Today, the 24th of January, the world celebrates the International Day of Education to recognize the role education plays in fostering peace and development. This year's theme is "to invest in people, prioritize education".

Education remains a veritable tool for eradicating poverty globally and achieving Sustainable Development Goals (SDGs). Without inclusive and equitable quality education, countries will not succeed in achieving gender equality and breaking the cycle of poverty that is leaving millions of children, youth and adults behind.

Over the years, CSEA has taken the lead in conducting large-scale evidence-based research on Education. One of our most recent engagements is the Research on Improving Systems of Education (RISE) Nigeria project, commissioned by the Foreign, Commonwealth and Development Office, which aims to understand how school systems in developing countries can overcome the learning crisis and achieve quality education.

The Centre is also part of the research organisations participating in the second edition of the Southern Voice “State of the SDGs” research which seeks to understand how the Covid-19 pandemic impacted education inequalities and learning trajectories. The first edition investigated three crucial questions: Exclusion in Education; Understanding synergies and trade-offs in meeting SDG4 in Nigeria and Global Systemic Issues.

CSEA is also conducting a comparative study of Accelerated Education programs and Girls Focused Education Models in Ghana, Nigeria, and Sierra Leone, commissioned by the Associate for Change.

To learn more about the outcomes of our research and policy recommendations, check out of some of our research on the education sector.

5 Ways to Build resilience in Nigeria's Education system

Measuring Learning Is Key to Reaching Education Goals: The Case of Nigeria

Learning trajectories: A practical tool for tracking learning and taking action

The Economic and Social Costs of Out of School Children in Nigeria

Following FACTS to Recover and Revamp Nigeria’s Education System During and Beyond COVID-19

Is Nigeria on track to achieving quality education for all? Drivers and implications

Reopening Schools For Learning

Student kidnappings threaten collapse of Nigerian education system

Learning assessments have played a key role in highlighting the extent of the learning crisis in Nigeria. The next step to addressing learning is improving assessments to close data gaps that still exist, and responding to evidence from them.

Large-scale learning assessments conducted in Nigeria have been crucial in examining the breadth and depth of the nation’s learning crisis. Results of learning assessments conducted over the last 25 years indicate five things:

Nigeria continues to miss its financial inclusion targets. Many constraints around the formal banking system have meant that a greater percentage of the Nigerian population remains excluded from the formal financial sector. This article highlights the need to strengthen mobile money as a means of driving financial inclusion in Nigeria.

Introduction

The financial sector plays five crucial roles in the growth of any economy. One is easing the exchange of goods and services by providing a payment system that enables economic agents to pay for goods and services, thereby facilitating trade in the economy; Two is mobilising and pooling savings from savers and, thus, making the proceeds from such fund available for firms in need of funding Three is acquiring and processing information about enterprises and possible investment projects, thus enhancing efficiency in the allocation of investment funds in the economy; Four is monitoring investment and carrying out corporate governance; five is diversifying, increasing liquidity and reducing investment risk (Caporale, Rault, Sova, & Sova, 2009).

Among the five channels enumerated, mobile money finds its place within the first (easing the exchange of goods and services through the provision of a payment system which enables economic agents to pay for goods and services, thereby facilitating trade in the economy). Mobile money technology allows people to receive, store and spend money using a mobile phone. It neither requires one to own a bank account nor does it require internet. It is sometimes referred to as a mobile wallet (IGI-Global, 2022). Thus, it is a crucial driver of financial inclusion, especially among the unbanked in remote areas who also lack access to internet facilities and among traders in the informal economy. Mobile money gains its acceptance by this population demography as it requires minimal digital skills. If one can send an SMS using a mobile phone, they already have the digital skills to operate mobile money.

While Mobile money is considered a key driver of financial inclusion, there has not been enough attention by the Nigerian government to create an ecosystem where mobile money operations can thrive. Thus, leading to the inevitable consistent dwindling of financial inclusion. Since 2012 when the CBN launched the financial inclusion framework, progress has been slow due to several constraints identified by stakeholders, among which include the high capital cost of investments in mobile money, bureaucratic procedures and the requirement for KYC, which involves sim-NIN linkage. The federal government’s projection of financial inclusion in its 2012 National Financial Inclusion Strategy (NFIS), revised in 2018, was to achieve 70% financial inclusion by the year 2020. However, only 64% inclusion has been achieved in the last quarter of 2022, which is a variance of 6% from the target. Given that countries like Kenya, which prioritised mobile money as a key financial inclusion driver, achieved a remarkable increase in financial inclusion, it would be a smart strategy for Nigeria’s government to pursue a similar objective.

Due to existing obstacles in operating a formal bank in Nigeria, especially the need for too many document requirements for opening an account and lack of access to banks in remote areas, it can be argued that the Nigerian government cannot achieve its financial inclusion targets of 95% by 2024 without putting mobile money at the forefront of its Financial Inclusion strategy. But before further comments, it would be vital to explain what mobile money is about and how it works.

The Mobile Money project was jointly launched by the GSM Association (GSMA) and Western Union in October 2007 to help the financially excluded to access financial services (Bello & Adenuga, 2013). The initiative comes in three models, which are, the operator-centric model (which involves only the mobile network providers such as the MTN mobile money), the bank-driven model (which is set up and managed by the bank like the POS), and the collaboration model (involving both banks and mobile providers like the use of USSD) . The operator-centric model is the only model that does not require one to own a formal bank account, making it the easiest model for driving financial inclusion. The Network providers offer the technology, operate the transactions and compensate the system without bank involvement or the need for a bank. Because mobile operators already have a large customer base, they benefit from service fees, and in turn, customers are happy to make quick and convenient payment transactions, and the result is an economy with high financial inclusion.

