Sport and Economy: The Fate of Developing Nigeria

Ever wondered why some countries win medals while others do not? Neither do they have the ability to win medals if they participate in sports event such as the Olympics? In developing countries, there are a number of economic concerns regarding sports. Arguments are made that a country’s performance in sports (Olympics) is relative to its economic resources, and that achievements in sport should be measured in terms of a country's Gross Domestic Product (GDP) per capita and investment in sport.

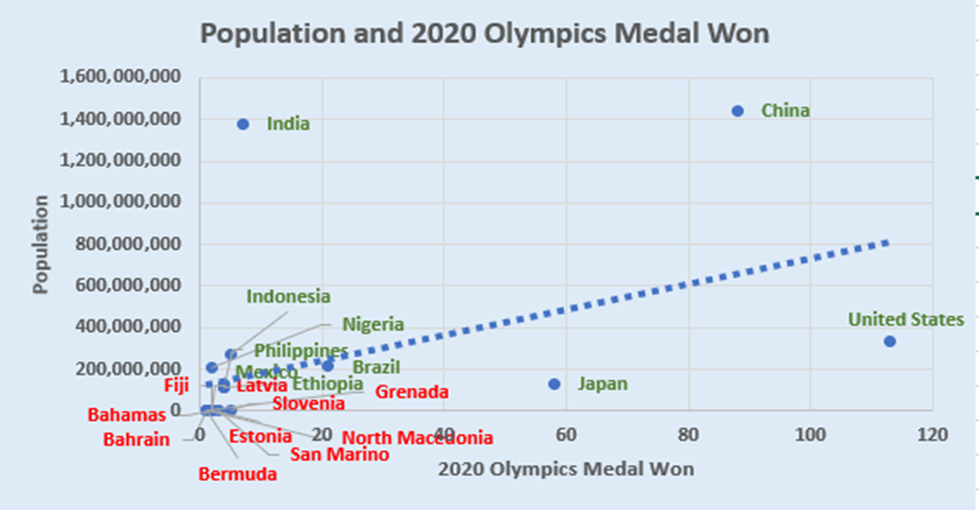

A well-organized sport development structure and a high level of funding can propel a country to the top of the medal table. Population is likewise salient, and with 1.4 billion people, China was well represented at the 2020 Olympic medal table, with a total of 88 medals won, trailing only the United States of America which had 113 medals won, a country with more than 300 million people.

Stylized facts on Sport and Economic Development

The three strongest markers of sports development in any economy are the degree of investment, the extent of population participation, and the level of political stability that exists. High investment correlates positively with buoyant economy, which has a knock-on effect on the amount of leisure time utilized. With more leisure hours, a larger proportion of the population can indulge in sports. Developed economies make significant investments in sport facilities, coaching skills, and sports science support programs, all of which are essential for sport sustainability. Sport investment can be an effective stimulus for developing the quality and quantity of sporting activities especially at the international level.

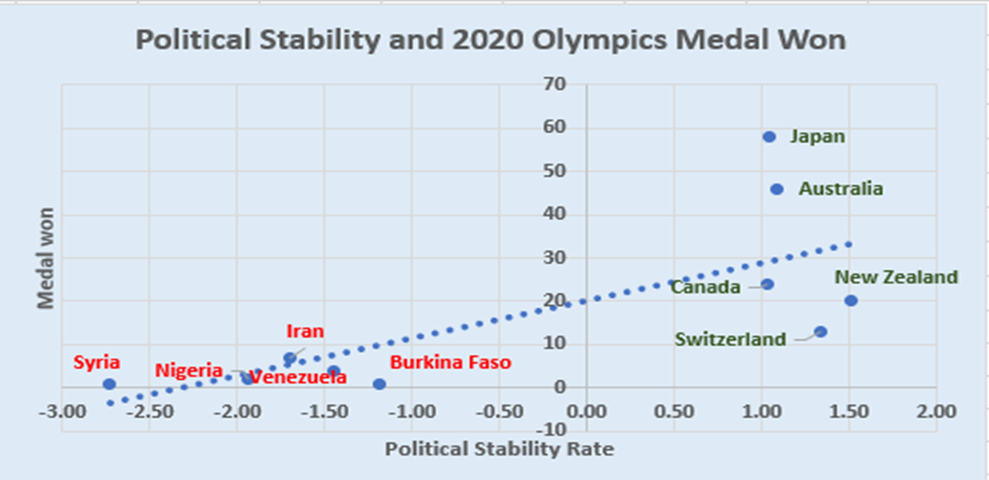

Figure 1 shows a positive correlation existing between political stability and the 2020 Olympic medal table. There is a clear disparity in the number of medals won between countries with stable political systems and those battling political instability.

Figure 1: Political Stability and 2020 Olympics Medal Won

Figure 2: Population and 2020 Olympics Medal Won

Figure 2 also shows that population matter for the number of medals won. However, we note that this is secondary, as countries like New Zealand and Australia do well in the Olympics despite their relatively smaller population. Large population size, on the other hand, is not a sufficient prerequisite for sport development. Figure 2 however supports the hypothesis that the larger the population, the more athletes with different physical qualities and skills.

