The commitment of the Central Bank of Nigeria (CBN) to stimulate the economy following the distortions caused by the coronavirus pandemic prompted the decision to reduce the Monetary Policy Rate (MPR) from 12.5% to 11.5% . However, the cash reserve ratio was retained at 27.5% and the liquidity ratio at 30%.

The major goal of the CBN’s monetary policy has been to ensure price stability in order to avoid distortions and disequilibrium in the Nigerian economy and achieve improved economic activities and employment.

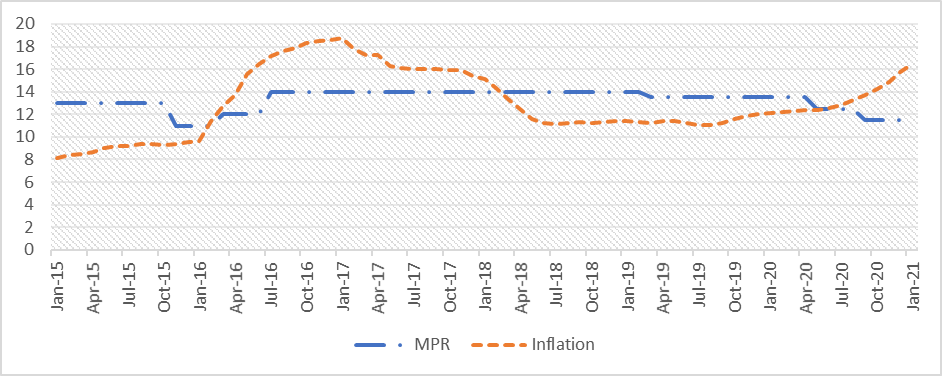

Prior to the reduction of the MPR to 11.5%, the CBN had consistently retained the MPR at 14% in 2018, and 13.5% between March 2019 to April 2020. Before 2018, similar patterns were observed. In those periods, as revealed in figure 1, the rate of inflation did not follow the expected pattern to changes in the MPR, even when considering time lags. Also, the correlation coefficient between the MPR and the inflation rate in Nigeria stood at 0.299 between January 2015 and January 2021, revealing a weak correlation between both variables. This suggests that inflation may not be responding to the MPR and that the CBN monetary policy may have been counterproductive.

Figure 1: Monetary Policy Rate and Inflation (M1, 2015 to M1, 2021)

Source: Central Bank of Nigeria (2021)

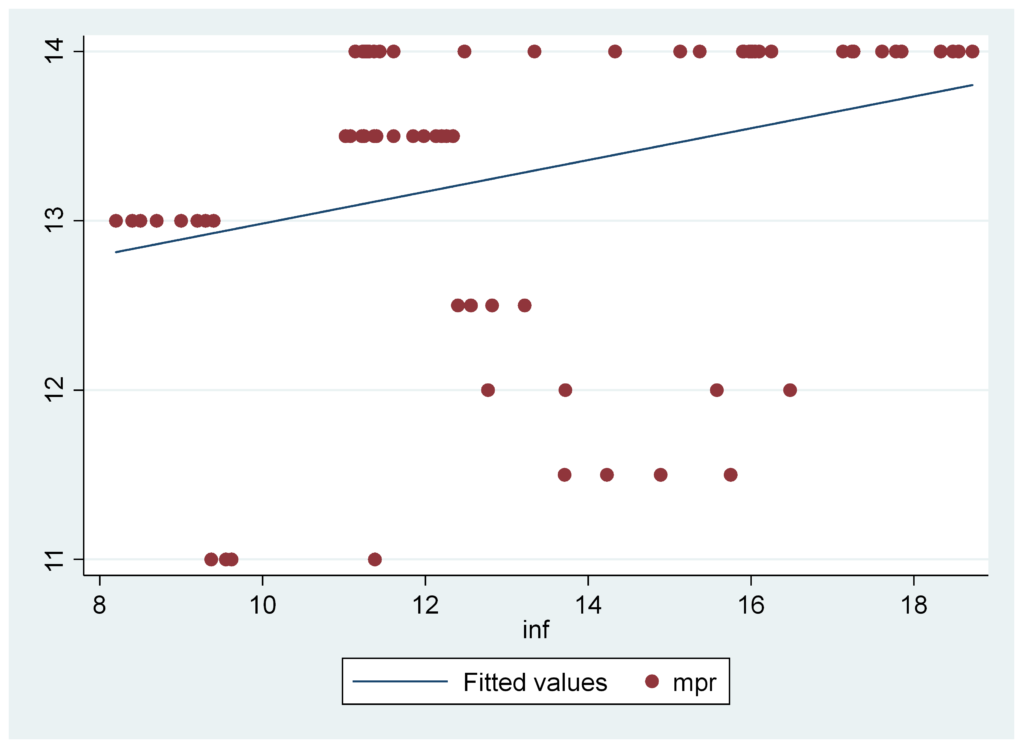

Figure 2 illustrates the relationship between the MPR and the inflation rate utilising the scatterplot and a regression line. It is revealed that there exists a positive association between the MPR and inflation that does not follow a priori expectations, implying that inflation increases with the MPR.

Figure 2: Scatter Plot and Regression Line of Monetary Policy Rate and Inflation (M1,2015 to M12, 2020)

Why does Inflation Rate not necessarily respond to MPR?

The major reason why the CBN’s monetary policy has not had a negative impact on Nigeria’s inflation rate over time is due to the factors that cause rising prices in the country. Inflation in Nigeria is influenced by the aggregate supply side of the economy and not the aggregate demand side of the economy which the CBN can influence with its monetary policy tools. This is evident in the continued depreciation of the Nigerian Naira and the subsequent rise in prices. In other words, the Nigerian inflation is a cost-push inflation while monetary policies are most effective in demand pull inflation.