Despite the fast-growing Fintech sector in Nigeria, Porteous & Omusi (2020) report that about 36.8% of the Nigerian population still lacks access to financial services, which necessitates a need for more flexible financial inclusion strategies such as the non-bank-centric mobile money models. This is evident from the statistics quoted by The Economist that the value of mobile money transfers and e-payments in 2018 was only 1.4% of the GDP in Nigeria, compared to 44% of Kenya’s GDP (The Economist, 2019).

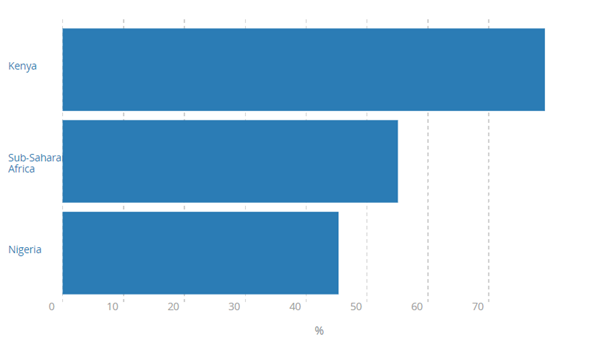

(Account ownership at a financial institution or with a mobile-money-service provider (% of population ages 15+) - Nigeria, Kenya, Sub-Saharan Africa

Figure 1. Financial Inclusion

Source (Worldbank 2022)

As shown in Figure 1, financial inclusion in Nigeria is below the Sub-Saharan African average. Meanwhile, Kenya surpasses the Sub-Saharan African average, which could be attributed to the success of the M-PESA mobile money project.

This operator-centric model remains the key to driving financial inclusion among the poor, uneducated and unbanked. The model would ensure that all classes of society would have greater access to financial services. A good example of a successful operator-centric model is the M-PESA project in Kenya. M-PESA, which stands for mobile money transfer service, ‘M’ for mobile and “PESA” for money in Swahili, was introduced in 2007 in association with Safaricom, Kenya’s largest mobile network provider. Vodafone, the largest shareholder in Safaricom, founded and owns M-PESA. Since its introduction in 2007, M-PESA has seen tremendous success and serves as the best illustration of a typical m-money service for the unbanked and underbanked. Over 9.4 million consumers and more than 18,000 agents have used the M-PESA initiative since it began in 2007 for person-to-person (P2P) transfers. According to Bello & Adenuga (2013), there is hardly a home in Kenya that does not utilise M-PESA. In fact, up to 13% of Kenya’s GDP was transferred using M-PESA between 2009 and 2010. Through M-PESA, users can make deposits into an account held on their mobile devices, transfer balances to other users (including vendors of goods and services), and exchange deposits for cash via SMS technology.

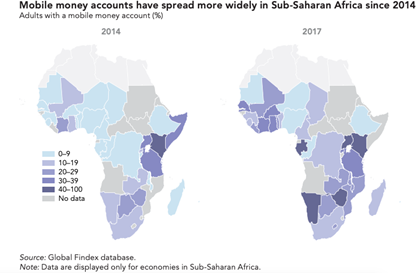

Mobile money accounts have also begun to gain popularity in the rest of Africa. However, Nigeria is lagging. According to Global Findex latest data (2017), many African countries (especially Kenya) have shown remarkable improvement in ownership of mobile money accounts, but Nigeria has remained largely stagnant.

Figure 2. Ownership of mobile money accounts in Sub-Saharan Africa

As shown in the diagram in Figure 2, it is evident that Sub-Saharan Africa has made good progress in terms of ownership of mobile money accounts, moving from 12% in 2014 to 21% in 2017. In Kenya, while a small percentage did not have access to mobile money accounts in 2014, this changed drastically in 2017, with close to 100% of the population owning mobile money accounts due to the ease of use of the service. In Nigeria, however, the numbers have remained low at about 0-9% of the population from 2014 to 2017.

Currently, in Nigeria, the dominant form of mobile money is the collaborative model (between the banks and the mobile operators), i.e., the use of USSD to send money from your bank account to another bank account. The problem with this model is that it requires you to have a formal bank account. The tedious process and document requirements to own a bank account in Nigeria make it challenging for people in remote areas and villages to own and operate a bank account. Thus, necessitating the need for investments in operator-centric models. Although there are existing operator-centric models in Nigeria, such as the Paga wallet founded in 2009, the adoption rate remains minimal, which could be attributed to constraints limiting the private sector from innovating and expanding. Thus, the success of mobile money in Nigeria might require the collaboration (investments) of both the public and private sectors in forming public-private partnerships (PPP).

There is no doubt that mobile money has the potential to drive economic growth by encouraging savings which leads to investments. Beshouri et al. (2010) affirm that mobile money has the potential to allow two important questions to be addressed at the same time: on the demand side, it represents an opportunity for financial inclusion among a population that is underserved by traditional banking services. On the supply side, they explain that it opens up possibilities for financial institutions to deliver a great diversity of services at low cost to a large clientele of the poorest sections of society and people living in remote areas.

