Nigeria’s Electrification Roadmap: After Two Years, Where Does It Stand?

The Nigerian government and German energy company Siemens AG signed the Nigerian Electrification Roadmap (NER) partnership, also known as the Presidential Power Initiative (PPI) in 2019. The Roadmap contains technical and commercial proposals for financing, implementing, and executing projects to revive the Nigerian power sector and manage Nigeria’s future electricity requirements.

The NER is structured in three phases, executed over six years, up to 2025.

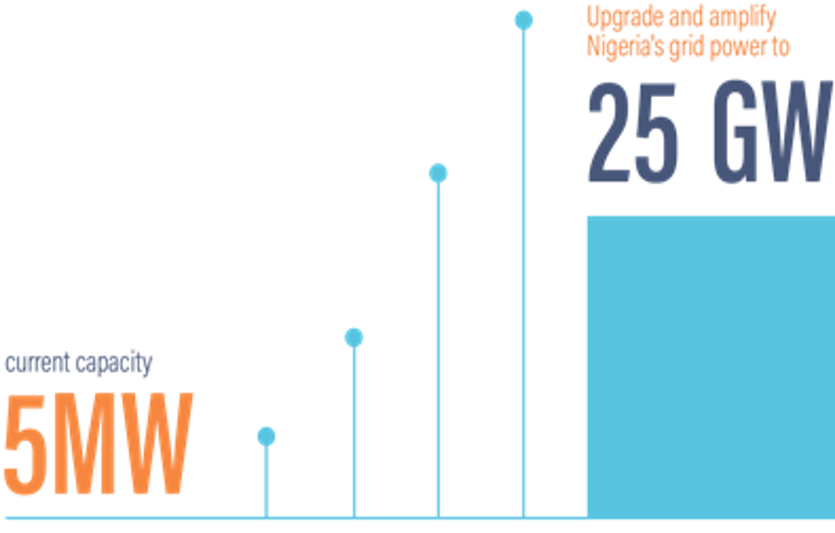

- Phase 1 (by 2021): Conducting quick impact projects to enhance the capacity of the existing grid system to utilize stranded generated power capacity, leading to an overall increase in operational power capacity from its current 5GW to 7GW.

- Phase 2 (by 2023): Tackling distribution network constraints, and expanding the grid to further maximize the use of current generation capacities, in order to achieve a combined capacity of 11GW.

- Phase 3 (by 2025): Building out new generation systems, while further modernizing and growing the national transmission and distribution (T&D) systems, in order to reach an overall full operational capacity of 25GW.

FIGURE 1: The NER target by 2025

The NER has made good progress so far…

Determined a financial structure. The Nigerian Electrification Roadmap deal will cost an estimated total of about N1.15 trillion (€3.11 billion).1 In 2020, all shareholders agreed that:

- 85% of this finance will come from a consortium of banks, guaranteed by the German government through credit insurance firm Euler Hermes.

- 15% will come from the Nigerian government in counterpart funding with a 2–3 year moratorium and 10–12 year repayment period at concessionary interest rates.

- To enable counterpart funding, the government approved initial offshore and onshore payments of N6.940 billion (€15.21 million) and N1.708 billion (€3.74 million), respectively.2

Ensured political durability. The Nigerian government set up a special purpose vehicle and Project Management Office to ensure the Roadmap’s sustainability through political transitions. These structures intentionally limit the government’s role in policy guidelines and supervision to minimize possible government interference.

Negotiated design. In early 2021, the Nigerian government and Siemens signed a contract for the pre-engineering aspects of the Roadmap, which determined the design, project specifications, commissioning works for T&D systems, network development studies, power simulation and training support services.3

…but there are some looming challenges

Information and institutional bottlenecks. Bureaucratic bottlenecks within T&D companies making it difficult to provide data and access to networks may be a challenge in Phase 1.

Slow progress in metering schemes. The nationwide metering scheme’s slow progress to date could stall plans to deploy a central computing environment for smart meters for both operators and customers

Facilitating capital recovery. The Nigerian Electricity Supply Industry’s efficiency in recovering invested capital ultimately depends on successful implementation of the cost- and service-reflective Multi-Year Tariff Order (MYTO).

Maintaining a fair and transparent procurement process. Committing to a fair and open procurement policy and processes is crucial to local content integration, reduce costs, and target the actual needs of the sector.

Conclusion

The NER’s ambitious plan to address the critical infrastructure deficits in the Nigerian power sector evokes hopes of vitalization across all socio-economic sectors and levels in the country. The NER aims to help eliminate technical and commercial inefficiencies along the electricity value chain, saving over $1bn in annual losses.4 The NER could also develop new technical skills and facilitate knowledge transfer that could help revitalize several other sectors, due to the local content inclusion policy mandating opportunities for Nigerian companies to contribute through conducting surveys, modeling, and supplying meters.

Siemens AG’s accomplishment of a similar Roadmap in Egypt, as well as its international reputation in power sector development provides some assurance that the NER is realizable. However, it is unclear whether Nigeria will achieve the Roadmap in the planned time frame, especially given the many possible complications of the COVID-19 pandemic.

Endnotes

- https://nairametrics.com/2020/02/22/nigeria-denies-plan-to-hand-over-electricity-distribution-to-siemens/

- http://apanews.net/en/news/nigerian-press-focuses-on-approval-of-payments-for-power-deal-with-siemens-others

- https://www.esi-africa.com/industry-sectors/transmission-and-distribution/pre-engineering-contract-signed-for-nigerias-presidential-power-initiative/

- https://nairametrics.com/2021/02/23/fg-siemens-ag-sign-contract-for-pre-engineering-phase-of-presidential-power-initiative-ppi/

This Article was first published at Energy for growth hub

English

English

Arab

Arab

Deutsch

Deutsch

Português

Português

China

China