World Water Day 2023: Accelerating Efforts towards Achieving SDG 6 in Nigeria

Access to clean water and sanitation is a basic human right. Nonetheless, it remains a challenge for millions worldwide, with approximately 2 billion people still lacking access to safely managed drinking water services as of 2020, and an estimated 4.2 billion people lack access to safe sanitation facilities (Sustainable Development Goals Report, 2022).

This crisis severely affects people's health, well-being, and economic productivity. The lack of safe water and sanitation leads to waterborne diseases, such as cholera, diarrhoea, and typhoid fever, which cause millions of deaths yearly, especially among children under five (WHO, 2022). Additionally, women and girls are disproportionately affected by the water and sanitation crisis as they spend hours each day collecting water, leaving them little time for education, work, or other activities. Moreover, inadequate sanitation facilities expose women and girls to violence, harassment, and sexual assault (UN, 2022). On the other hand, access to clean water is critical for agriculture, industry, and household use.

The water and sanitation crisis has a significant impact on economic development as well. People who lack access to safe water and sanitation facilities often cannot work or attend school due to illness, which limits their productivity and economic potential (Water.org, 2022). Additionally, the cost of treating waterborne diseases significantly strains individuals, families, and healthcare systems. Furthermore, the water and sanitation crisis perpetuate the cycle of poverty. It disproportionately affects vulnerable populations, such as the poor, marginalised, and rural communities, often excluded from basic services and infrastructure (Water.org, 2022).

The global water crisis has reached a critical point, and urgent action is needed to address the challenges faced by communities and nations around the World. This article provides insights on the water and sanitation crisis in Nigeria, with a focus on the recurring issue of flooding, poor water management, inadequate access to water and sanitation facilities, measures to tackle this menace so far, and the strategies to accelerate change in Nigeria’s water crisis.

Each year on March 22nd, World Water Day is observed to raise awareness about the importance of water and the need for sustainable management of water resources. The 2023 World Water Day theme is "Accelerating Change," which highlights the urgency of taking action to address the global water crisis. World Water Day 2023 is to call for accelerated change and collective action to ensure access to safe and sustainable water and sanitation for all.

The Water and Sanitation Crisis in Nigeria: An Insight

Nigeria is facing a severe water and sanitation crisis affecting millions of people in urban and rural areas. Flooding, poor water management, water scarcity, and a lack of access to sanitation facilities are widespread and have significant public health and economic implications.

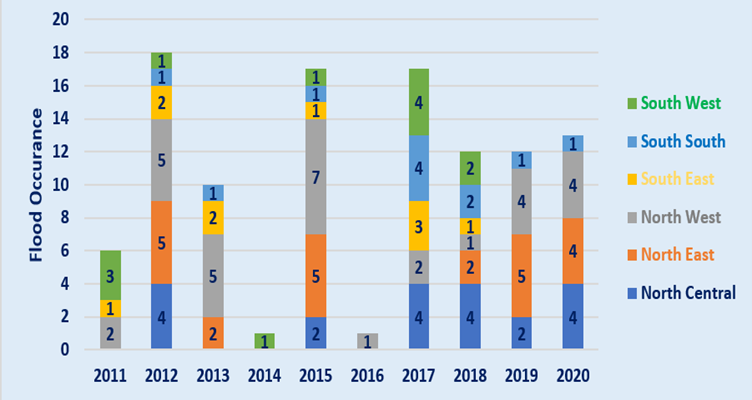

The recurring issue of flooding is one of Nigeria's most pressing water-related challenges. Widespread flooding has affected over 3.2 million people in Nigeria, resulting in over 600 fatalities and displacing over 1.4 million people. According to the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), the floods have affected 34 of Nigeria’s 36 states, destroying or damaging over 569,000 hectares of farmland and exacerbating the country’s alarming food insecurity. Flooding not only worsens the existing water and sanitation crisis in the country, but it also causes significant damage to infrastructure, property, and crops, resulting in economic losses and long-term negative impacts on livelihoods.

The geography and topography of Nigeria contribute significantly to the frequency and severity of flooding in the country. Nigeria is a low-lying area with numerous rivers, streams, and lakes, and its coastal regions are particularly vulnerable to flooding during the rainy season. Furthermore, factors such as poor urban planning, inadequate drainage systems, deforestation, land-use changes, and the construction of dams and reservoirs have exacerbated the adverse effects of flooding in Nigeria.