Another notable factor is investment, investment in sport clearly plays an important role in some athletic activities than in others. Games like rowing, cycling, golf, shooting, sailing and equestrian require exclusive equipment and amenities; Nigeria have never won medals at any of these sports. Even in less expensive sports, there is a huge inequality in access to coaching and training facilities. A survey in developing countries by UNESCO in 1995, referred to in Manzenreiter (2007), found that 16 of the least developed countries had an average of just 71 football pitches, 31 volleyball courts, 13 athletics tracks and 3 swimming pools per country. In recent times, the African continent has in total, 141 constructed Soccer stadiums and about 78 volleyball courts. The combination effect of investment in sport and human capital, political stability, and high population participation rate are necessary and sufficient for sport development.

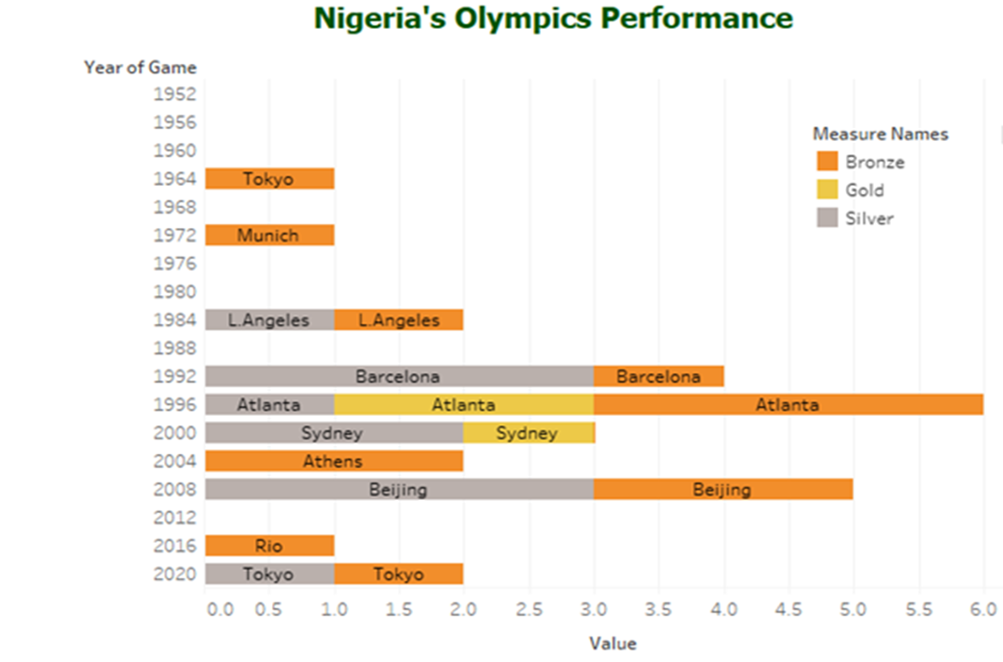

Nigeria and Olympics

Nigeria officially competed in the Olympic Games in Helsinki 1952 and has since sent representatives to every Summer Olympic Games, apart from the 1976 Summer Olympics, which was boycotted. Nigeria has won 27 Olympic medals in total, including 3 gold, 10 silver and 14 bronze. The majority of the medals come in athletics and boxing. Nigeria achieved her finest result to date in the 1996 Atlanta Olympics, when the Dream Team football team were decorated with gold and Chioma Ajunwa won gold in the athletics division. Nigeria’s second best performance was in the 2008 Beijing Olympics where the men’s football team won a silver medal and Blessing Okagbare, an athlete won a silver medal.

Figure 3: Nigeria’s Olympics Performance

Since then, Nigeria's games have been on a downhill spiral. Lamentably, neither the men's nor women's football teams qualified for the 2020 Tokyo Olympics, which was compounded by the disqualification of ten athletes.

Socio-economic benefits of Sport

Sports impact on the Nigerian economy may be evaluated in terms of its contribution to GDP, employment, and the indirect multiplier effect on improving public health, reducing crime rates, and supporting other sectors.

Sport is now a significant aspect of vast entrepreneurial activities, providing on the one hand, job creation for many in the various components of sport, and on the other hand, income and revenues to individuals and governments respectively. Currently, assessing the impact of sport on Nigeria's GDP is challenging because sport is not one of the key sectors considered by statisticians when estimating GDP. However, the sector is computed as part of the entertainment and recreation sector, which contributed 0.19, 0.31, and 0.33 percent to the Nigerian GDP in 2019, 2020, and 2021 respectively. Sport contribution remains below one percent due to inadequate finance and investment.

Sport also helps to improve fundamental social and interpersonal skills, which aids in crime reduction and building national unity. Football tournaments, for instance, are regarded as one of the few events in Nigeria that have fostered a sense of national cohesion among the country’s heterogeneous population. In addition, sport provides an important platform for youths to develop life skills that will enable them to cope better with everyday life challenges and transition away from drug abuse, violence, and crime. Sport can be utilized as a medium to advocate for sustainable human rights, such as the right to social security and equality across gender and race.

Strategies to support sport development in Nigeria

Clearly, finance is the major constraint to sport development in Nigeria. There is a need to support national sporting bodies to implement targeted fund-raising programs and prioritize the allocation of resources for sport.

Furthermore, the Nigerian government should strive to implement a comprehensive sports policy that includes encouraging participation in all sporting activities in primary, secondary, and tertiary educational institutions as well as promoting local sports development. There is a need to boost private investors' confidence in the industry so they can fully participate in the business aspect of sports. These will help make the sports sector more appealing for the youth to pursue as a career and profitable for businesses.

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China