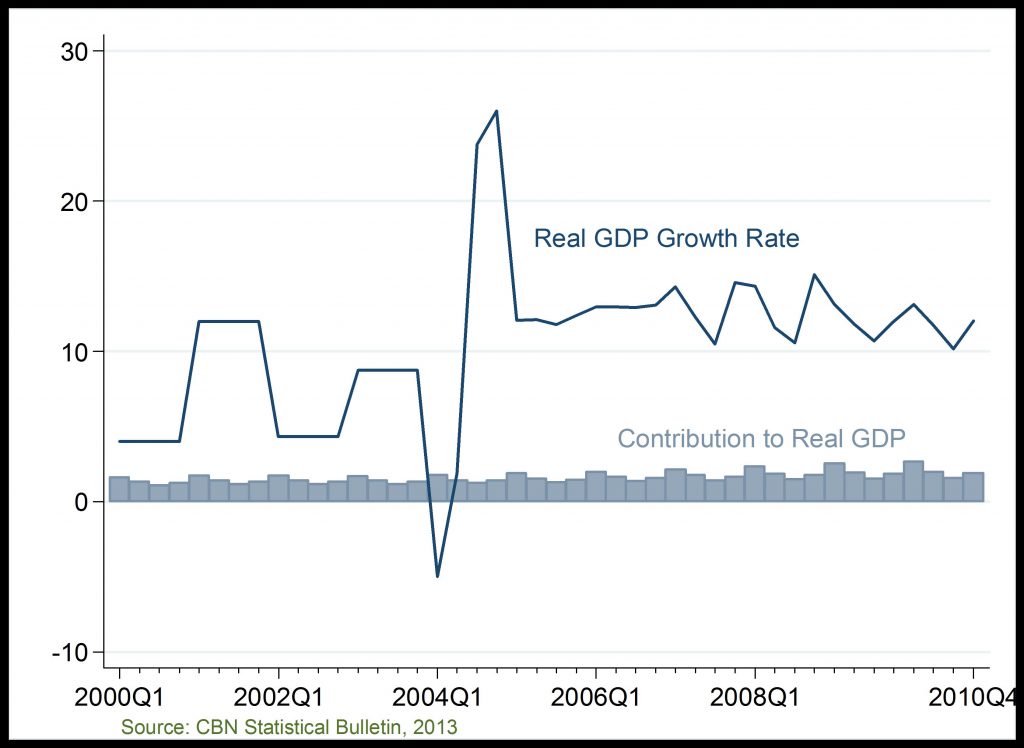

Real GDP at 1990 Base Year

Fair growth, post-2004

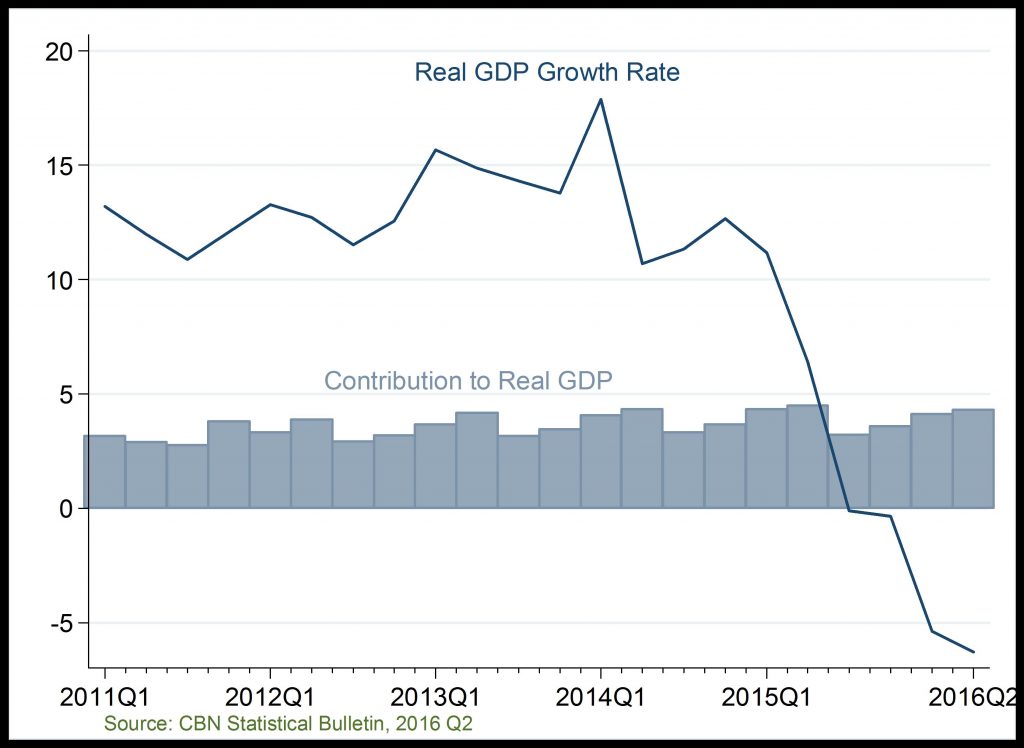

Real GDP at 2010 Base Year

Government revenue falls, Construction contracts

Capital Importation: Capital expenditure into the construction sector remained above 10 percent since 2005 until 2015. Similar to the manufacturing sector, overall capital imported into the construction sector fell most significantly in 2015 and 2016 on the account of present FOREX issues affecting businesses in the sector; thus discouraging investors.

Gross Domestic Product Growth Rate and Contribution to GDP: The sectors GDP growth rate declined dramatically in 2016Q1, due to worsening fiscal position of both Federal and State governments which adversely affected construction services in the private sector. Weakened fiscal position of the public sector orchestrated by the fall in crude oil revenue substantially contributed to the sectors poor performance. However, the slight increase in the sectors contribution to GDP in 2016Q1 largely reflects the relative fall in contribution of other sectors of the economy.