Until recently, policy design and interventions in basic education were unduly focused on increasing school enrollment in developing countries, with little attention on improving the quality of learning. Using two states in Nigeria – Lagos and Kano, this paper examined the extent to which School Based Management Committees (SBMCs) mobilized actions (collective and private) to improve school-level accountability, and how this affected school performance and learning outcomes. The study finds that increasing citizen clients‘ participation and voice via SBMCs can improve educational outcomes by strengthening accountability. When functional, their activities remarkably raise intermediate outcomes (i.e., school resources and enrolment), however, there is no evidence

to suggest that they improve children‘s learning outcomes.

Policy Brief & Alerts

March 11, 2018

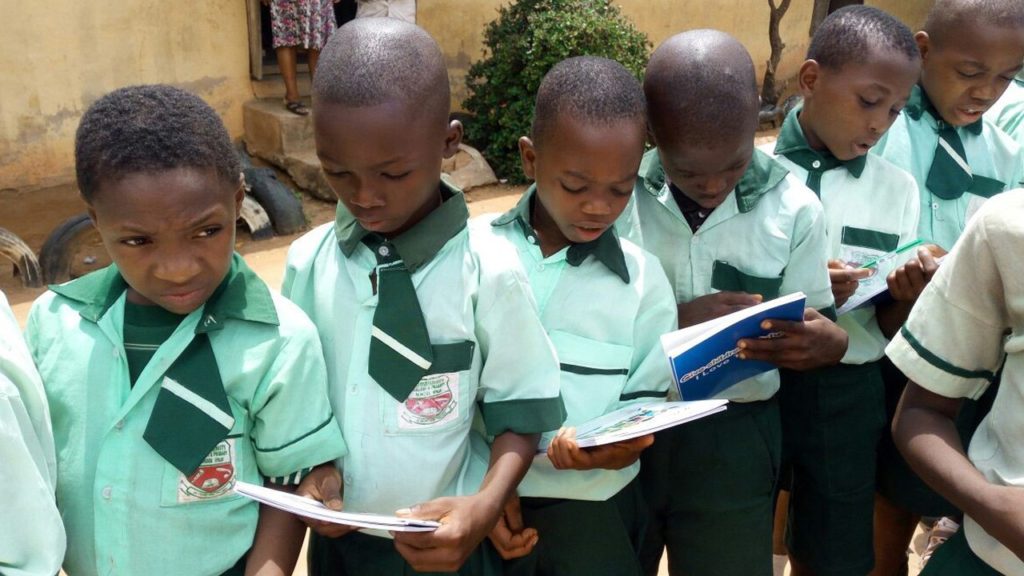

Examining Nigerias Learning Crisis: Can Communities Be Mobilized To Take Action?

Until recently, policy design and interventions in basic education were unduly focused on increasing school enrollment in developing countries, with little attention on improving the quality of learning. Using two states in Nigeria – Lagos and Kano, this paper examined the extent to which School Based Management Committees (SBMCs) mobilized actions (collective and private) to improve school-level […]

Read →