In the following section, four key facts about why the mobile money system should be prioritised in Nigeria are presented.

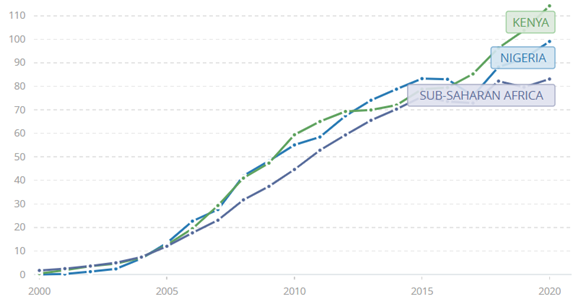

FACT 1: Nigeria’s high mobile phone penetration can support faster mobile money penetration

Although the M-PESA in Kenya has recorded massive success, Nigeria’s transaction volume in mobile money will be even higher due to its vast population. Since 2005, Nigeria has had consistently higher mobile phone penetration than the Sub-Saharan African average (WorldBank, 2022). As shown in figure 3, it is evident that in comparison to the Sub-saharan average (although still slightly lower than Kenya), Nigeria has had a higher mobile phone subscription rate since 2005, which shows the country’s potential in mobile money operations.

Figure 3. Mobile Cellular subscriptions (per 100 people)

Source: World Bank (2022)

Given that Nigeria’s mobile phone penetration is still lower than Kenya’s despite having a higher population, the policy route to maximise mobile money will therefore include a strategy to increase mobile phone penetration in Nigeria

FACT 2: Mobile Money Drives Financial Inclusion

Credit and deposits are now easier to obtain by the unbanked as a result of mobile money service accessibility: mobile money lower transaction costs, particularly those associated with maintaining physical bank branches. In addition, Andrianaivo & Kpodar (2011) affirm that the increasing use of mobile telephony in developing countries has contributed to the emergence of branchless banking services, thereby improving financial inclusion. They add that mobile money allows expansion and access to financial services for previously underserved groups in developing countries, emphasising that this improved access to financial services for those who are underserved contributes to closing the infrastructure gap in the financial sector, particularly in developing nations where the expenses of travel and time are quite high for conventional banking services.

FACT 3: Financial Inclusion Contributes to Economic Development

Financial inclusion as a strategy has emerged as a global concern for policy, including in Nigeria. It is seen as a means of fostering inclusive Economic Growth and a transmission mechanism for eradicating poverty (Stephen and Wakdok, 2020). Access to financial services stimulates incentives for private investments made by people and thus promotes economic growth (Andrianaivo & Kpodar, 2011). Many empirical papers have presented overriding evidence of a positive link between financial inclusion and economic growth (Chakraborty and Abraham, 2021). The common channel through which financial inclusion impacts economic growth is that financial inclusion encourages savings which then lead to investment, and in turn, investment leads to economic growth. Financial inclusion (especially ownership of a mobile money account) also encourages entrepreneurial activities, especially in remote areas where there is a high risk of carrying physical cash. This growth of entrepreneurship helps to reduce poverty and foster economic development.

IMF Studies for African countries such as Kpodar and Andrianaivo (2011) have also shown that while mobile phone penetration positively impacts economic growth, the channel through which this happens is financial inclusion fostered by the use of mobile phones for financial transactions. These same findings are replicated in a recent study by Ifediora et al (2022) for African countries, where the authors demonstrate that ownership of mobile money accounts and mobile money transactions foster economic growth

Finally, the supply-leading hypothesis, which states that the development of the financial sector gives rise to an increase in economic growth, has been validated by several authors (McKinnon, 1973; Shaw, 1973; Schumpeter, 1934; Wesiah and Onyekwere, 2021; Apergis, Filippdis and Economidou, 2007; Vazakidis and Adamopoulos, 2011; Nyasha and Odhiambo, 2015). The authors are of the view that financial institutions and markets trigger economic growth through the efficient allocation of financial resources to the most productive investments.

Fact 4: Mobile Money Makes Lives Easier

Mobile money affects lives positively by making day-to-day transactions hassle-free. For instance, because of mobile money, people in remote areas can easily transfer money from any location to any location just by pressing a few commands on their mobile phones. They no longer need to commute to the bank to wait in a long queue before they can make a deposit. Thus, mobile money saves both time and cost. Secondly, mobile money drives a digital economy that makes people live happier with less banking stress. Another important benefit is that with mobile money, cash payments will be reduced, and traceable payment methods (especially in the informal economy) make it easy to prevent fraud. Back in the days when cash was used, anyone could easily deny that you made a payment to them. But with mobile money, it is easy to make such payments cashless, which is traceable and cannot be denied.

Learning trajectories are graphs that show how many children achieve a certain level of minimum proficiency at each grade. While learning trajectories have previously been used for research, two new efforts show that they can also serve as practical tools to analyse the learning crisis and take informed action.

First, the Research on Improving Systems of Education (RISE) Programme, in partnership with the GEM Report, have created a webpage offering a one-stop resource on learning trajectories. This webpage introduces learning trajectories and what they offer through a series of interactive data visualisations and a data explorer which allows users to build and analyse their own learning trajectories. Second, RISE and the Centre for the Study of the Economies of Africa (CSEA) have partnered to train around 75 policymakers and government officials in West Africa on the use of learning trajectories for informed policymaking.

