas, economic losses accrued to Nigeria in the form of medical treatments and loss of productivity from tobacco-related diseases are estimated at US$ 591 million as of year 2015, twice the amount spent on all malaria treatment interventions in 2015.

While Nigeria has a low smoking prevalence (about 5 percent of adult population), suggesting that tobacco does not pose an imminent health and social challenge, the trend is rapidly changing. The daily cigarette consumption per smoker has doubled from 7 to 14 sticks between 1980 to 2012. The share of male adults who are smokers has also increased from 11 percent in 2000 to 17 percent in 2015. Some key factors have driven the trend in cigarette demand in Nigeria. One is the shift in the strategy of tobacco companies who are increasingly moving away from high income countries where they face more stringent control measures to low- and middle-income countries in Africa with weak tobacco control systems. Another is the effect of popular culture which makes tobacco use seem fashionable particularly for young people.

Despite these striking changes in smoking trends, the policy space for tobacco control is not evolving as rapidly. In June 2018, the government introduced a N58 specific excise tax which will be implemented between 2018 and 2021. However, the new policy puts the excise tax burden at 16% which is significantly below the WHO recommended benchmark of 70% of retail price. Worse still, the tobacco industry is actively lobbying the government to rescind the tax increment.

Aside implementing only a modest increase in tobacco tax, the government is also deficient in other tobacco control measures. Both states and federal governments do not protect citizens from secondhand smoking. So far, only four out of 36 states have implemented laws prohibiting smoking in public places and even in these states, citizens continue to flout the law with no consequence. Also, there are no help services provided to tobacco users willing to quit. Few programmes exist to provide tobacco cessation advice, and low-cost medicines to people who want to stop smoking. At the same time, there are no accessible telephone lines that offer treatment for tobacco addiction.

These gaps in tobacco control efforts is an indication of the dearth of political will for tobacco control policy reforms in Nigeria? Government officials are hardly committed to designing policies in line with global standards as well as mechanisms to ensure the sustainability of these policies. Civil Society Organizations which continue to advocate for better laws and dialogue with stakeholders to achieve results cannot directly bring about the much-needed reforms. Building the political will among state and non-state actors is crucial to achieving remarkable strides in tobacco control.

How can political will be built?

The key actors in the tobacco policy space, the Ministry of Health and the Ministry of Finance (for taxation policies) will need to initiate and lead reforms more effectively. The presence of a team of reformers who can convene relevant stakeholders, sidestep bureaucratic bottlenecks and neutralize tobacco industry lobbying can potentially lead to major reforms in the policy space. Nevertheless, collaboration between these ministries and other state and non-state actors is important. This is because implementing tobacco control policies requires the action of other government agencies such as the Customs and tax collection agency. Also, government officials will need to leverage on the expertise and influence of CSOs and advocacy organizations, the research capacity of think tanks, and the financial and political clout of international organizations in order to achieve results.

Also, the research and analysis component of tobacco control will need to be enhanced to allow for proper analysis of tobacco control measures. Presently, available (freely accessible on the internet) research outputs on tobacco control, which can potentially serve as evidence for designing and implementing important health policies, are few and limited in scope. For instance, to the best of our knowledge, no nationwide research has been conducted to identify the cost of tobacco-related diseases and its impact on livelihoods.

Applying credible sanctions is another area where political will needs to be built. Despite the fact that the federal law contains an enforcement component, the support and use of sanctions to provide incentives that promote compliance is weak. Law enforcement agencies should routinely examine the manufacturing, storage and distribution process of tobacco companies in order to curtail their activities that are not in accordance with the law. Failure to punish offenders will turn Nigeria into a target country for exploitative tobacco companies.

To ensure that these efforts are sustainable, more resources should be provided to state agencies to boost their operational capacity. For key government agencies such as the Ministry of Health and Nigeria Customs Service, budget allocations for tobacco control should be put in place to cater to tobacco control activities. In particular, modern equipment and facilities required to curb smuggling should be provided to Customs units in border towns. Also, the technical capacity of officials should be built through trainings and peer-to-peer learning.

