Capital Importation And Budgetary Allocation (Oil And Gas)

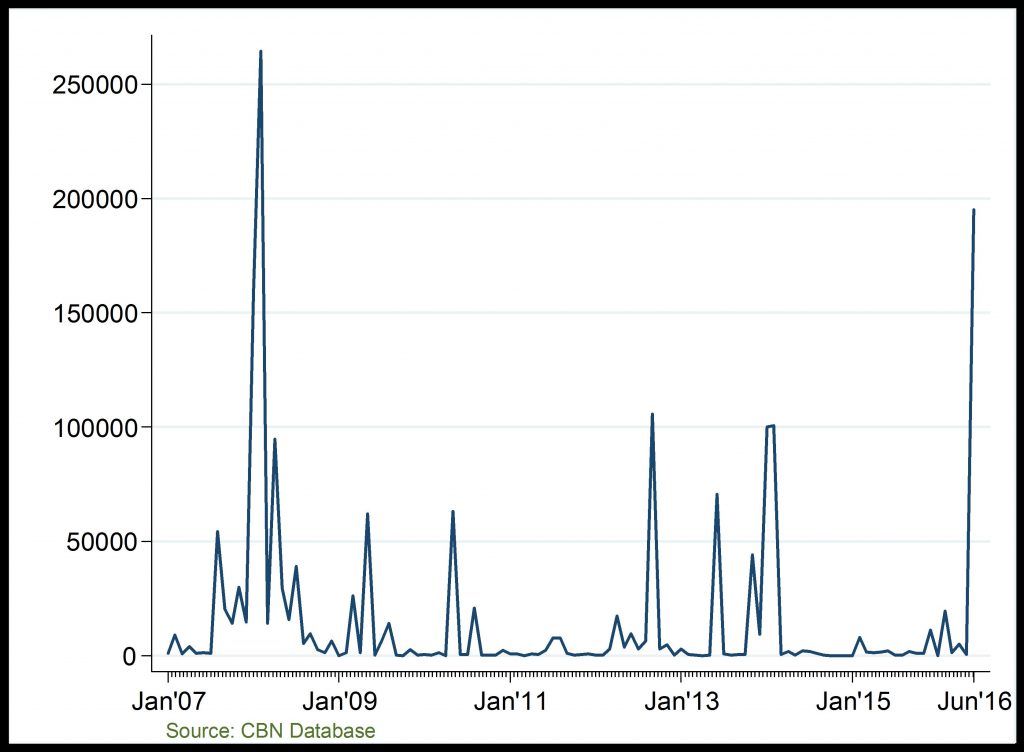

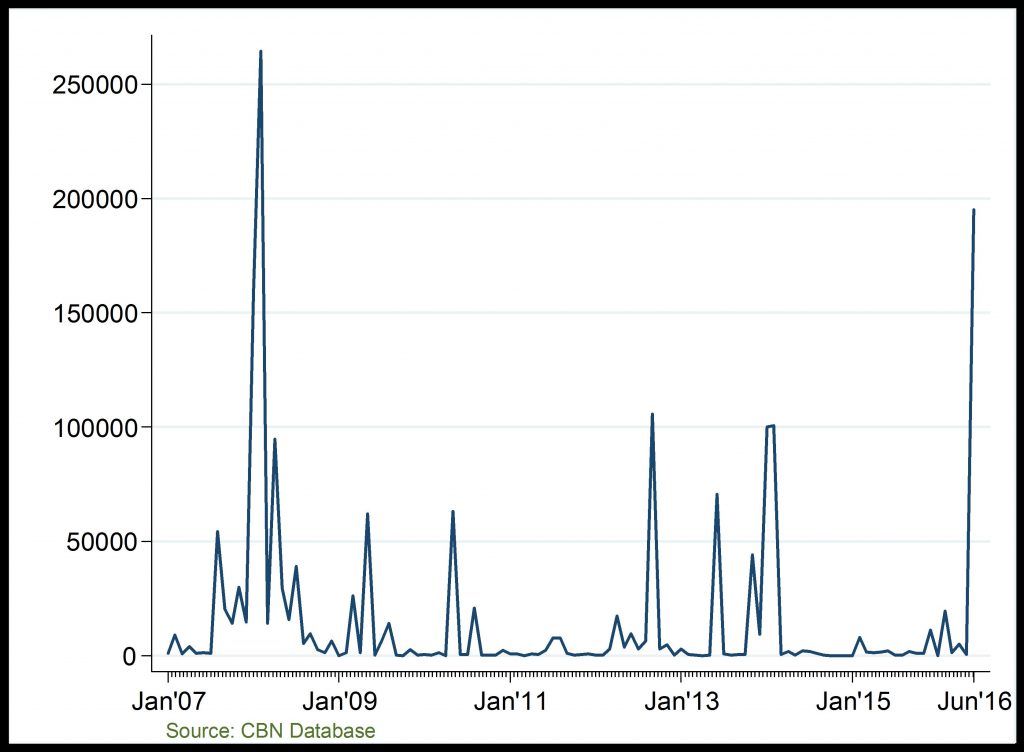

Capital Importation (US$ Thousand)