This article was written by Rastee Chaudhry, Jason Silberstein, and Julius Atuhurra (RISE Programme) and Adedeji Adeniran, Thelma Obiakor, and Sixtus Onyekwere (Centre for the Study of the Economies in Africa)

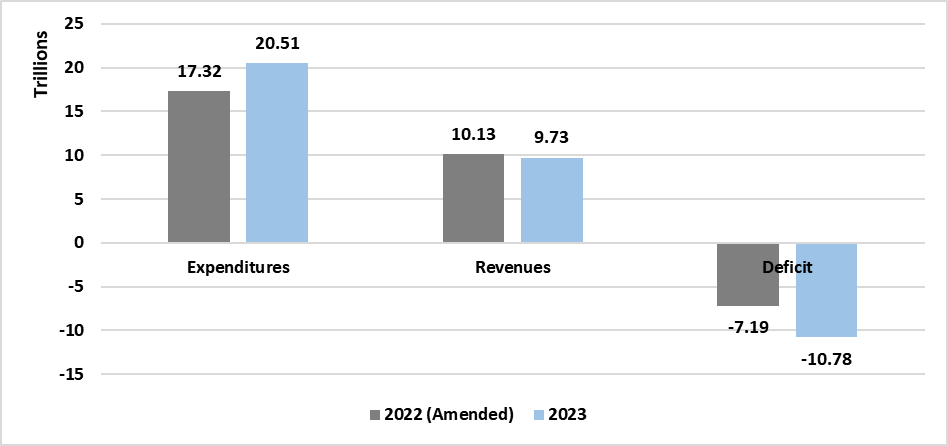

The proposed 2023 budget Bill was presented on October 07, 2022. While presenting the budget, President Muhammadu Buhari highlighted the revenue challenge, which may have influenced the size of the budget. This article uses nine charts to highlight the 2023 budget in relation to the amended 2022 budget at the aggregate level. In terms of expenditure size, the 2023 budget is higher than the 2022 budget

Not all elements of expenditure increased; expenditure items relating to productive investment, such as capital expenditure and statutory transfers, were reduced, whereas recurrent expenditure and debt services that had limited impacts on the future growth outlook were increased.

In contrast to expenditure, the proposed revenue for the 2023 fiscal year was reduced in comparison to the amended budget for 2022. The revenue decline reflected challenges in crude oil production and weak revenue mobilisation. The following section provides a detailed breakdown of the 2023 budget.

Overview of the 2023 Budget

In the 2023 proposed budget, the total expenditure is N20.53 trillion, which is approximately N770 billion more than the N19.76 trillion in the approved Medium Term Expenditure Framework and N17.32 trillion in the 2022 amended budget. The increase in expenditure might be argued to be consistent with the rising prices. However, total revenue in the proposed budget for 2023, fell to N9.73 trillion from N10.13 trillion in the amended budget for 2022. As a result, the budget deficit increased to N10.78 trillion from N7.19 trillion in the 2022 amended budget. This indicates that the rising price level had an increasing effect on the expenditure side while decreasing the revenue outlook of the government. Based on the historical trend of revenue underperforming relative to expenditure as seen in the first quarter of 2022, government borrowing at the end of 2023 is very likely to exceed N10.78 trillion. However, the extent to which the government may borrow, particularly external borrowing, will depend on the interest rate in the international market. If the government is unable to borrow as anticipated, expenditure rationing would be predominant in the next fiscal year.

Figure 1: Aggregate Expenditure and Revenue

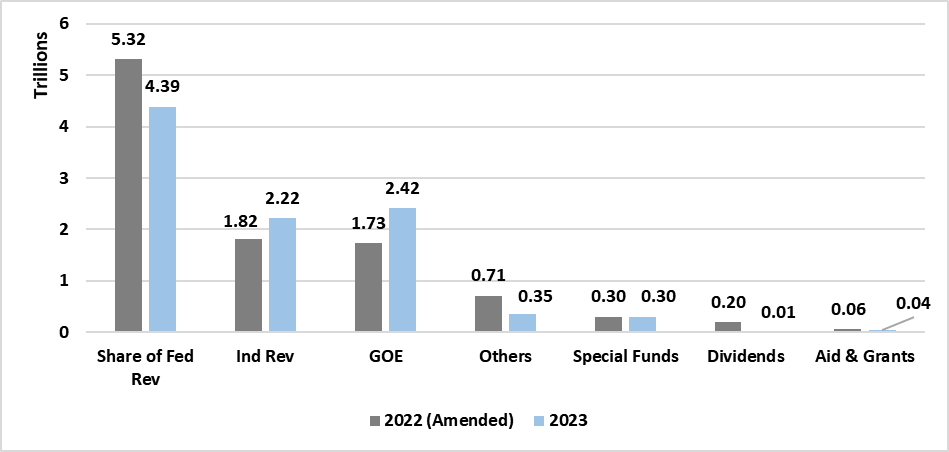

The breakdown of the revenue is shown in Figure 2. The revenue element has seven main categories, and only two items were increased in the proposed 2023 budget compared to the 2022 budget - independent revenues and government-owned enterprise. The government retained the values of special funds and lowered other revenue items such as share of federal revenues, dividends, aid and grants, among others.