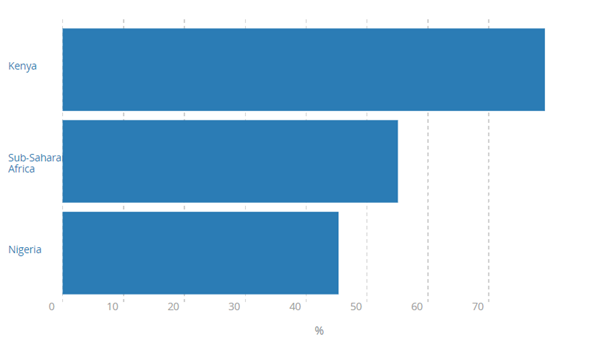

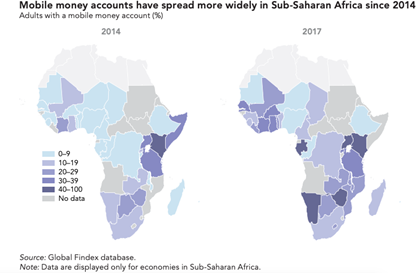

Figure 1: Frequency of Major Flood Occurrences Between 2011–2020, by Geopolitical Zone in Nigeria

Source: Data compiled from Centre for Research on the Epidemiology of Disasters

The impact of flooding on water and sanitation infrastructure is particularly alarming as it causes water contamination and damage to sanitation facilities, resulting in the spread of water-borne illnesses such as cholera, typhoid fever, and diarrhoea. The situation is particularly dire in urban areas, where access to safe drinking water and sanitation facilities is already scarce.

There is also an issue of inadequate access, and poor water management. Inadequate access to water, and poor water management practices majorly contribute to Nigeria’s water and sanitation crisis. According to the World Bank, approximately 70 million Nigerians do not have access to safe drinking water, and 114 million do not have access to basic sanitation facilities. While evidence has also shown that water sources are frequently polluted with hazardous substances such as industrial pollutants, human and animal waste, and other contaminants, posing substantial health risks to those who consume or use the water (CDC, 2018).

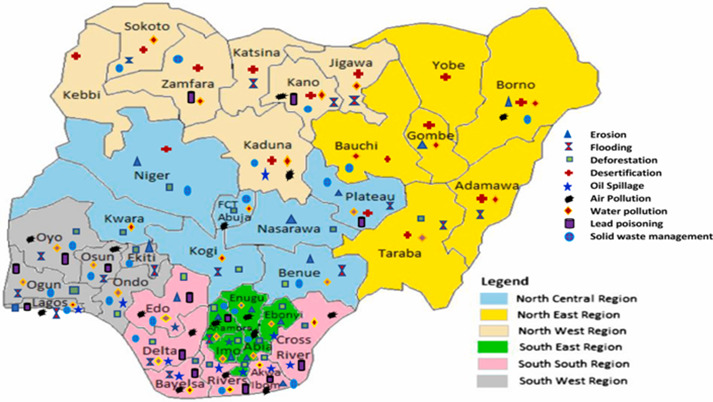

Figure 2: Map illustrating various environmental issues and their corresponding locations in Nigeria

Source: Pona, Xiaoli, Ayantobo, & Tetteh, (2021).

The lack of water and sanitation infrastructure investment is a major contributor to poor water management. Nigeria's water and sanitation infrastructure is outdated and inadequate, with no infrastructure in many areas. As a result, only a small percentage of the population has access to clean and safe drinking water and sanitation facilities. Additionally, pollution of water sources due to inadequate waste disposal and industrial practices is a major issue in Nigeria. This pollution makes it challenging to obtain clean and safe water for drinking, and it has a detrimental effect on the environment and health of the people who depend on these water sources.

Nigeria faces a significant water scarcity challenge despite having abundant water resources - more than 215 cubic kilometres of available surface water per year. This issue is due to poor water management practices and inadequate infrastructure, which renders most water resources unfit for human consumption. The average Nigerian consumes only 9 litres of water per day, which falls below the national acceptable minimum standards of 12 to 16 litres per day. According to the World Resources Institute (WRI), Nigeria's per capita water availability has decreased, exacerbating the scarcity challenge.

This decrease in water availability results from rapid population growth, urbanisation, and industrialisation. all of which have exerted significant pressure on the country's water resources. As a result, water sources have been depleted and polluted, leading to the current scarcity situation.

Measures Implemented to Tackle Nigeria's Water Crisis

The Nigerian government has been taking significant steps to address the water and sanitation crisis in the country. In 2000, the government implemented the National Water Supply and Sanitation Policy to improve access to safe drinking water and sanitation facilities. The National Action Plan on Water Supply and Sanitation, launched in 2012, also provides a framework for addressing the water crisis in the country. The recent National Development Plan 2021-2025 has set a goal of achieving all access to water and sanitation by 2030 and ending open defecation by 2025 in compliance with SDGs 6.1 and 6.2.

To achieve these goals, the Nigerian government plans to invest an estimated 1.60 trillion naira over the next five years to extend water supply access and improve sanitation services to 90 per cent of the population. The government also launched the Clean Nigeria Campaign in 2018 to eradicate open defecation, committing ₦10 billion to these programs in 2019. However, due to the COVID-19 pandemic, the allocation for these plans was only ₦12 million in the 2020 budget and N60.9 million in 2022.

In 2021, the government implemented various measures to enhance access to water and sanitation, including creating more than 2,300 Water Points and constructing 6,546 hygiene facilities and sanitation compartments in different parts of the nation. Individual and collective efforts at the community level have also contributed to improving access to safe drinking water and sanitation facilities. Many Nigerians have taken it upon themselves to provide clean water to their communities by digging wells, constructing water tanks, and other similar initiatives.