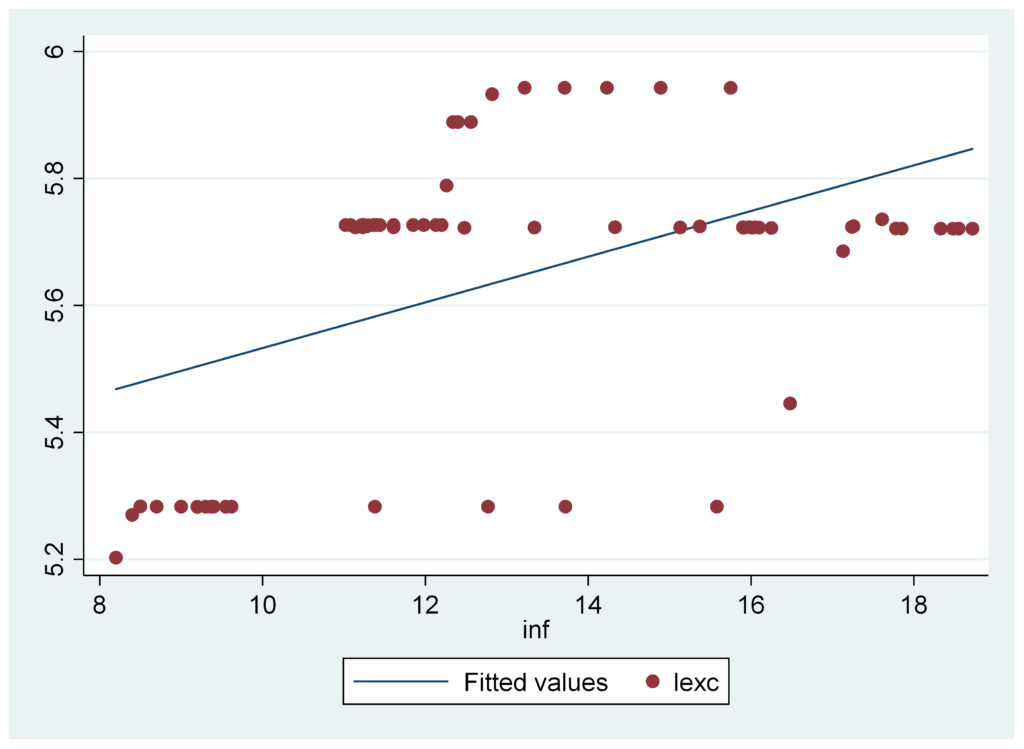

Figure 3: Scatter Plot and Regression Line of the logarithm of Exchange Rate and Inflation (M1,2015 to M12, 2020)

As revealed in figure 2, a scatter plot and a regression line observes this positive relationship between the natural logarithm of exchange rate and the inflation rate in Nigeria.

The Nigerian inflation problem has continued to emanate majorly from exchange rate depreciation due to crude oil price shocks. The fallen crude oil price level has led to the fall in the value of our exports compared to the value of imports. This has led to pressure on the Naira and has caused both currency depreciation and devaluation over recent times. Because Nigeria is heavily dependent on both imported consumer and producer goods, currency depreciation immediately transmits to rising prices, through the prices of imported consumer and producer goods and further multipliers in the economy.

Aggregate supply side inflation makes conventional monetary policy almost obsolete as they are engineered for demand pull inflation. Furthermore, as Nigeria battles with boosting her economy, the mandate of the Nigerian government should be to provide policies that can aid in improving the level of aggregate supply in the Nigerian economy.

Answering the question on what factors lead to the fall in aggregate supply is one way that can propel Nigeria out of a stagflation type economy—a situation where falling output level and rising unemployment is accompanied with rising prices.

Reducing the Monetary Policy Rate to boost Domestic Production

The goal of the double-digit MPR has been to stabilise prices over time. However, as previously acknowledged, the country’s inflation problem is not caused by an excess of money supply in the economy. Instead, it has risen from low productivity and high cost of production in the Nigerian economy. If the CBN maintains its double-digit MPR, it will continue to transmit to high lending rates in the financial sector, making borrowing from the financial sector very expensive.

This in turn would keep productivity down and those who can still borrow for productive purposes would increase their price levels in order to make enough profit to repay their debt. This means that the double-digit MPR may be insignificant in terms of curbing inflation, or worse, it may act as a determining factor in raising Nigeria’s inflation level and even limiting the economic growth

While the CBN has taken steps to boost the Nigerian economy by reducing the MPR, further reduction in the MPR is imperative to bring significant increase in domestic production, particularly for Small and Medium Scale Enterprises (SMSEs). The importance of local production, economic diversification and improving the Nigeria’s export base should be taken into consideration by the CBN as they reduce the MPR. It is only when the local economy grows that Nigeria’s export base can grow and bring lasting solutions to Nigeria exchange rate problem.

Conclusion

Finally, given the peculiarity of the Nigerian inflationary problem – such that, inflation is propelled by cost push phenomenon and not demand-pull inflation, thus rendering the conventional monetary policies counterproductive. For the Nigerian economy to experience an increase in economic activities, it is essential that a key lever for facilitating this would be to significantly reduce the monetary policy rate to a single digit.

Moreover, lowering interest rates in the banking system, and making credit available would enable SMSEs maximise financial flow for development – thereby improving productivity, lowering commodity prices, and a reduction in unemployment. Policy makers must work to ensure economic policies are aimed at improving export base, as this would reduce the exchange rate problem which transmits to inflationary pressures.