The share of federal revenues was cut from N5.32 trillion in the 2022 budget to N4.39 trillion in the proposed budget. On the positive side, the government increased independent revenue from N1.82 trillion in the amended 2022 budget to N2.22 trillion in the proposed budget. Similarly, revenue from government-owned enterprises (GOE) from N1.73 trillion in the amended 2022 budget to N2.42 trillion in the proposed budget. The historical performance of GOEs makes one sceptical of potential revenue from the GOEs in the next fiscal year.

The assumptions that underline crude oil production and prices appear optimistic, especially crude oil production. The benchmark price of crude oil is $70 per barrel and crude oil production is 1.69 million barrels per day (mbpd). Without bold initiatives to reverse the decrease in crude oil production in the past few years, crude oil production in the next fiscal year is likely to be lower than the projected level of 1.69 mbpd. In the third quarter of 2022, Nigeria’s daily crude oil production was an average of 1 trillion mbpd, which is a 23.1 percent decrease from 1.3 mbpd recorded in the first quarter of 2022. The assumed production level in the 2023 budget, which is lower than the OPEC quota of about 1.8 mbpd but slightly higher than the assumption of 1.60 mbpd in the 2022 amended budget seems too high based on the current production level. With the projected low global demand in the next fiscal year and the contribution of high energy prices to the rising price levels, there is a high possibility that crude oil prices might fall below the $70 per barrel assumed in the next fiscal year. Overall, there is an urgent need to overhaul the revenue strategies, especially the GOEs, to attain the revenue projection of N9.73 trillion.

Figure 2: Revenue Breakdown

Notes: Share of Fed Rev denotes the share of federal revenues; Ind Rev denotes independent revenues; GOE denotes government-owned enterprises.

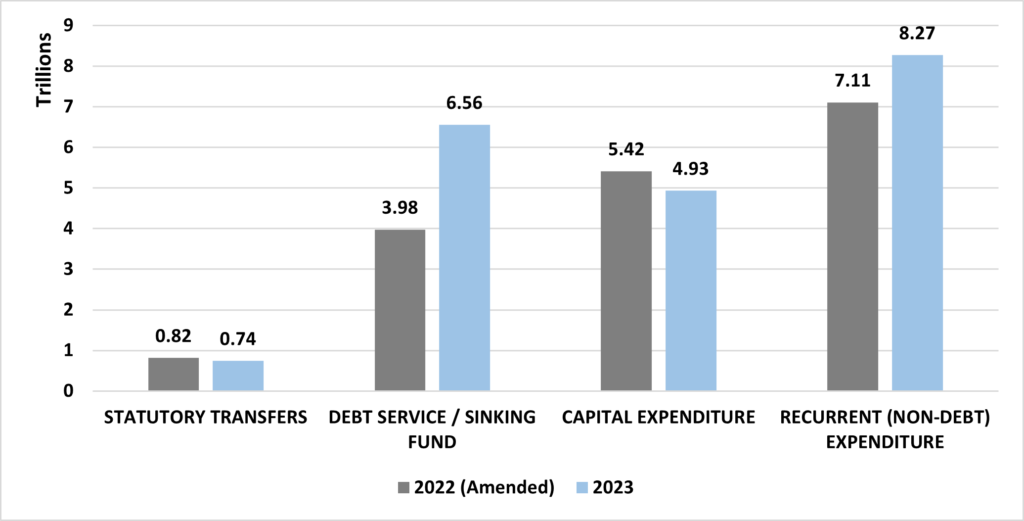

Next is the expenditure side. Government expenditure is broadly grouped into four categories: (i) statutory transfers, (ii) debt service and sinking fund, (iii) capital expenditure, and (iv) recurrent non-debt expenditure. Figure 3 shows that without adjusting for inflation, non-debt recurrent expenditure and debt services increased whereas statutory transfer and capital expenditures were reduced in the proposed 2023 budget relative to the 2022 amended budget. The Statutory transfers and capital expenditure were reduced by about N73.6 billion and 480.9 billion, respectively, making a total of N554 billion. In contrast, debt service and recurrent non-debt expenditure increased by about N2.58 trillion and N1.16 trillion, respectively, making a total of N3.74 trillion. However, the magnitude of the latter (N3.74 trillion) is higher than the former (N554 billion), resulting in an increase in government spending in the proposed budget by about N3.19 billion. The analysis suggests that the increment in the proposed budget is not driven by productive expenditure items, which are critical in enhancing a nation's competitiveness and productive capacity, casting doubt on the country's future growth and development.