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China

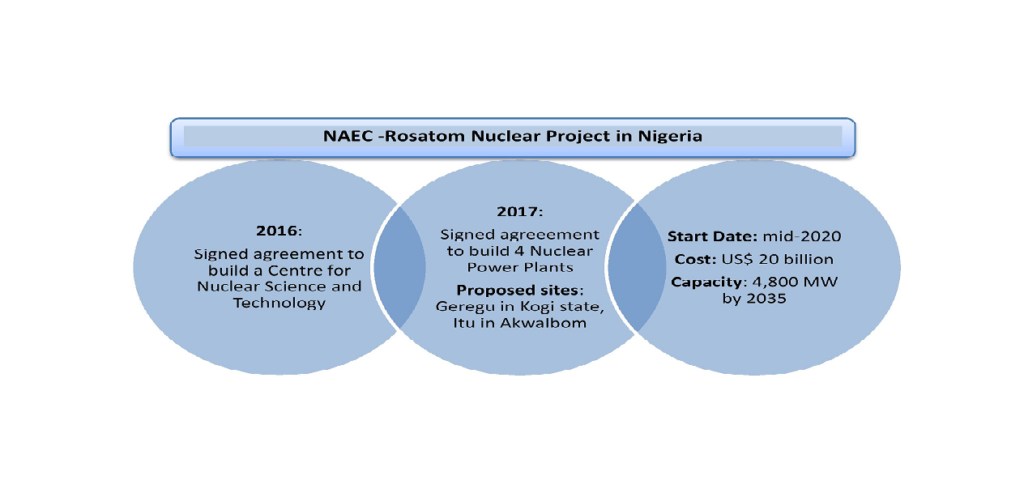

In light of the nuclear power development, two key questions call for objective analysis:

In light of the nuclear power development, two key questions call for objective analysis:

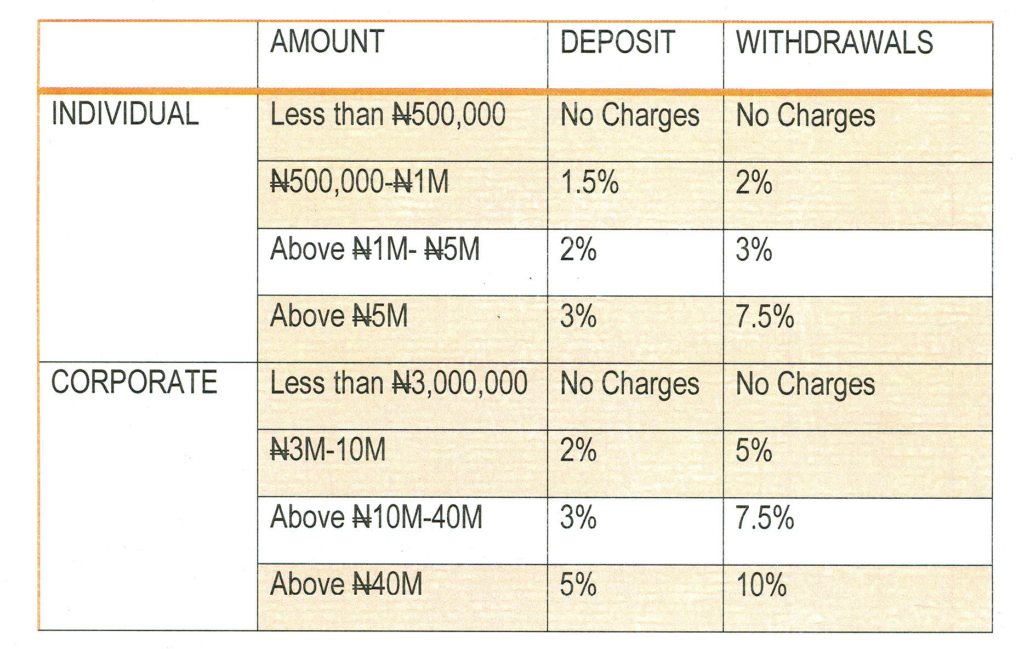

Source: mbauniverse, 2018

Source: mbauniverse, 2018