Civil Society Organizations (CSOs) have also played a critical role in addressing the water crisis in Nigeria. Several CSOs are working to provide safe drinking water and sanitation facilities to underserved communities in the country. These organisations have also advocated for policy reforms and increased investment in the water sector. Overall, while progress has been made, much work is still needed to ensure access to safe drinking water and sanitation for all Nigerians.

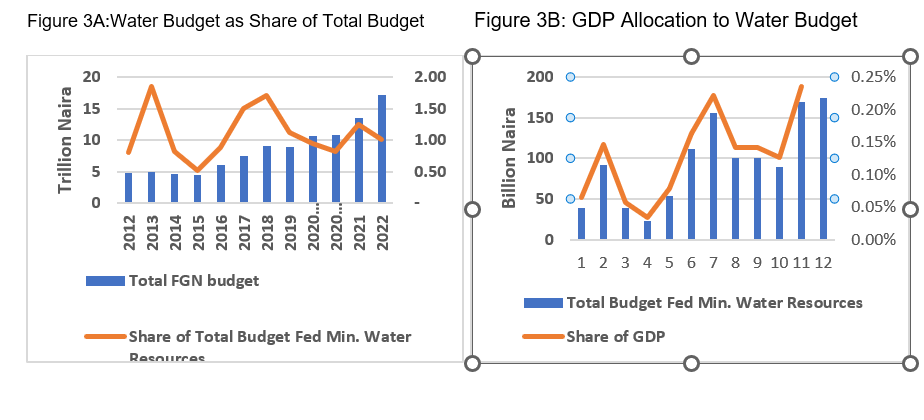

However, despite the efforts of the Nigerian government to address the water and sanitation crisis in the country, there are still several challenges that need to be addressed. One of the major defects is the inadequate budget allocation and funding for water and sanitation infrastructure. For instance, the budget allocation to water and sanitation infrastructure development in Nigeria has been below the international requirement of 2 percent (see figure 3A). Although the government has set a goal of investing 1.60 trillion naira over the next five years to extend water supply access and improve sanitation services to 90% of the population, the allocation for these plans in the 2020 budget was only ₦12 million due to the COVID-19 pandemic. This indicates a lack of commitment to addressing the water and sanitation crisis. Additionally, there is a lack of coordination between the different tiers of government in the implementation of water and sanitation programs, resulting in duplication of efforts and inefficiencies. Corruption and mismanagement of funds have also been identified as major challenges that undermine the effectiveness of water and sanitation interventions in Nigeria (NIH, 2018). Therefore, sustained efforts are required to address these challenges and ensure that access to safe drinking water and sanitation facilities is available for all Nigerians.

Strategies for Accelerating Change in Nigeria's Water Crisis

The role of individuals and communities: Individuals and communities play a crucial role in accelerating change toward a water-secure world. Individuals can take small but impactful actions, such as conserving water, reducing pollution, and promoting sustainable water management practices. Communities can also play a role in improving access to safe water and sanitation facilities through the establishment of community-led initiatives, such as water committees or community-based organisations. Furthermore, individuals and communities can advocate for policy changes that prioritise sustainable water management practices and ensure that vulnerable populations can access safe water and sanitation facilities.

The need for investment in water and sanitation infrastructure: Investment in water and sanitation infrastructure is crucial to accelerating change towards a water-secure world. This investment includes building and upgrading water treatment plants, distribution systems, and sanitation facilities. Investment in water and sanitation infrastructure is also essential for ensuring access to safe water and sanitation facilities for vulnerable populations, such as the poor, marginalised, and rural communities. For instance, the share of budget to the Ministry of water resource over the last ten years has been below 2 percent (see figure 3A), indicating its inadequacy. Furthermore, according to an OECD report 2022, to achieve universal access to safely managed water supply and sanitation for all, it is recommended that countries allocate 1 -2% of their GDP towards the development of water supply and sanitation infrastructure from 2015 to 2030, however, the share of GDP to water supply and sanitation infrastructure in Nigeria has been below 1 percent overtime (see figure 3B). Governments, international organisations, and private sector actors must invest in water and sanitation infrastructure to ensure everyone can access safe and sustainable water and sanitation.

The importance of education and awareness: Education and awareness are critical to accelerating change towards a water-secure world. This includes educating individuals and communities about water conservation, sustainable water management practices, and the health risks associated with the lack of safe water and sanitation facilities. Education and awareness campaigns can also help change behaviours and attitudes towards water and sanitation, leading to more sustainable and equitable use of water resources.

The need for international cooperation and collaboration: International cooperation and collaboration are essential to accelerating change towards a water-secure world. The collaboration between governments, international organisations, civil society, and the private sector to promote sustainable water management practices, build and upgrade water and sanitation infrastructure, and ensure access to safe water and sanitation facilities for all. Furthermore, international cooperation and collaboration can help address the root causes of the water and sanitation crisis, such as climate change and pollution, which require a collective effort to address.

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China