Figure 3: Sources of changes in aggregate expenditure

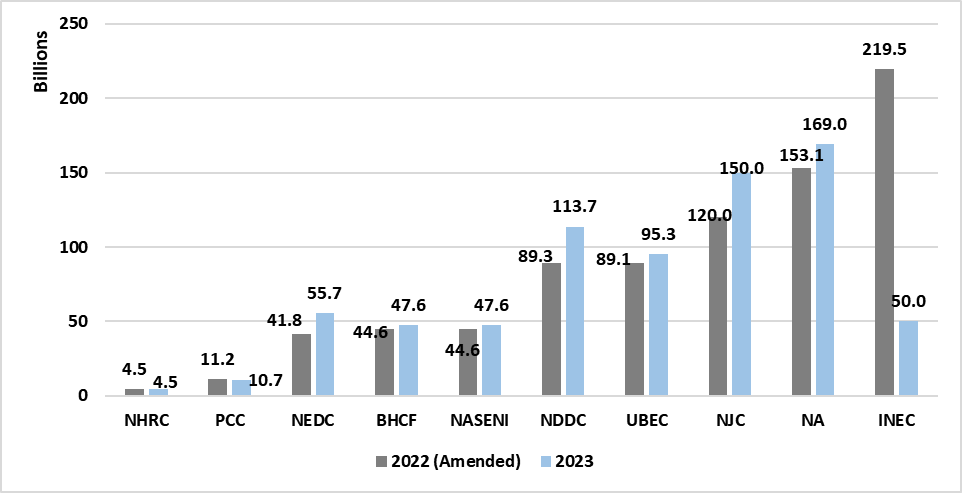

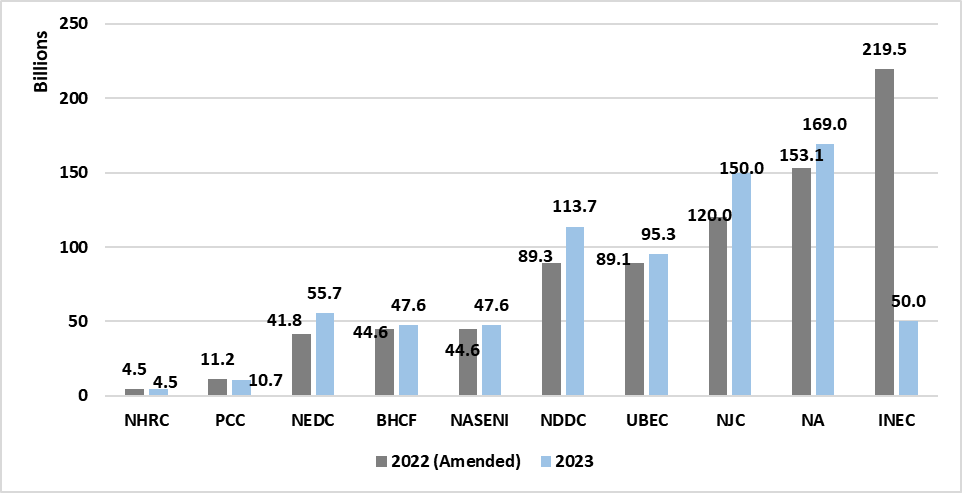

Statutory transfers are funds apportioned to government institutions that do not receive direct funding from the executive due to the nature of their functions. Currently, ten institutions receive funding through the statutory transfers depicted in Figure 4. The year-on-year decrease in the proposed budget is driven by the cut in two institutions (Public Complaints Commission (PCC), and Independent Electoral Commission (INEC)). For instance, the budgetary allocation to INEC in the proposed budget is N50 billion, which is about a quarter of the amount budgeted in 2022. The sharp decline in INEC exceeds the increase in the other statutory transfer items that increased.

Figure 4: Composition of statutory transfer

Notes: NHRC is the National Human Rights Commission; PCC is the Public Complaints Commission; NEDC is the Niger-Delta Development Commission; BHCF is Basic Health Care Fund; NASENI is National Agency for Science and Engineering Infrastructure; NDDC is Niger-Delta Development Commission; UBEC is Universal Basic Education; NJC is National Judicial Council; NA is National Assembly; INEC is Independent Electoral Commission.

Every fiscal year, the government appropriates funds to ensure the timely payment of loan interest and principal. Nigeria's debt service is divided into two categories: domestic debt service and foreign debt service. Budgetary allocations for both domestic and foreign debt services were increased in the proposed budget relative to the amount stipulated in the 2022 amended budget, as shown in Figure 5. The increase implies that the limited government revenue would be used to service the debt. Domestic debt service was increased by 75% to N4.5 trillion in the proposed budget, while foreign debt service was increased by 62% to N1.8 billion.

However, the sinking fund was decreased by 15 percent to N247.7 billion. As a result, the amount allocated for sinking funds and debt service stood at N6.56 trillion and 67.4 percent of the proposed revenue. Of the N3.19 trillion increase in total expenditure, debt services accounted for about 80.9 percent of the increase. Given that budgeted debt service is usually higher than actual, whereas budgeted revenue is less than actual, debt service as a ratio of government revenue might exceed 100 percent.