Investment rise sharply in 2016Q2

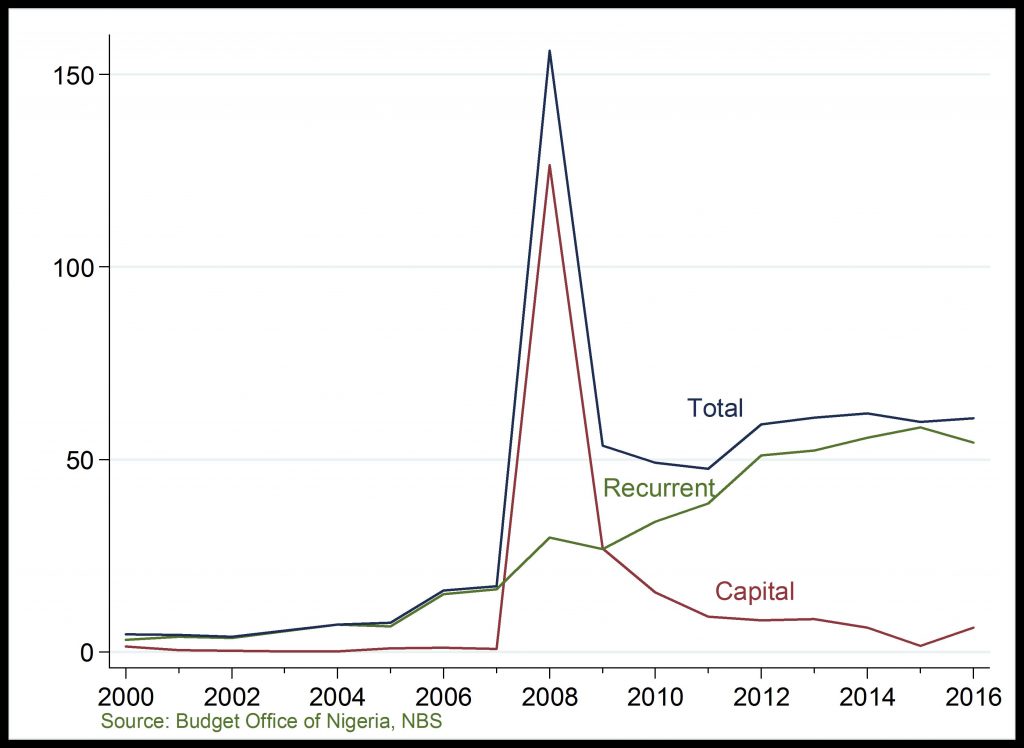

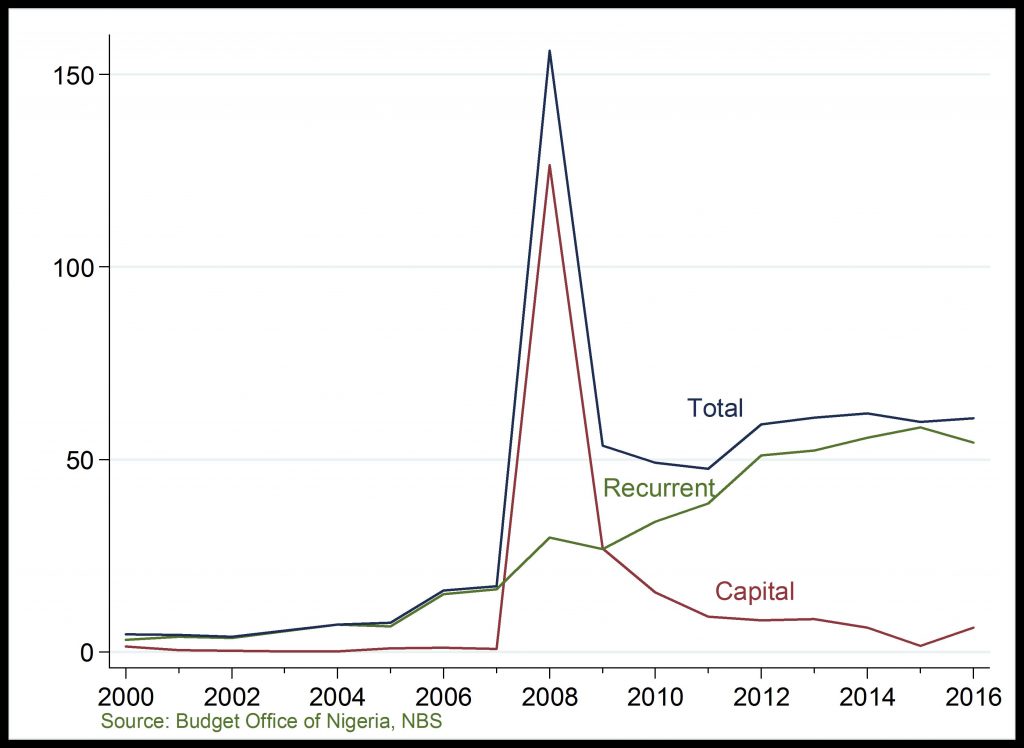

Budgetary Allocation (Billion )

Capital vs Recurrent expenditure, closing the gap?

Capital Importation: Investment in the oil and gas sector has remained low since 2009. However, investments into the sector fell more deeply in 2015, on the account of persistent global and domestic challenges to the sector. However, it increased sharply in 2016Q2 on the account of increased disbursement in the sector by the CBN for the repair of damaged oil and gas pipelines.

Budgetary Allocation: Recurrent spending has continued to rise as capital spending fall (or rise marginally) in annual national budget allocation since 2009. However, considerable convergence capital and recurrent expenditure is recorded in 2016 budget, signalling government interest in improving the oil and gas sector.

Related

All-Share Index: In 2016Q1, the decline in ASI was driven by declines in Banking, Insurance, Consumer goods, Oil/Gas, Lotus Islamic, Industrial, AseM, Pension and Premium NSE indices. However, the ASI

Public Debt Stock and Debt Servicing: Public debt stock has steadily increased overtime; reaching over N12, 000 billion naira by 2015Q4. With the persistent fall in crude oil price and the attendant d

Internally Generated Revenue: Total internally generated revenue particularly declined across the 36 states in Nigeria, in 2015. This is attributable to the weak macroeconomic and financial conditions

Export and its Components: In 2015 and 2016Q1, overall export earnings declined significantly to a record low of less than $3000 million in 2016Q1, as against the peak of above $10,000 million in 2008