Figure 5: Proposed 2023 budget: Rising sinking fund and debt service

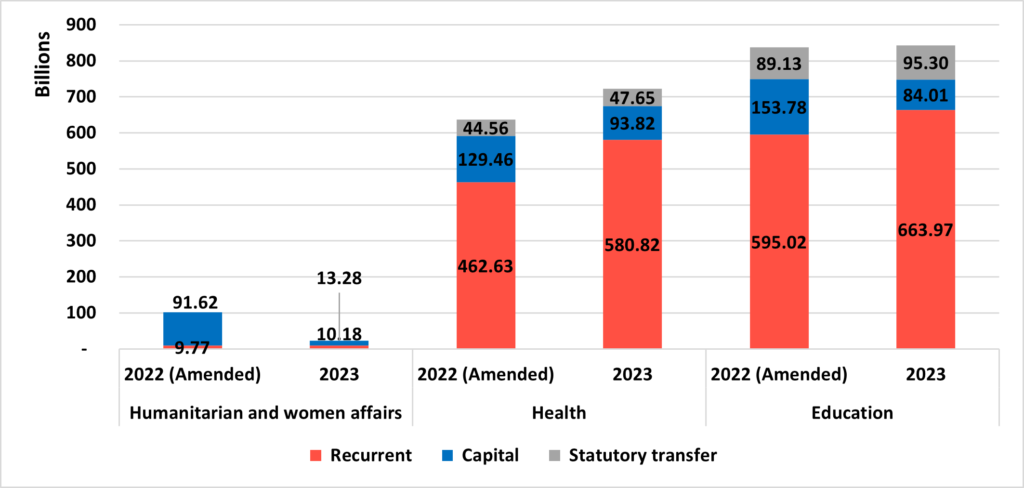

Budgetary allocation to critical economic sectors is examined in the following four charts. In Figure 6, we presented information about humanitarian and women’s affairs, health, and education. Adequate budgetary allocations, especially capital expenditure, to these sectors, are essential in having enlightened citizens in good health. In the proposed 2023 budget, it is evident that all the sectors recorded a decrease in capital expenditure, reducing the ratio of capital expenditure to recurrent expenditure. However, the recurrent expenditure increased in all the sectors. The increase in recurrent expenditure for both the health and education sectors exceeded the cut in capital expenditure. The increase in the education sector’s recurrent expenditure is partly consistent with the recent upward review in the retirement age (to 65 years) and elongation of service years (to 40 years) for teachers in the Harmonised retirement age for teachers in Nigeria Act. The decrease in the ratio of capital expenditure to total expenditure for the social sector indicates that actors in the sector would be faced with situations of working with old and ageing equipment with no hope of replacement. Also, newly developed modern pieces of equipment are less likely to be acquired, which ought to enhance their productivity.

For example, doctors are more likely to be denied access to new w surgical tools that could make them attend to more patients in a day, which in turn, would increase patients waiting time in hospitals. Furthermore, the low budgetary allocation for teachers indicates that teachers in unity schools are less likely to have access to the most up-to-date digital teaching tools.

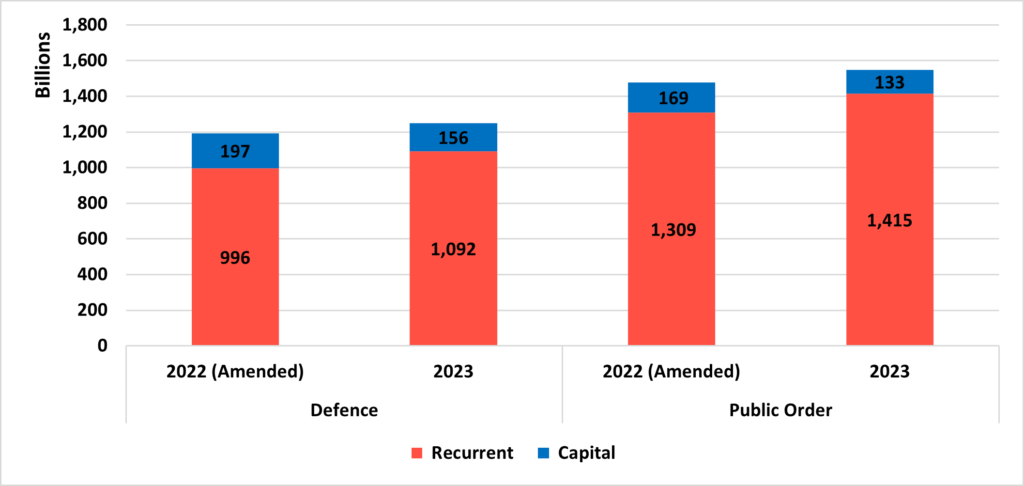

Figure 6: Social sector

Nigeria is dealing with insecurity, which to a large extent, has limited the economy's rate of expansion. The proposed budget for security in 2023, depicted in Figure 7, provides guidance on how the government will address insecurity. The allocation to defence and public order mirrors what was previously observed in the education and health sector, where less than a quarter of budgetary allocation was assigned to capital spending. In the proposed budget, capital spending was reduced for both defence and public order, whereas the recurrent expenditure was increased. The pattern is like what was earlier reported for the aggregate expenditure. The public order consists of the Ministry of Interior, the Office of the National Security Adviser, the Federal Ministry of Justice, Police Services, the Federal Ministry of Police, the National Judicial Council, and the Police Service Commission. A source of concern here is that an economy with an upcoming election year that has been characterized by uncertainties and embroiled with high insecurity should prioritise spending on capital expenditure for security agencies in 2023 to facilitate investment in modern-day equipment and strengthen intelligence gathering to effectively protect lives and properties.

Figure 7: Defence and public order

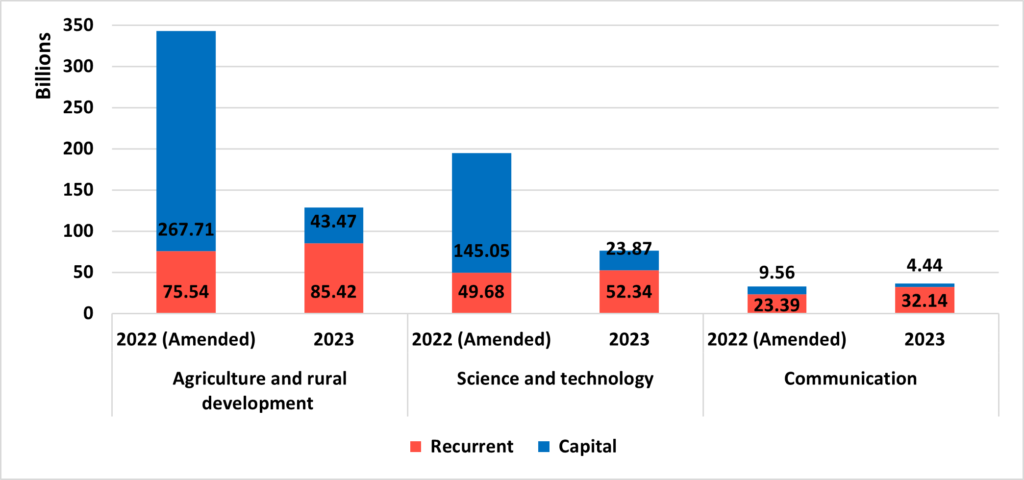

Nigeria is an agrarian society with agriculture accounting for more than a quarter of the domestic output and employing more than a third of the labour force, especially in rural areas. As the economy advances and with the emergence of new industries, the share of employment in agriculture is decreasing. The disruption associated with the pandemic is projected to increase the transition away from agriculture as technological space expands. The extent to which an economy would develop depends mainly on investment in science and technology, including communication. In the proposed 2023 budget, the allocation to Science and Technology decreased by N118.5 billion to N76.2 billion from N194.7 billion in the 2022 amended budget. The decrease was mainly driven by the cut in capital expenditure which declined by about N121.2 billion to N23.9 billion in the proposed budget. Further, the government reduced capital expenditure allocation for agriculture and rural development and communication. As a result, in these sectors, the ratio of capital expenditure to total expenditure decreased by about half. The ratio decreased from 78 percent in the 2022 amended budget for agricultural and rural development to 33.7 percent in the proposed 2023 budget. Similarly, for the communication sector, the ratio decreased from 29 percent in the 2022 amended budget to 12 percent in the proposed 2023 budget.

Figure 8: Enabling sectors: Agriculture, Communication and Science

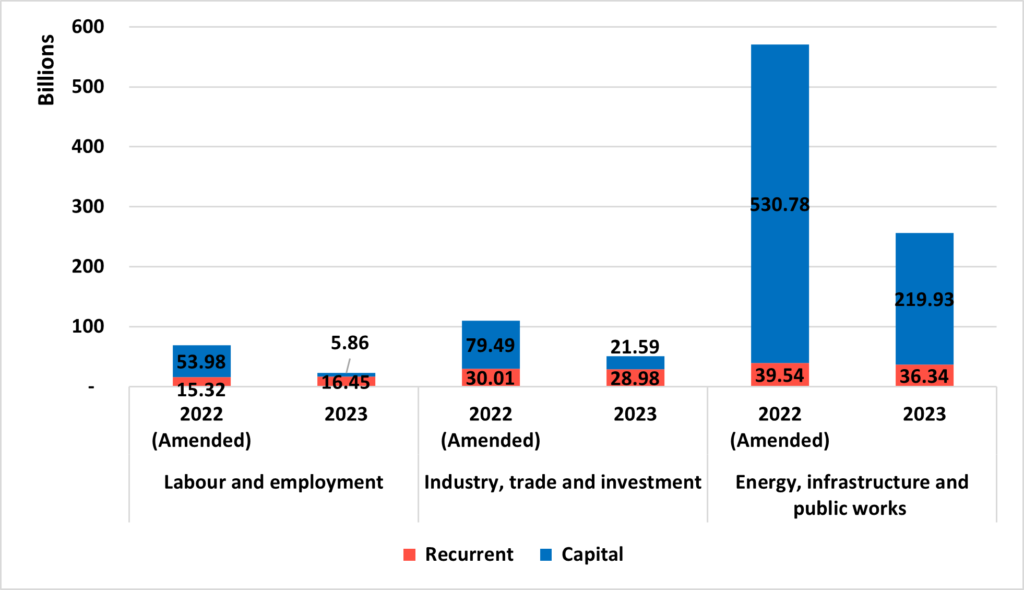

The potential growth of an economy is informed by labour and capital investment. Figure 9 shows proposed budgetary allocation to (i) labour and employment; (ii) industry, trade, and investment; and (iii) energy, infrastructure, and public works in the 2023 fiscal year. Unlike the pattern observed for social sectors and defence and public order, allocation to recurrent and capital expenditure decreased in (i) industry, trade, and investment; and (ii) energy, infrastructure, and public works. The decrease in budgetary allocation to these sectors in the face of rising price levels indicates that limited projects might be executed in the 2023 fiscal year compared to 2022. Also, the government may not be able to execute enough projects that are critical to starting industrialisation necessary to create jobs and reduce poverty, as envisioned in the Medium-Term National Development Plan, 2021 – 2025.

Figure 9: Engine of growth: Labour, Investment, and Infrastructure

Implications

The 2023 proposed budget has two key implications for the 2023 fiscal year:

Conclusion

This article highlights how imperative it is for the government to effectively mobilize all available revenue sources; otherwise, more than half of the 2023 budget will be financed through high-interest-rate borrowing, increasing future debt service. Furthermore, to realize the federal government's investment commitment in the National Development Plan, budgetary allocation for capital expenditure must be significantly increased in 2023 and beyond. Hence, in the deliberation and preparation of the implementation framework for the 2023 budget, due consideration should be given to two keys: (i) revenue mobilisation and debt management and (ii) performance of capital expenditure and incentivization of the private sector participation in the provision of infrastructure.